Os 5 maiores concorrentes da Airbnb em 2026 [Análise baseada em dados]

Tabela de conteúdo

Você acreditaria na chocante verdade de que o Airbnb é 2,5 vezes mais popular do que seus cinco principais concorrentes juntos? Pode parecer inacreditável, mas é exatamente isso que os dados sobre reconhecimento de marca e presença on-line revelam.

O Airbnb é o mais forte, mas não o único participante do setor de aluguel por temporada. O mais notável Concorrentes do Airbnb são Booking.com (regras na Europa), Agoda (superior na Ásia), e Expedia (serviços de viagem abrangentes). E isso é só o começo!

O Airbnb é uma das marcas mais reconhecidas do mundo. Para mim, ela está na mesma prateleira que a Apple, a Tesla ou o McDonald's.

Sei que isso pode parecer um exagero, mas sou sincero com você. Acho que minha percepção está relacionada à maneira como vivo - sempre em movimento.

Portanto, para mim e para outros viajantes que buscam acomodações exclusivas, o Airbnb é extremamente familiar e visitar seu site é uma das primeiras coisas a fazer ao planejar outra aventura.

Ok, mas há mais sites como o Airbnb! Ele não é o único jogador no jogo.

Para ver como ele se compara, precisamos dividir as coisas em três fases:

- Descobrindo que Alternativas ao Airbnb desempenham os papéis mais importantes no mercado de aluguel por temporada.

- Examinando o atual Airbnb desempenho.

- Benchmarking Airbnb com seu concorrentes.

Como descobrir os principais concorrentes do Airbnb?

01 Pesquisa no Google

O bom e velho tio Google é um ótimo ponto de partida para descobrir concorrentes do Airbnb, especialmente porque ele mostra Carrosséis de concorrentes na parte superior dos resultados de pesquisa.

Os resultados são baseados em tendências de pesquisa e fontes de dados disponíveis publicamente.

A pesquisa do Google funciona bem para fornecer uma visão geral rápida, mas requer pesquisa de acompanhamento para descobrir quais empresas são as principais concorrentes do Airbnb.

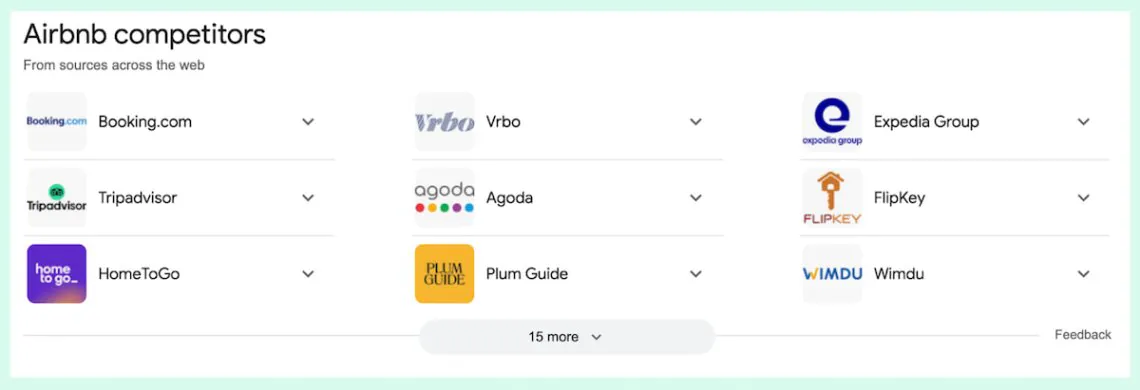

02 Ferramenta de monitoramento de mídia com tecnologia de IA

Uma ótima maneira de fazer essa pesquisa de acompanhamento é usar um monitoramento de mídia ferramenta como o Brand24.

Em resumo, o Brand24 rastreia e analisa os mentions da marca publicados:

- Mídia social, ou seja, Facebook, Instagram, X (Twitter), TikTok, LinkedIn, Reddit, Telegram, Twitch e Bluesky;

- Sites de notícias, blogs, plataformas de vídeo, podcasts e outros sites;

- Boletins informativos e plataformas de avaliação.

Ele faz isso com a ajuda de recursos baseados em IA, como Assistente de marca com IA.

É semelhante para o ChatGPTmas melhor.

A vantagem do Brand Assistant sobre o ChatGPT (e outras ferramentas semelhantes) é acesso a dados internos.

Diferentemente das ferramentas gerais de IA, que dependem de informações publicamente disponíveis, o Brand Assistant aproveita dados em tempo real de milhares de fontes on-line.

Em outras palavras, graças a informações detalhadas sobre o Airbnb - como o análise de sentimentos - que vem do rastreamento de mentions da marca, o Brand Assistant fornece dados muito mais precisos e embasados pesquisa da concorrência.

Veja isso.

Pedi ao assistente de marca que listasse os 5 principais concorrentes do Airbnb.

Depois de um alguns segundosRecebi uma lista com dados em tempo real explicando por que essas empresas representam o desafio mais significativo para o Airbnb.

As 5 principais alternativas ao Airbnb:

⭐ Booking.com

⭐ Vrbo

⭐ Agoda

⭐ Expedia

⭐ HomeToGo

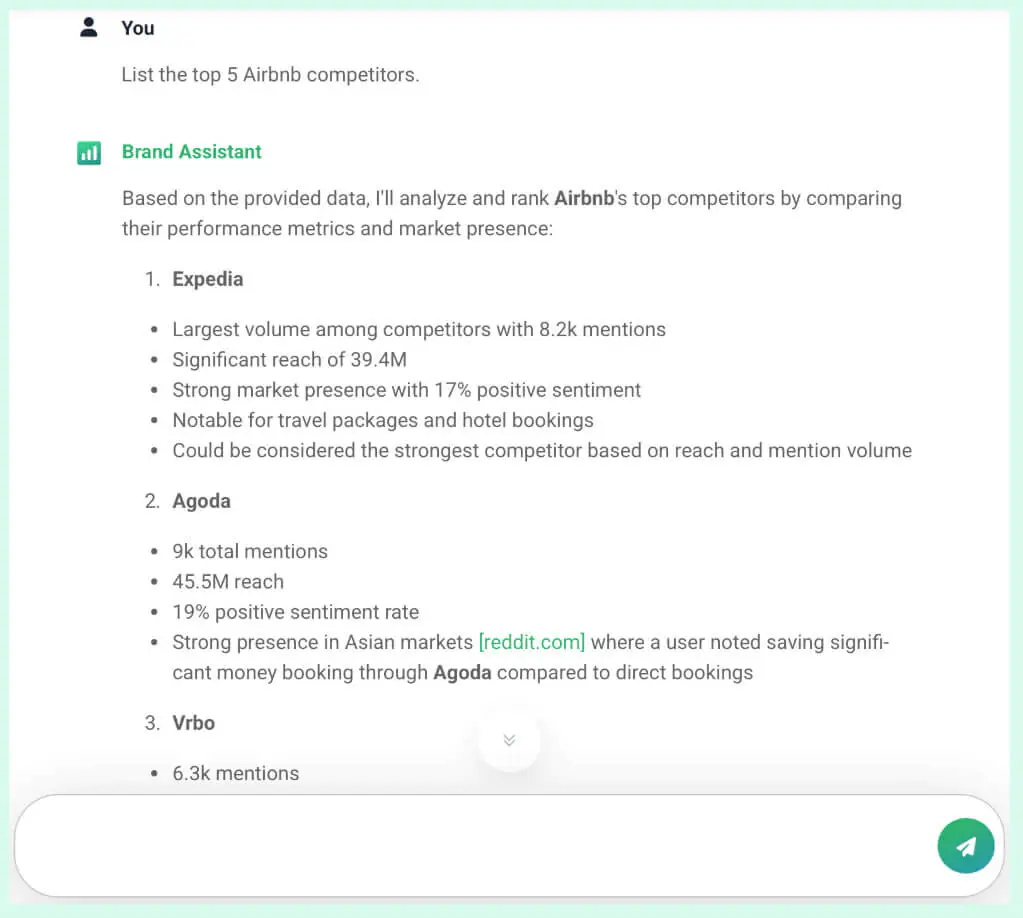

03 Ferramenta de pesquisa de SEO

Você pode verificar novamente sua pesquisa com uma ferramenta de pesquisa de SEO como a Semrush.

Ele fornece informações sobre concorrentes orgânicosque mostra quais plataformas são classificadas para palavras-chave relacionadas a aluguel por temporada semelhantes às do Airbnb.

Ao analisar o tráfego de pesquisa orgânica, as sobreposições de palavras-chave e as tendências de visibilidade, a Semrush ajuda a identificar os concorrentes que estão competir ativamente com o Airbnb nos resultados dos mecanismos de busca.

Isso adiciona outra camada de análise orientada por dados à sua pesquisa competitiva.

Como estará a Airbnb em 2026?

Descobrimos como encontrar os participantes mais importantes do setor de aluguel por temporada.

Agora, vamos verificar a situação atual da marca Airbnb. Como ela está se saindo em 2026?

O melhor ponto de partida é o Guia Análise.

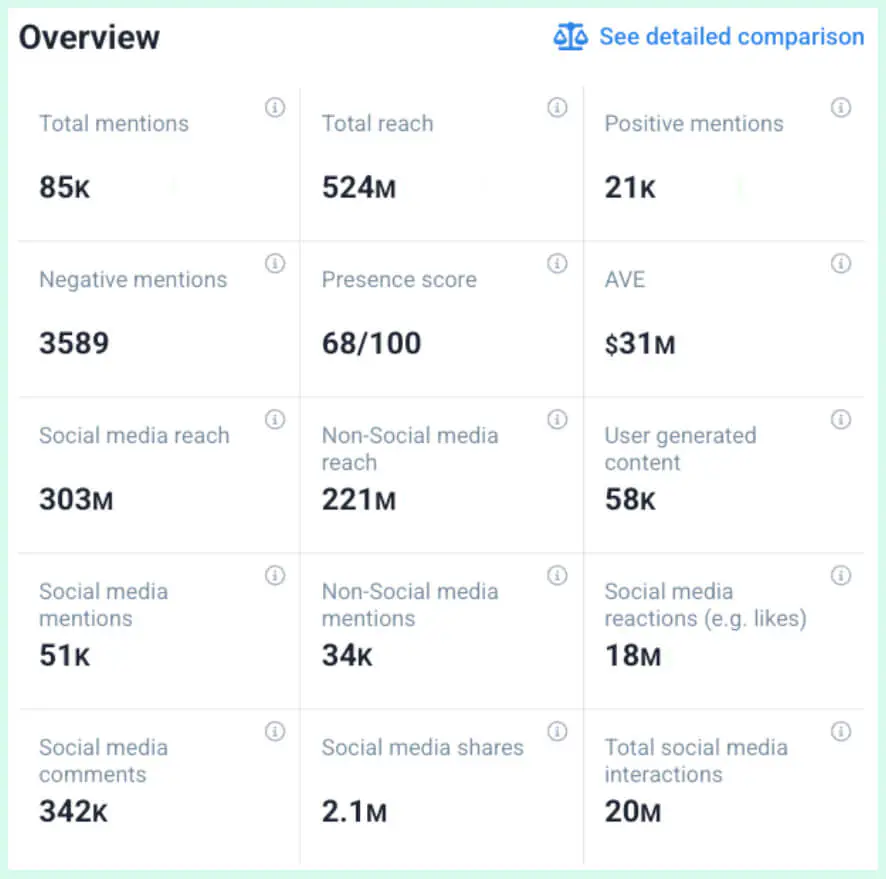

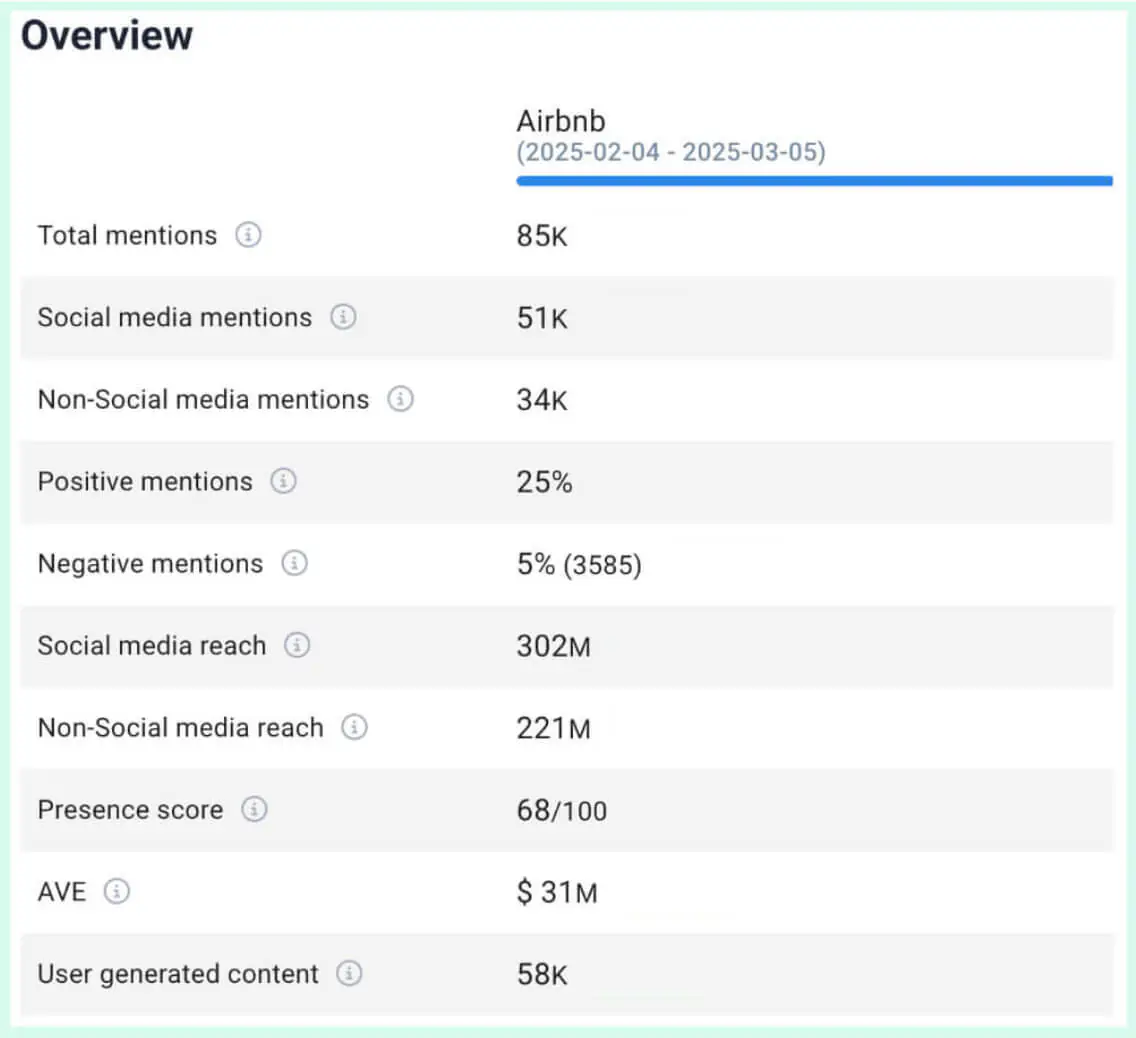

À direita, você verá uma matriz simples de "Visão geral" que apresenta os dados mais importantes de cada um. métricas da marca. Limitei o período às duas últimas semanas de fevereiro (15 a 28).

Como alternativa, você pode clicar em "Ver comparação detalhada" para comparar o desempenho atual e passado do Airbnb.

Muito bem, e em quais indicadores você deve se concentrar para verificar o desempenho da plataforma de aluguel por temporada? presença no mercado?

São elas:

- Número total de mentions - mostra quantas vezes o nome da marca foi usado em discussões on-line. O Airbnb tem 85,000.

- Número de mentions positivos - apresenta quantos mentions tiveram um sentimento positivo e qual é a sua participação no número total de mentions. O Airbnb tem 21.000 (26% do total)

- Número de mentions negativos - shows quantos mentions tiveram um sentimento negativo e qual é a participação deles no número total de mentions. O Airbnb tem 3585 (5% do total).

- Alcance da mídia social - indica quantas pessoas podem ter visto os mentions do Airbnb em plataformas de mídia social. O Airbnb alcançou 302 milhões usuários de mídias sociais.

- Alcance não social - analogicamente, apresenta quantas pessoas poderiam ter visto os mentions do Airbnb em fontes não sociais (sites de notícias, blogs, podcasts, etc.). Usando fontes não sociais, o Airbnb alcançou 221 milhões pessoas.

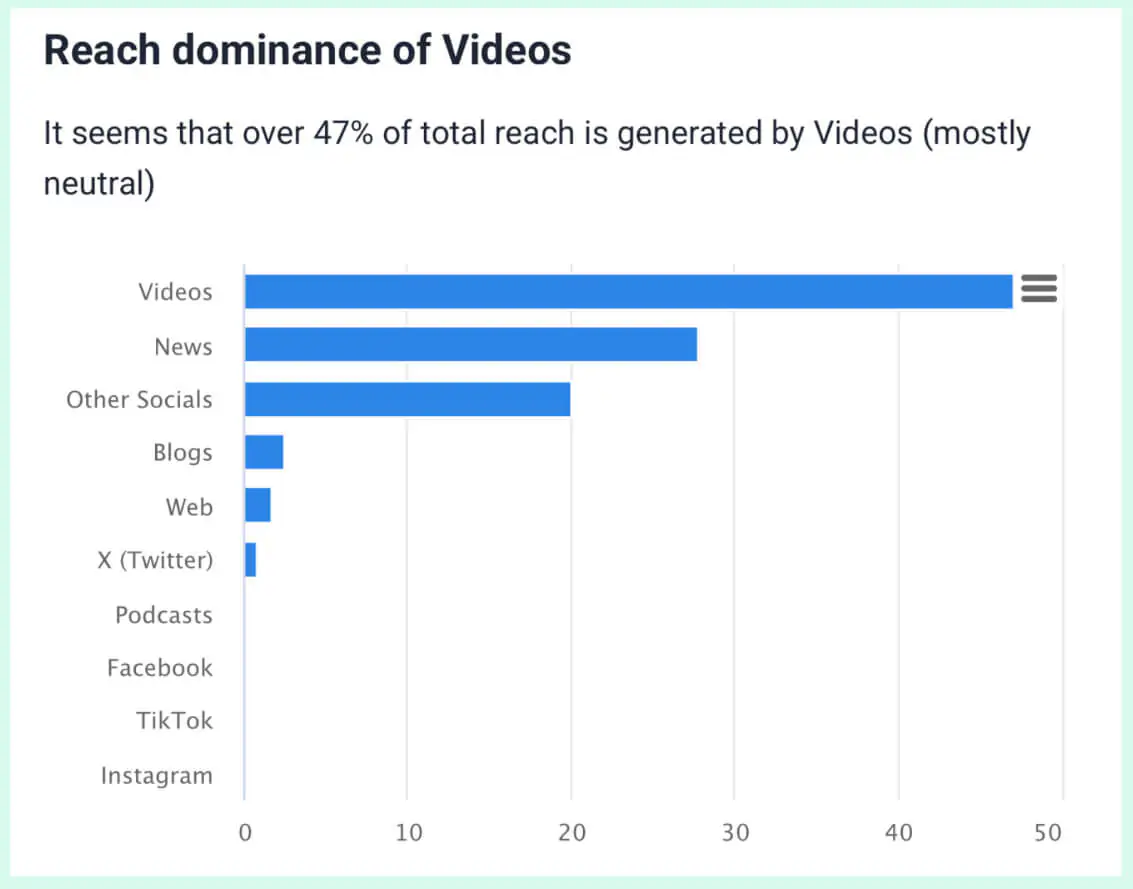

- Principal fonte de alcance - destaca qual fonte de mentions atinge o maior número de pessoas. No caso do Airbnb, são elas vídeos.

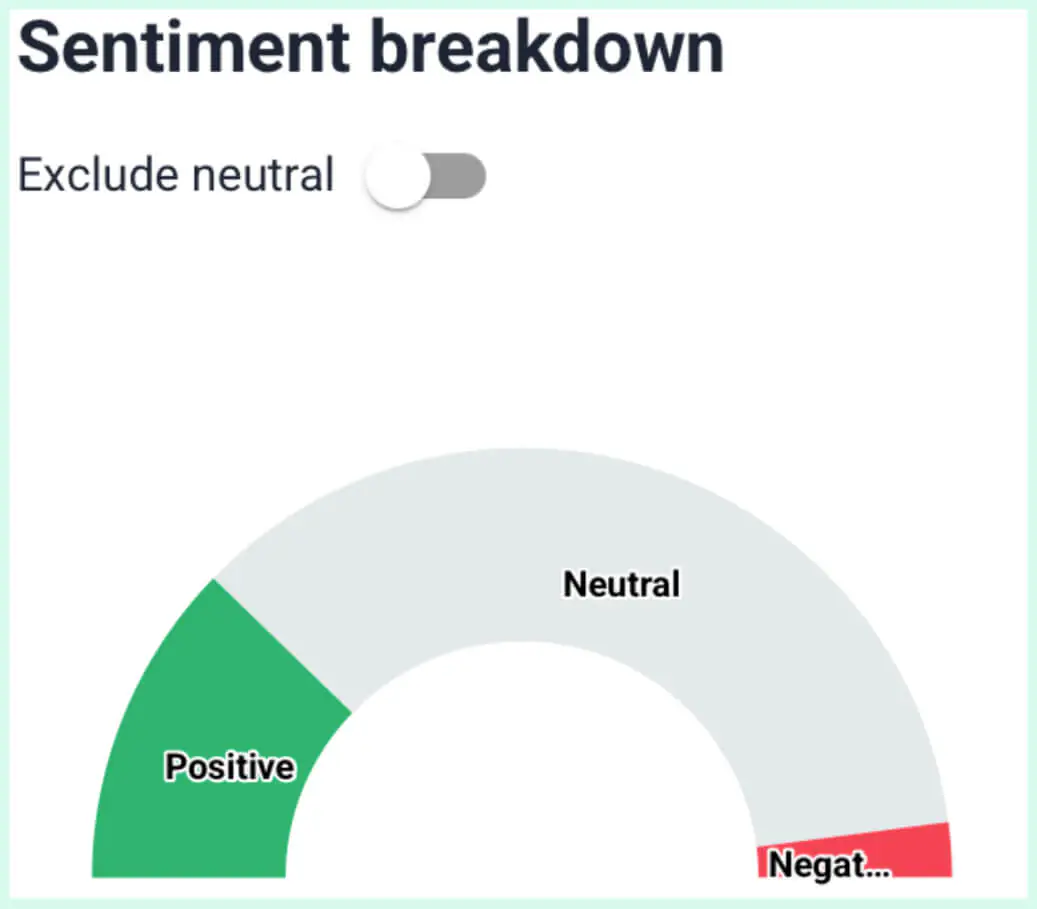

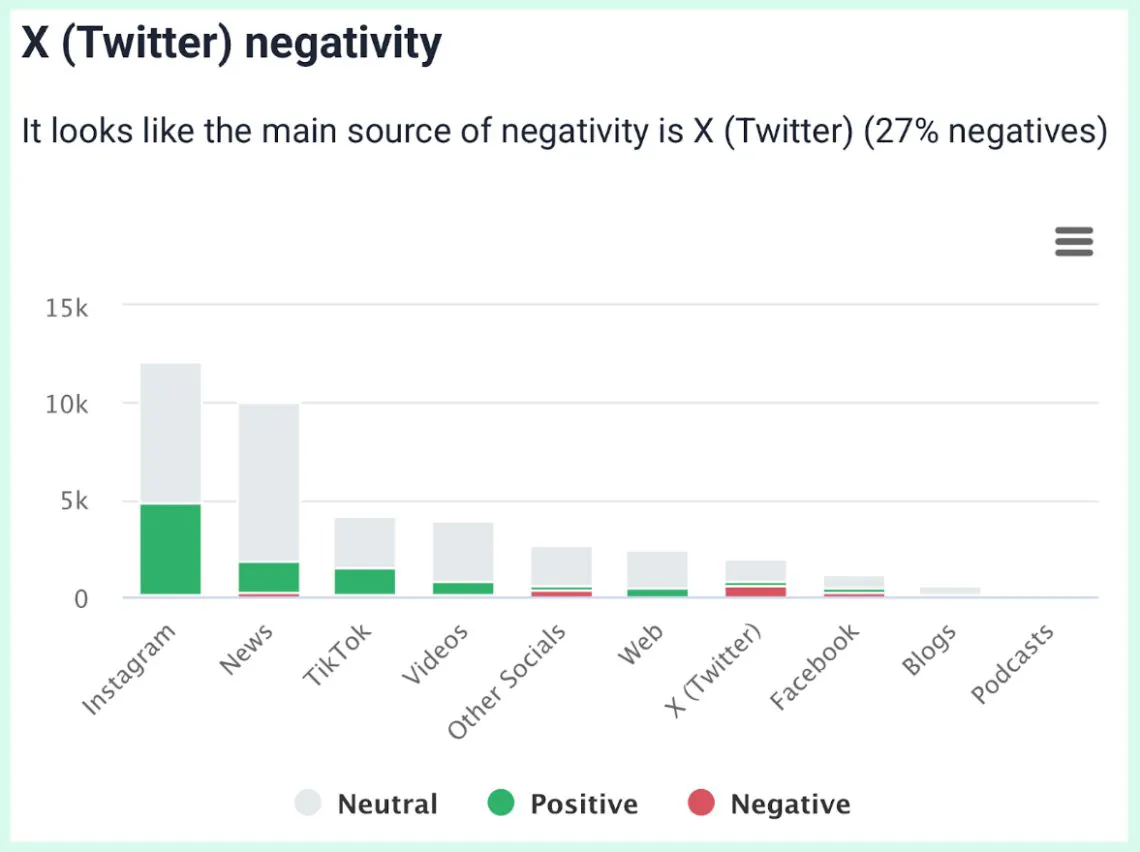

- Sentimento geral - o instantâneo de como a marca é percebida nas discussões on-line. Para o Airbnb, são 70% neutros, 26% positivos e 5% negativos

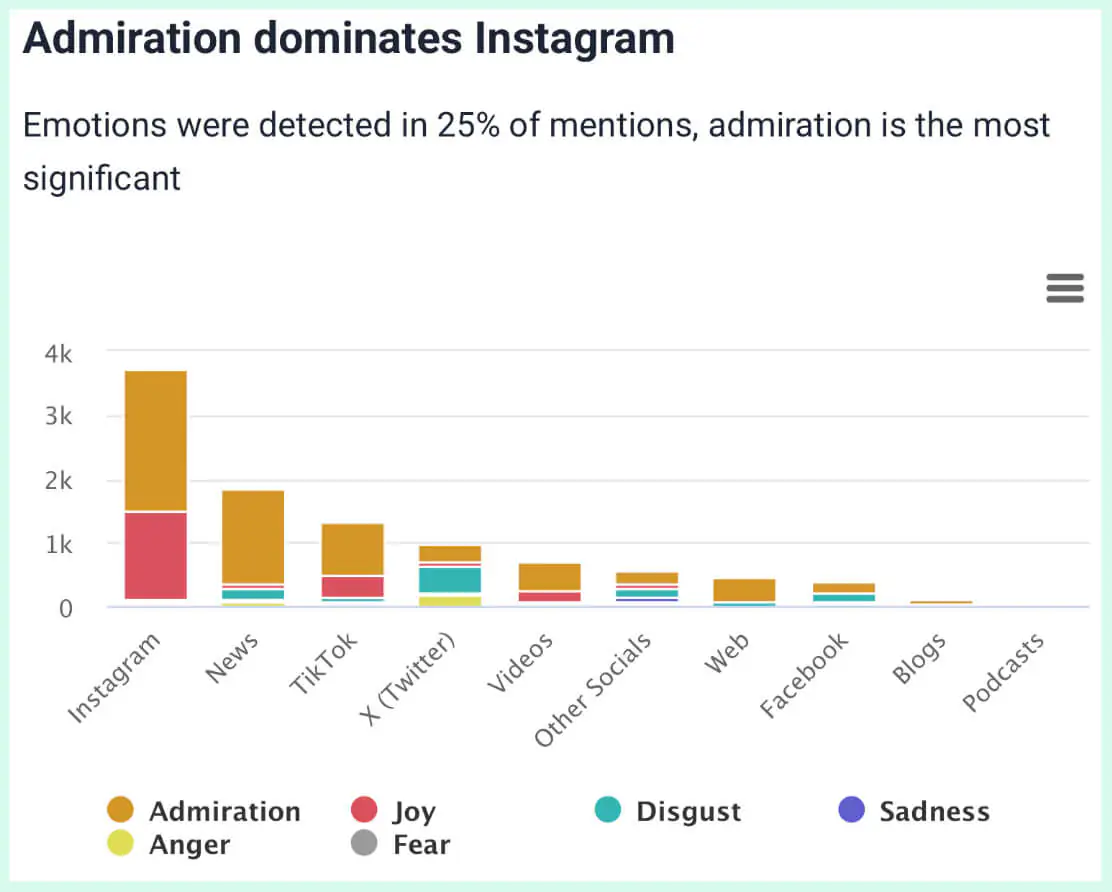

- Principal fonte de sentimento positivo - portanto, a plataforma ou canal com a maior parcela de mentions positivos. O Airbnb tem o sentimento mais positivo em Instagram.

- Principal fonte de sentimento negativo - portanto, a plataforma ou canal com a maior parcela de mentions negativos. O Airbnb sofre o sentimento mais negativo em X (Twitter).

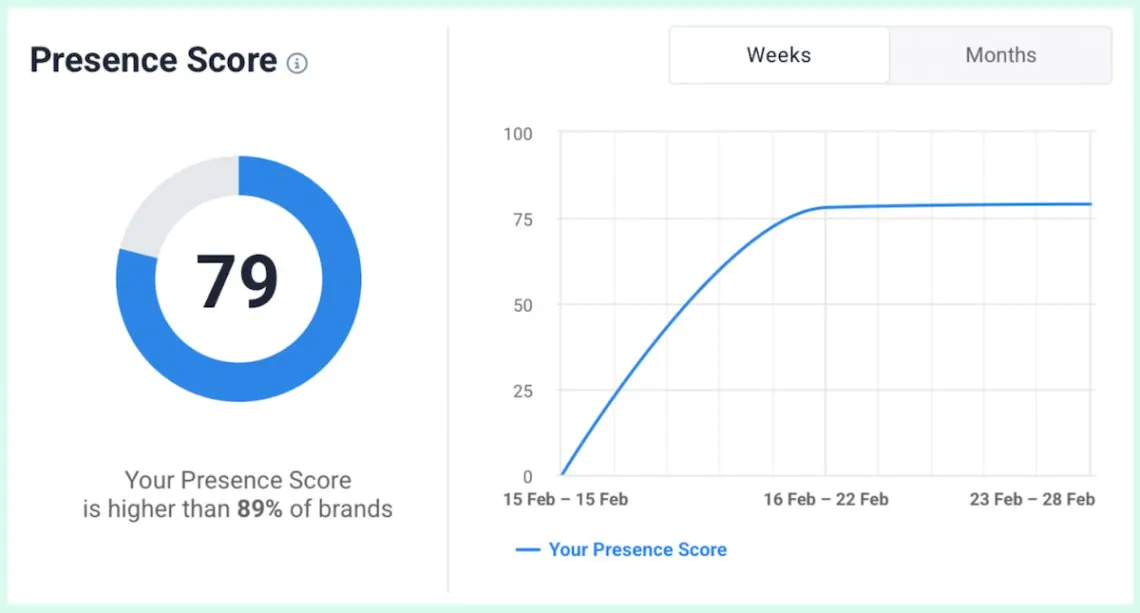

- Pontuação de presença - a métrica que apresenta a popularidade on-line do Airbnb em um determinado período. Para o Airbnb, é 79.

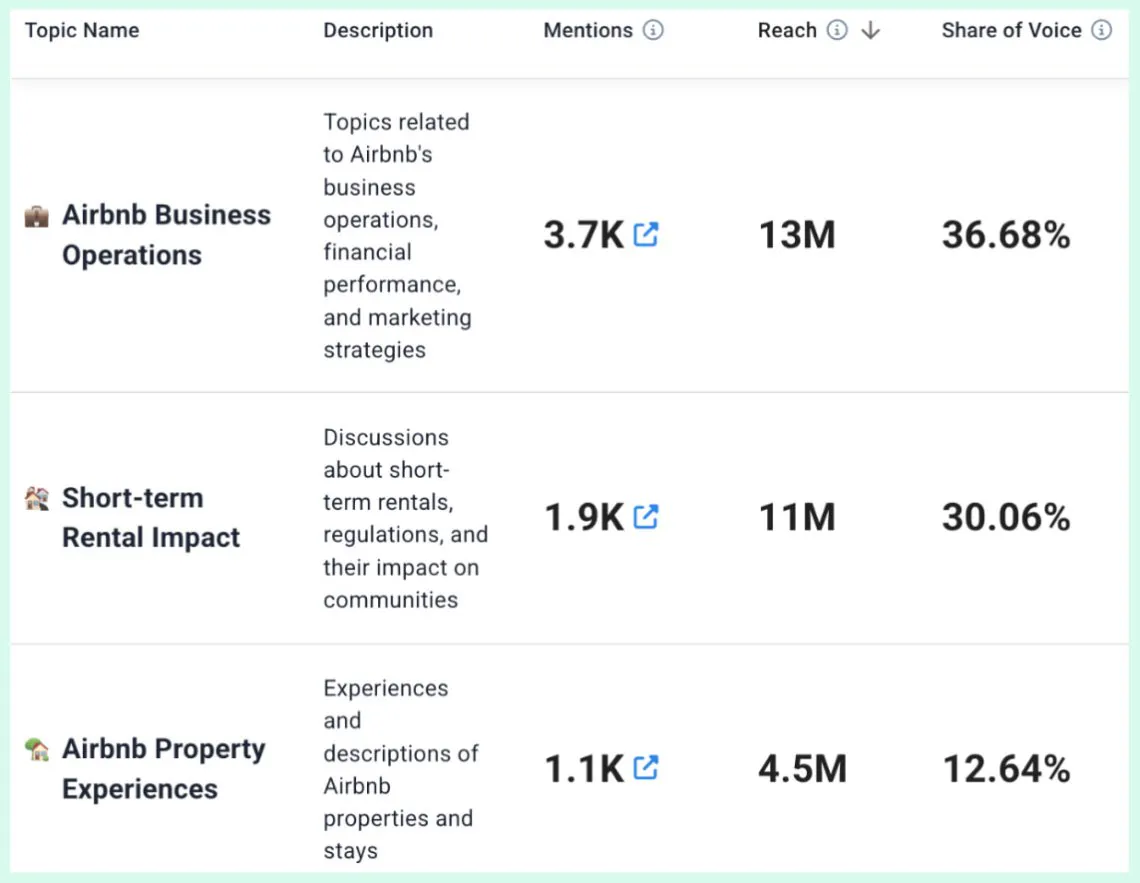

- Tópicos mais populares sobre a marca - quais assuntos geram mais interesse quando as pessoas falam sobre uma determinada marca. No caso do Airbnb, esses assuntos são operações comerciais, impacto do aluguel de curto prazo e experiências com propriedades.

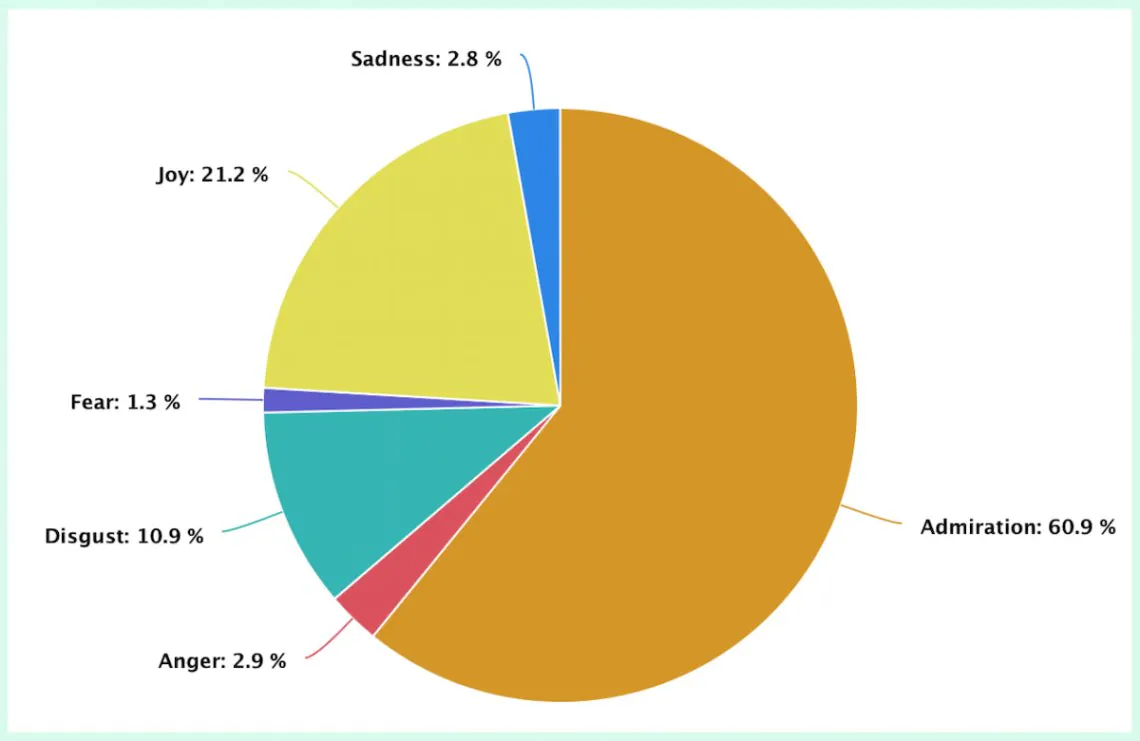

- Análise de emoções - a visão geral mais granular dos sentimentos. Quando as pessoas falam sobre o Airbnb, as três principais emoções são admiração (60,8%), alegria (21,2%) e nojo (10,9%)).

Agora que temos dados reais sobre o Airbnb, vamos ver o desempenho de outras empresas de aluguel por temporada!

Desempenho dos 5 principais concorrentes do Airbnb em 2026

01 Booking.com

Fundada em 1996 em Amsterdã, a Booking.com aparece como a alternativa mais significativa ao Airbnb.

De acordo com os dados principaisé também a plataforma mais popular que oferece aluguéis de férias na Europa.

Falando francamente, quando estou procurando casas de férias ou acomodações particulares durante minhas viagens, o Booking.com é sempre minha primeira opção. E sim, eu sou definitivamente europeu.

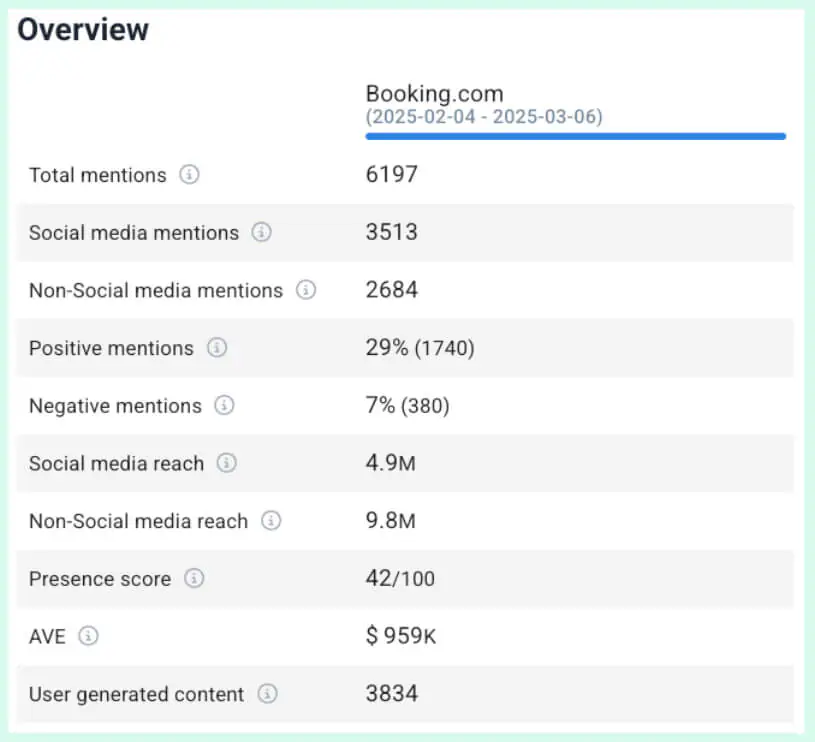

Aqui está um rápido resumo das métricas de desempenho do Booking:

- Número de mentions: 6197

- Número de mentions positivos: 1740

- Número de mentions negativos: 380

- Alcance da mídia social: 4,9 milhões

- Alcance não social: 9,8 milhões

- Principal fonte de alcance: Sites de notícias

- Sentimento geral: 29% positivo, 7% negativo, 54% neutro

- Principal fonte de sentimento positivo: Instagram

- Principal fonte de sentimento negativo: Facebook

- Pontuação de presença: 42

- Tópicos mais populares sobre a marca: experiência na plataforma de reservas, dicas de viagem, controvérsia Israel-Palestina

- Análise de emoções: admiração (59%), alegria (20,4%), nojo (17,1%), raiva (2%), tristeza (0,8%), medo (0,7%).

Airbnb vs. Booking.com

O análise competitiva da Airbnb e da Booking.com não deixa dúvidas - a O Airbnb é muito mais popular espaço para aluguel por temporada.

Com relação a reputação da marcaA única vantagem da Booking.com é a maior participação de mentions positivos (29% vs. 25%).

02 Vrbo

O Vrbo (Vacation Rentals by Owner) é um mercado on-line americano para aluguéis de férias.

Como o próprio nome sugere, o modelo de negócios da Vrbo é baseado em conectando os proprietários de imóveis diretamente com os viajantes procurando por aluguéis de férias.

Ao contrário de alguns concorrentes, o Vrbo concentra-se exclusivamente em propriedades inteirasO hotel é uma opção popular para famílias e grupos que buscam acomodações privativas.

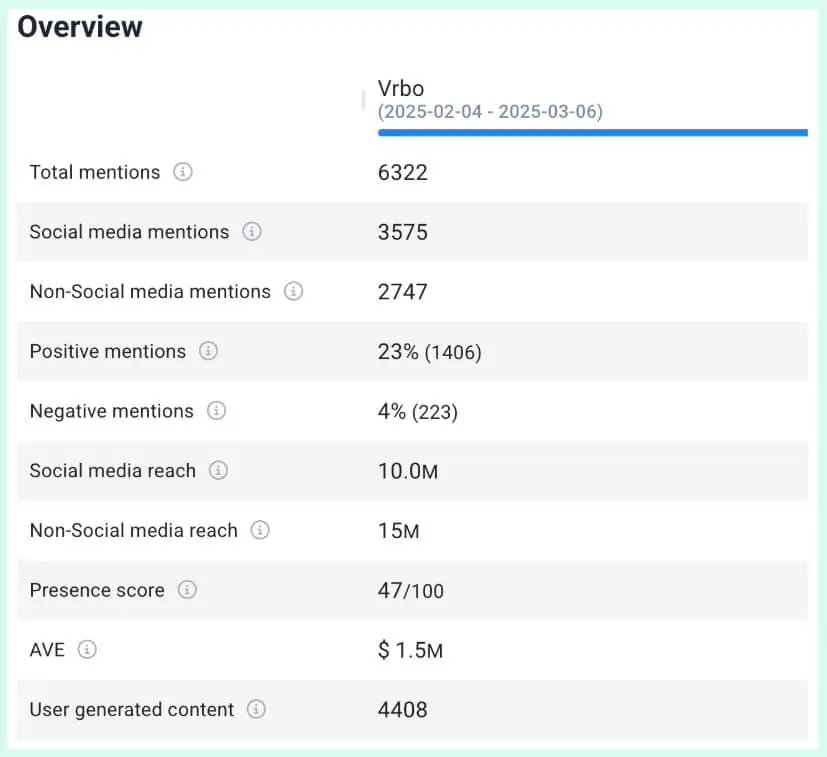

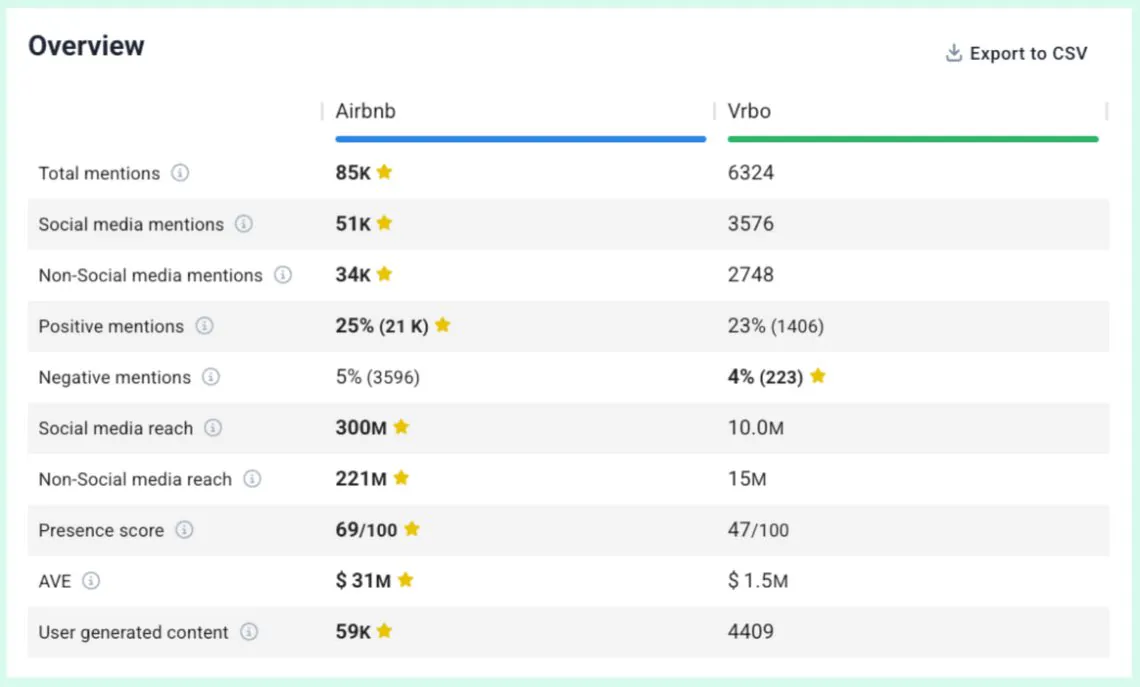

Aqui está um rápido resumo das métricas de desempenho da Vrbo:

- Número de mentions: 6322

- Número de mentions positivos: 1406

- Número de mentions negativos: 223

- Alcance da mídia social: 10 milhões

- Alcance não social: 15 milhões

- Principal fonte de alcance: Sites de notícias

- Sentimento geral: 23% positivo, 4% negativo, 73% neutro

- Principal fonte de sentimento positivo: Instagram

- Principal fonte de sentimento negativo: Outras redes sociais (Reddit, Quora, etc.)

- Pontuação de presença: 47

- Tópicos mais populares sobre a marca: regulamentações de aluguel de curto prazo, experiências de reserva do Vrbo e destinos de férias na praia

- Análise de emoções: admiração (63,5%), alegria (21%), nojo (13%), raiva (1,1%), tristeza (0,9%), medo (0,5%).

Airbnb vs. Vrbo

Da mesma forma que a comparação anterior, Airbnb vence o Vrbo em quase todos os aspectos.

A única métrica em que a Vrbo tem um desempenho melhor é uma relação negativa de mentions (4% vs. 5%).

Quer você administre um hotel ou um restaurante, competir com plataformas como o Airbnb significa saber exatamente o que seus rivais estão fazendo:

- Análise competitiva de hotéis: Descubra como os melhores hotéis monitoram os concorrentes, otimizam os preços e obtêm mais reservas.

- Análise da concorrência de restaurantes: Saiba como os restaurantes inteligentes analisam a concorrência para aumentar a visibilidade e impulsionar o tráfego de pessoas.

03 Agoda

A Agoda é um mecanismo de metabusca de aluguel por temporada fundado na Tailândia e registrado em Cingapura.

Ele oferece uma das mais ricas opções de listagens de aluguéis de férias, especialmente no Sudeste Asiático (Tailândia, Vietnã, etc.).

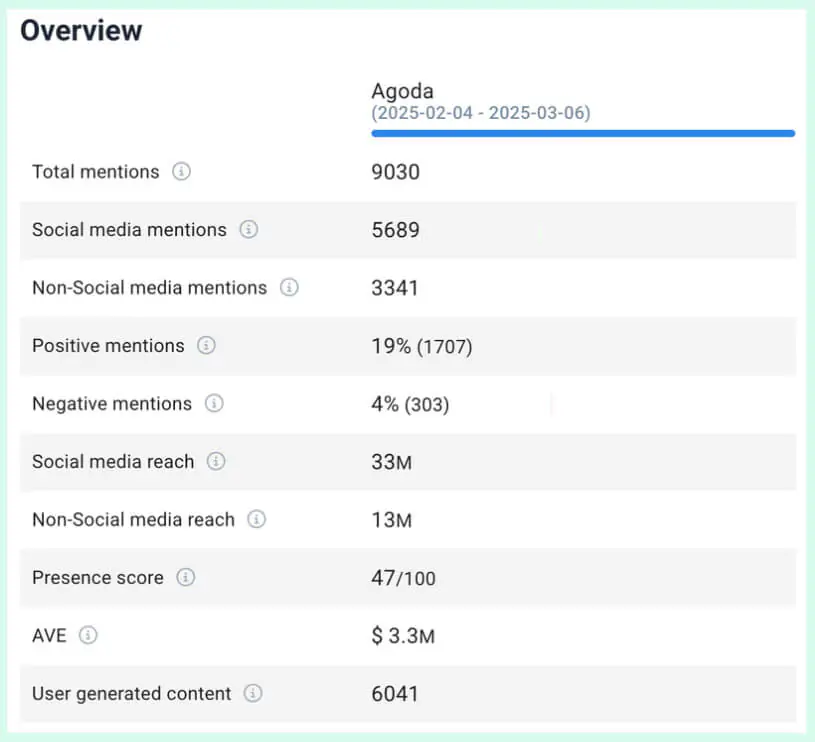

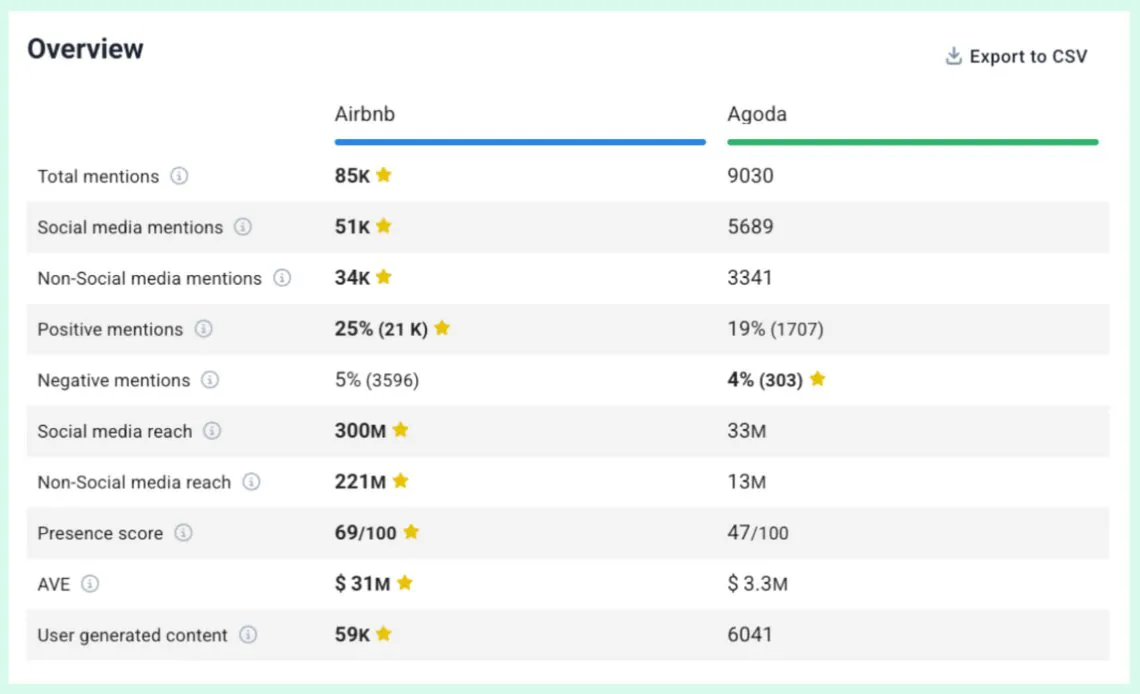

Aqui está um rápido resumo das métricas de desempenho da Agoda:

- Número de mentions: 9030

- Número de mentions positivos: 1706

- Número de mentions negativos: 303

- Alcance da mídia social: 33 milhões

- Alcance não social: 13 milhões

- Principal fonte de alcance: Sites de notícias

- Sentimento geral: 19% positivo, 3% negativo, 78% neutro

- Principal fonte de sentimento positivo: Plataformas de vídeo

- Principal fonte de sentimento negativo: X (Twitter)

- Pontuação de presença: 56

- Tópicos mais populares sobre a marca: informações sobre reservas de hotéis, plataformas de reservas de viagens, guias de viagem

- Análise de emoções: admiração (70,7%), alegria (12,5%), nojo (9,5%), raiva (3,8%), tristeza (3%), medo (0,5%).

Airbnb vs. Agoda

Novamente, O Airbnb é um campeão indiscutível.

A única coisa que a Agoda faz melhor em termos de visibilidade da marca é a melhor relação entre mentions negativos e totais (4% vs. 5%).

04 Expedia

A Expedia é muito mais do que apenas uma plataforma de aluguel de acomodações.

De fato, essa empresa de propriedade do Grupo Expedia é uma agência de viagens on-line que você pode usar para encontrar aluguéis de longo e curto prazo, aluguel de carros, passagens aéreas, cruzeiros marítimos, pacotes de férias e muito mais.

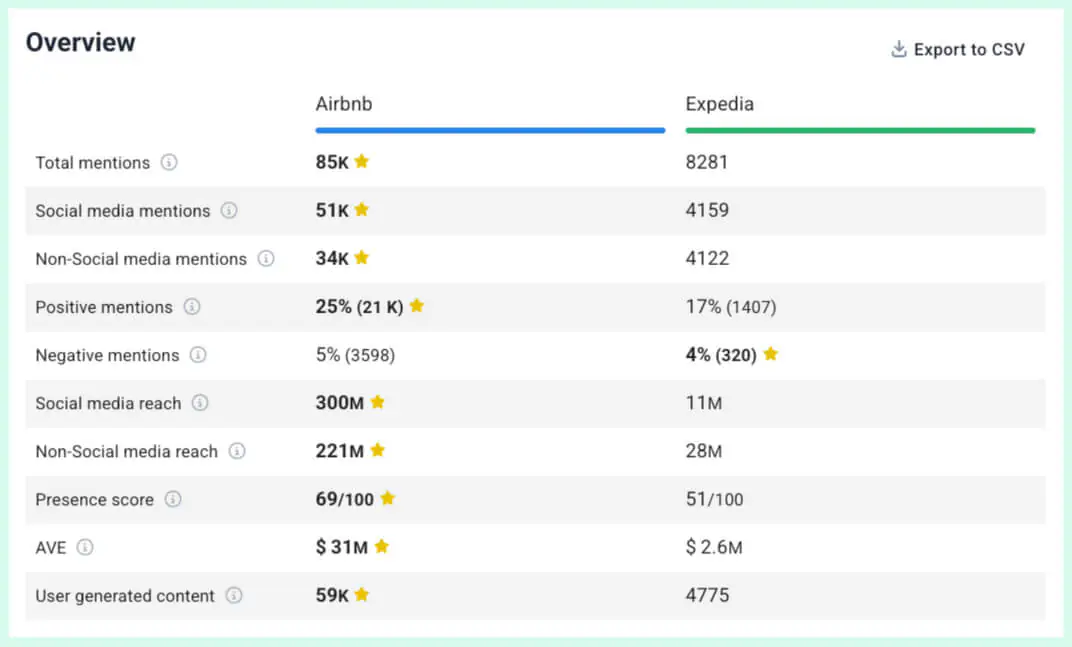

Vamos verificar o total reconhecimento da marca desse magnata do setor de lazer.

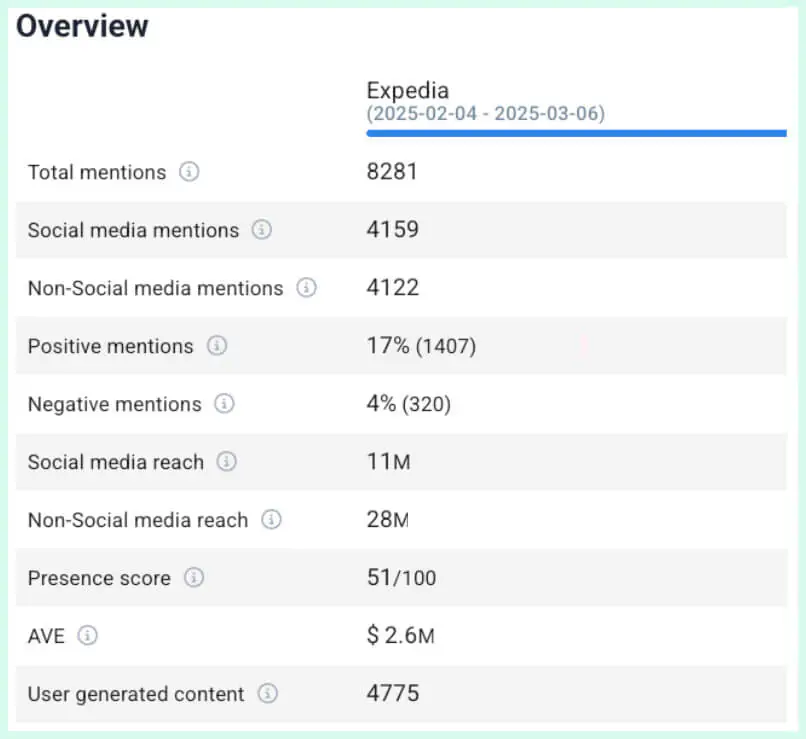

Aqui está um rápido resumo das métricas de desempenho da Expedia:

- Número de mentions: 8281

- Número de mentions positivos: 1407

- Número de mentions negativos: 320

- Alcance da mídia social: 11 milhões

- Alcance não social: 28 milhões

- Principal fonte de alcance: Outras redes sociais (Reddit, Quora, etc.)

- Sentimento geral: 17% positivo, 4% negativo, 79% neutro

- Principal fonte de sentimento positivo: Instagram

- Principal fonte de sentimento negativo: X (Twitter)

- Pontuação de presença: 51

- Tópicos mais populares sobre a marca: avaliações e ofertas de viagens, marketing e conteúdo de viagens, tecnologia do setor de viagens

- Análise de emoções: admiração (66,2%), nojo (15,6%), alegria (12%), raiva (3,2%), tristeza (2,4%), medo (0,7%)

Airbnb vs. Expedia

Bem, devo dizer que estou um pouco surpreso!

Da mesma forma que outros concorrentes do Airbnb na lista, não chega nem perto a ela. Além disso, a Expedia é a única marca da lista com um maior porcentagem de aversão do que de alegria.

05 HomeToGo

A HomeToGo é uma empresa com sede em Berlim que lista acomodações alternativas em 25 países na Europa, América do Norte, América do Sul, Austrália e Ásia.

É também a empresa de aluguel por temporada mais jovem da lista (fundada em 2014).

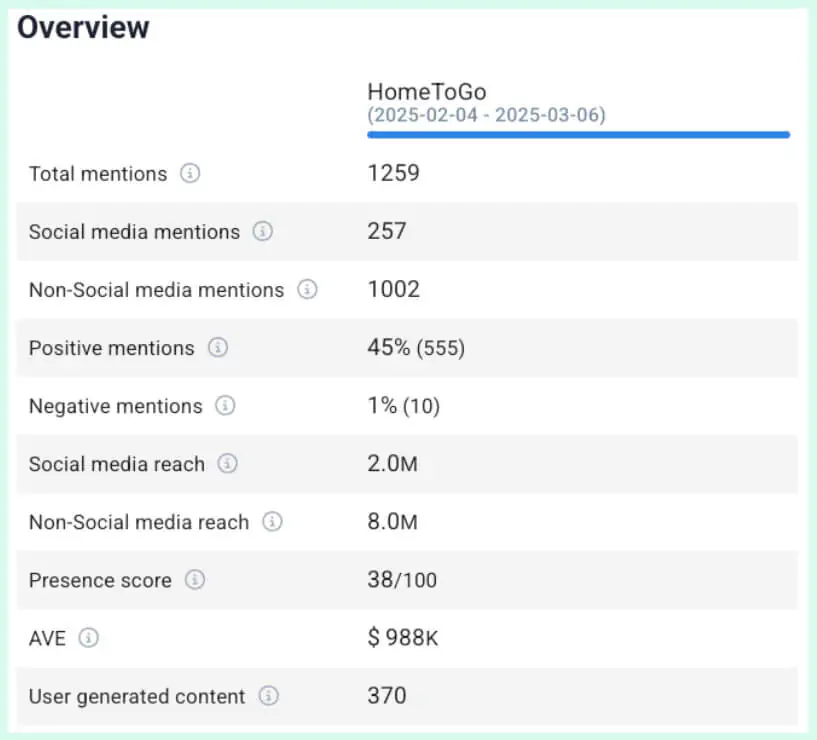

Aqui está um rápido resumo das métricas de desempenho do HomeToGo:

- Número de mentions: 1259

- Número de mentions positivos: 555

- Número de mentions negativos: 10

- Alcance da mídia social: 2 milhões

- Alcance não social: 8 milhões

- Principal fonte de alcance: Sites de notícias

- Sentimento geral: 34% positivo, 9% negativo, 57% neutro

- Principal fonte de sentimento positivo: Sites de notícias

- Principal fonte de sentimento negativo: TikTok

- Pontuação de presença: 38

- Tópicos mais populares sobre a marca: plataformas de aluguel por temporada, expansão dos negócios da HomeToGo

- Análise de emoções: admiração (88,4%), nojo (7,2%), alegria (3,9%), raiva (0,5%).

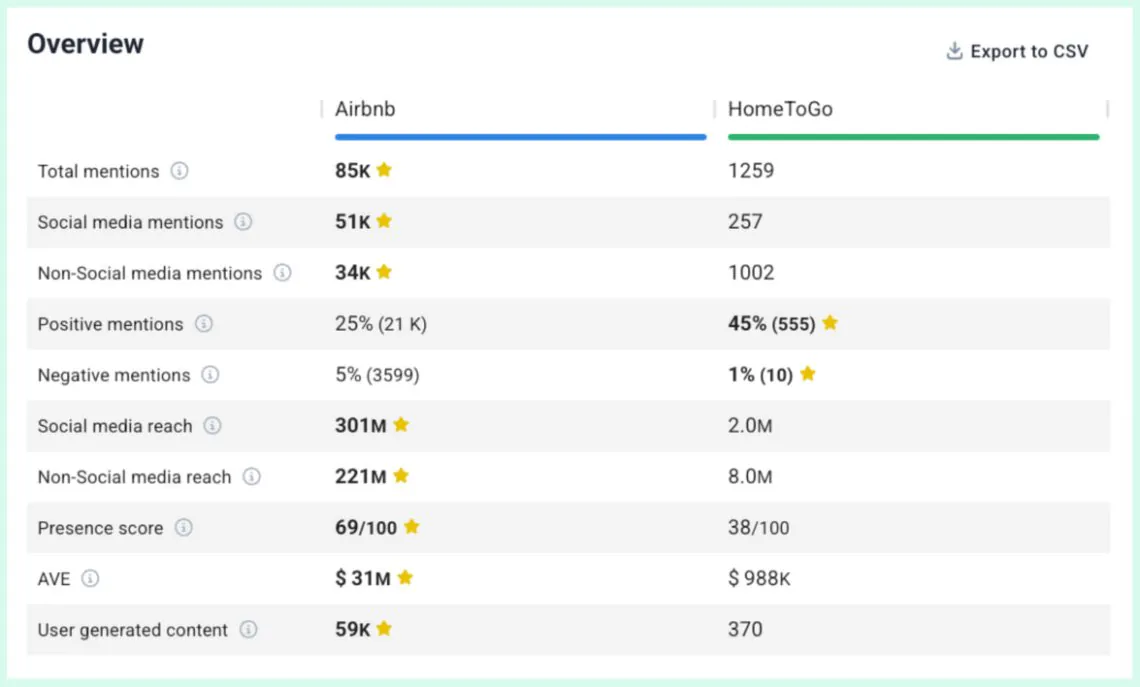

Airbnb vs. HomeToGo

Obviamente, A HomeToGo é uma empresa muito menor do que a Airbnb.

Vale a pena observar, no entanto, que a HomeToGo desfruta de uma verdadeira excelente reputação! Até 45% de mentions têm um sentimento positivo e apenas 1% - um sentimento negativo.

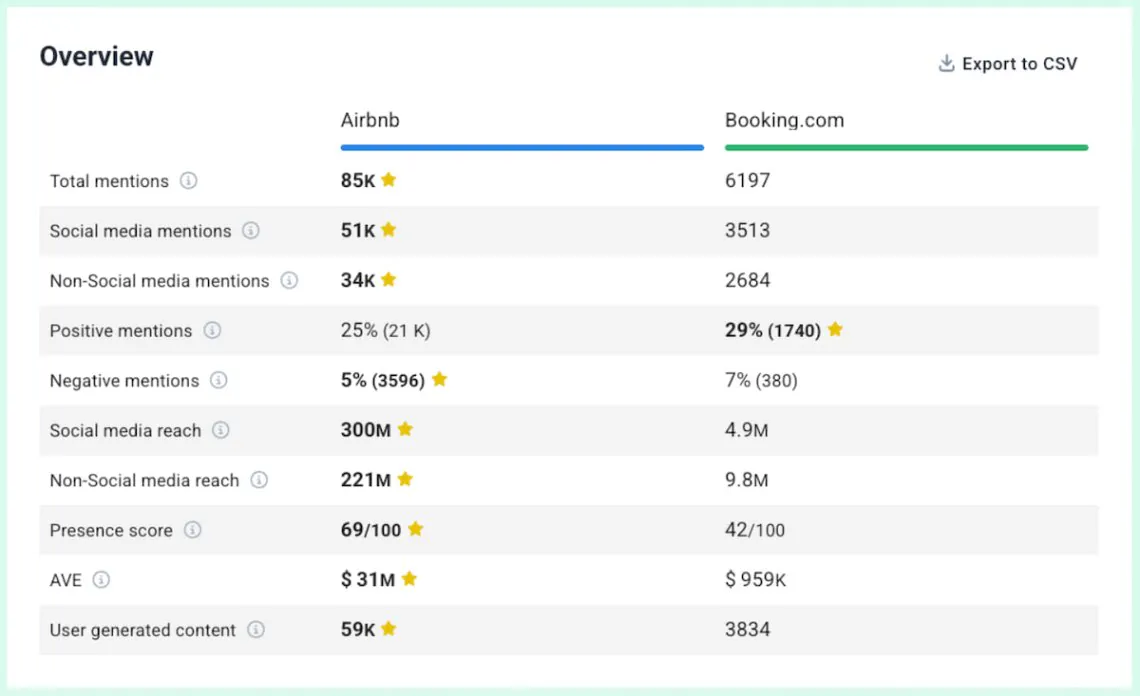

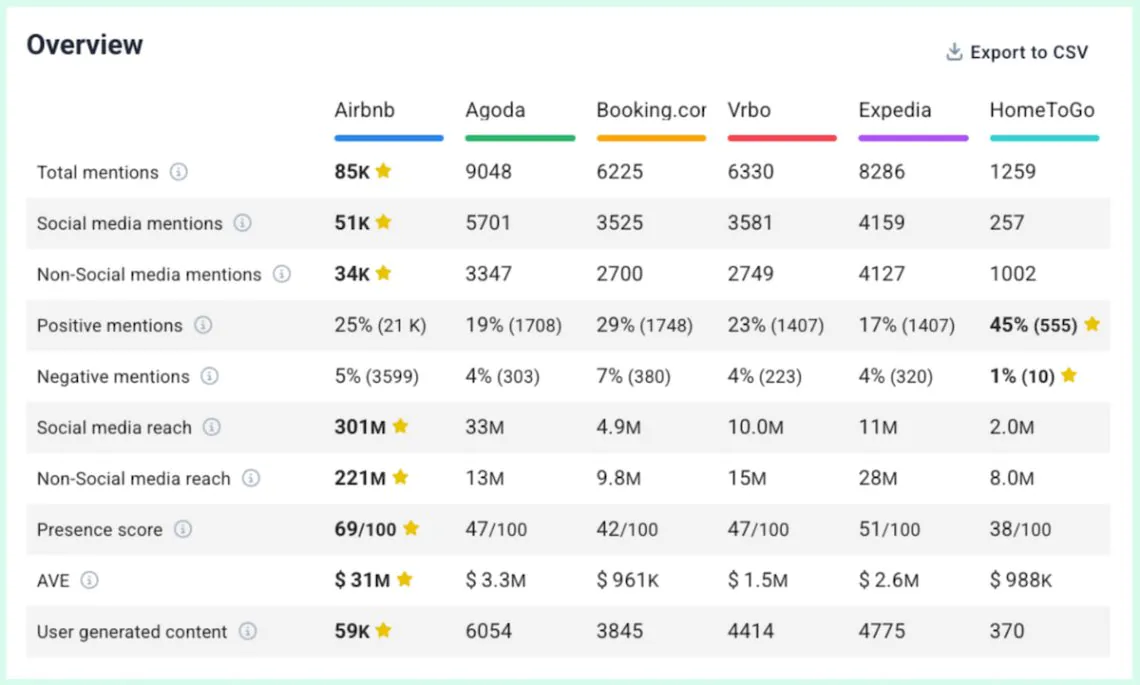

Comparação detalhada

Agora, vamos dar uma olhada no Airbnb e em sua vantagem sobre os concorrentes de um ponto de vista panorâmico.

A tabela de resumo que resume o desempenho da marca prova claramente que O Airbnb é o carro-chefe do mercado de aluguel por temporada.

Um verdadeiro dominador.

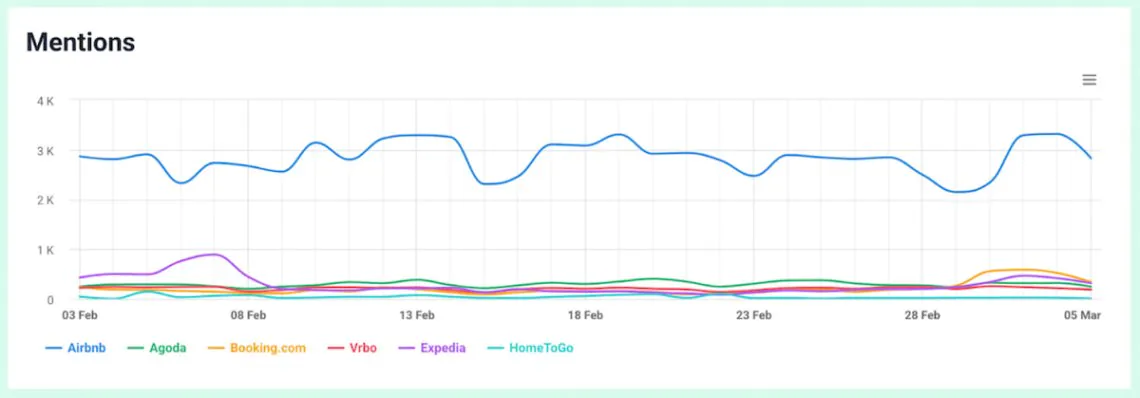

Mentions

31,148.

Esse é o número total de mentions da Booking.com, Agoda, Vrbo, Expedia e HomeToGo combinados.

85,211.

Esse é o número total de mentions do Airbnb.

2,7 vezes mais!

Se precisar de provas mais convincentes do poder do Airbnb, dê uma olhada neste gráfico.

Perdoe minha malícia, mas parece que Usain Bolt competindo em um sprint de 100 metros com caracóis.

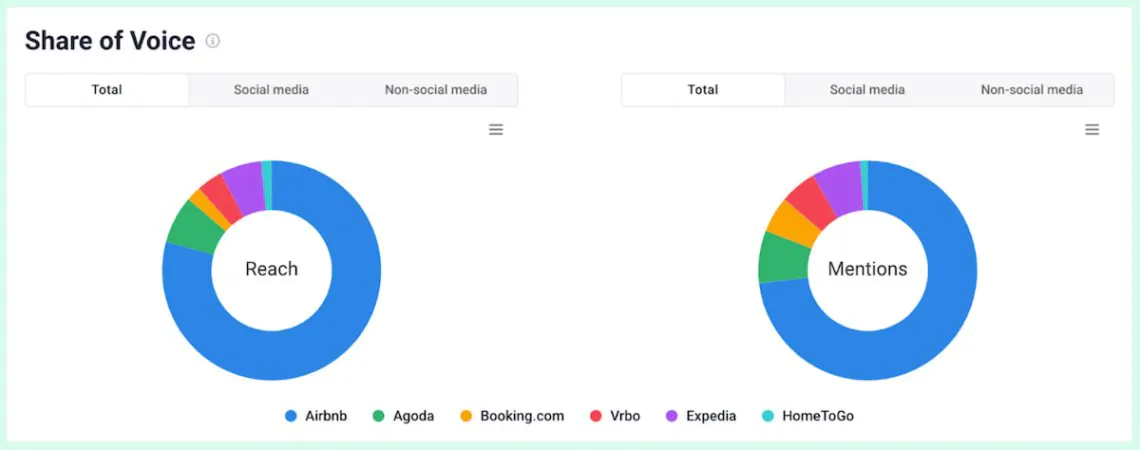

Compartilhamento de voz

Uma última visualização comparativa apresenta dois gráficos em anel com o compartilhamento de voz compartilhamento de voz.

Tanto no caso de alcance quanto de mentions O Airbnb leva cerca de 75%.

Mas isso não é definitivo!

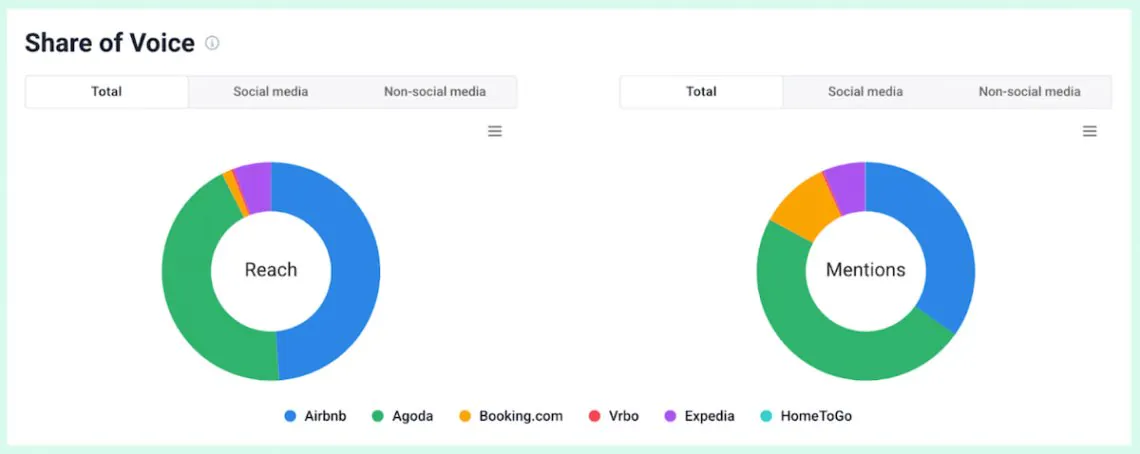

O recurso de comparação Brand24 permite que você use recursos avançados, incluindo geolocalização.

Quando limitei os dados a Somente no Leste Asiático, Os resultados apresentaram uma imagem diferente.

Agoda torna-se um líder incontestávelcom uma participação de voz de 44% em alcance e 48% em volume de mentions.

Considerações finais:

- Os maiores concorrentes do Airbnb são Booking.com, Vrbo, Agoda, Expedia e HomeToGo porque elas dominam os mercados de aluguel por temporada em diferentes regiões e oferecem serviços exclusivos.

- Nenhum concorrente está sequer perto do Airbnb em sua presença geral no mercado. No entanto, a Booking.com lidera na Europa, a Agoda domina o mercado asiático e a HomeToGo tem a melhor reputação, mostrando potencial de crescimento.

- Airbnb se destaca em reconhecimento de marca e alcance global mas poderia melhorar sua reputação no X (Twitter) e sua presença nos mercados asiático e europeu.

Inicie um teste gratuito de 14 dias do Brand24 e descubra o posicionamento exato de seus concorrentes!