Principais estratégias de marketing digital para fintechs em 2020

Tabela de conteúdo

Fintech companies have been on the rise for a couple of years now. The new type of business faces many challenges — starting with technological issues and ending with marketing and promotion. Marketing plays a vital role when it comes to the success of your fintech company. How do you successfully market your fintech app in a saturated market? We have prepared a list of digital marketing strategies you can implement to your fintech company.

The saturation of the fintech market is both a blessing and a curse. Because of the number of competitors, it will be harder to stand out in the crowd. Attracting new customers and keeping the churn levels low is a major issue for any fintech company.

But the number of available data is astounding. It means you can perform a thorough market analysis and build your fintech digital marketing strategy based on hard numbers. No more counting on lucky guesses, you will have a solid basis for your business decisions.

Which fintech marketing tactics should you employ?

We did some research and put together the most effective strategies for your fintech business!

Top fintech digital marketing strategies:

Monitorar a reputação da marca

Trust is a deciding factor when it comes to choosing a fintech or a robo app. After all, you are asking your potential clients to trust you with their money. You have the assurances of governmental institutions but that’s not enough.

You have to build trust with your target audience.

Prevention is better than cure. This old saying applies to the world of fintech businesses as well.

One of the aspects of building trust is monitoring every mention about your company and reacting accordingly. In other words, you need to be aware of everything that is being said about your company, product, or service.

The process of monitoring will indicate what is working well and what you still need to improve. Media monitoring will help you collect the feedback straight at the source, which is priceless.

Brand reputation is your most important asset. Protecting your reputation should be your top priority.

To accomplish the process of gerenciamento da reputação da marca, you need to monitor what people say about you. The nature of fintech business and the targeted demographic makes the process easy to accomplish.

The key to building trust is to answer all queries and complaints as soon as possible. To save time and do it effectively, take a look at a monitoramento da marca ferramenta.

A dedicated tool will collect and analyse all publicly available mentions regarding your product or service.

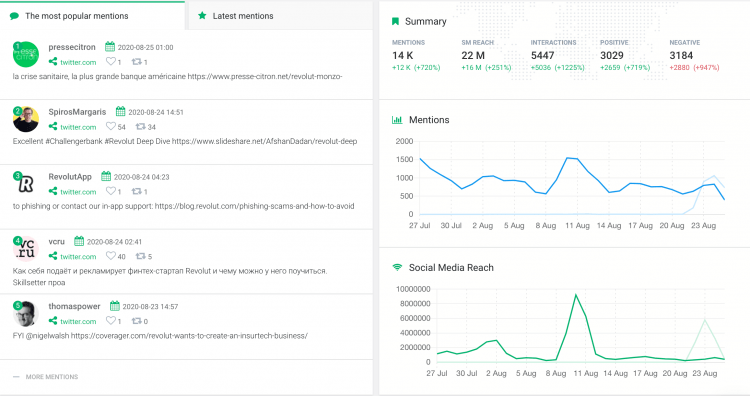

Let’s see how it works based on the results from Brand24, one of the most affordable tools on the market.

Firstly, we will examine the sources Brand24 covers. The tool will collect mentions from:

- all major social media platforms, including Facebook fan pages, Instagram, Twitter, and YouTube

- podcasts

- boletins informativos

- fóruns

- blogs

- sites de notícias

Moreover, you can add an RSS feed of a website if you want to monitor any additional sources.

Examine all collected mentions in the Mentions feed.

The tool also offers a wide range of filters you might find useful.

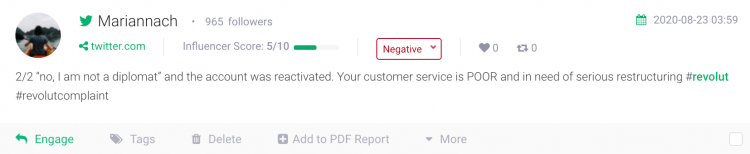

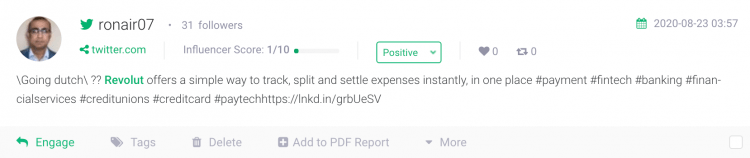

First of all, there is the Sentiment filter. The sentiment will tell you whether the mention is positive, negative, or neutral.

Here’s an example of a negative mention:

Here’s an example of a positive mention:

Your existing and potential customers will tell you what their needs and wants are. Your job is to listen and develop fintech solutions that meets their expectations.

And that’s just the beginning of how media monitoring can help your business thrive.

Protect your fintech’s brand reputation! Start a 14-day free trial (no credit card required)

Invest in a relationship marketing

Building trust among your audience does not come down to replying to negative comments. To succeed, you need a deep connection with your target audience.

To help establish a relationship with your audience, build a community around your brand.

You can achieve your goal by implementing different strategies. All of the actions should have one goal — to relieve some pain your customers experience every day.

Building a relationship with your clients will help you achieve two goals — lower churn and lower the customer acquisition costs.

Let’s talk about churn first. It’s one of the most pressing problems when it comes to any SaaS business.

There are many ways to fight high churn levels, and one of them is to build a loyal customer base.

Successful customers don’t churn. Building a relationship with your clients’ will help you discover what is working and what is not within your fintech app.

Relationship marketing makes it much easier to discover the pain points. You will be able to get the feedback straight from the source. Building a relationship will ensure that your customers are honest with you and take the time to indicate what is working and what is not.

Relationship marketing will also tackle the second prominent problem — customer acquisition costs. Successful customers will refer others to your app, creating a priceless word-of-mouth marketing campaign.

Você pode build a community around your brand by setting up Facebook or LinkedIn groups, taking part in conversations, or answering some questions on Quora.

Invest in influencer marketing

Fintech marketing strategy should revolve around building credibility around your brand.

That is why it is a good idea to work with influencers.

Influencer marketing has had some bad press recently, but, if done right, it can do wonders for your business.

The benefits of influencer marketing for fintech industry include:

- increased trust in your brand due to influencer recommendation

- saving your time

- possibility of attracting brand new audiences

- promoting your brand with dedicated and thoughtful content

The key to running a successful influencer marketing campaign is to choose the right influencer to work with. To do that, you need to perform industry research.

A media monitoring project will help you find the right influencer for your campaign. All you have to do is follow a few steps:

- Create an industry-related project. Think about the industry you want to focus your actions on and come up with the keywords related to this business niche.

- Start monitoring the conversations around this topic.

- Take a look at the Analysis tab. On the bottom of the page, you will find two tables: top public profiles and most active public profiles. They are accompanied by auxiliary metrics, for example, the compartilhamento de voz or reach.

This analysis will indicate potential influencers to work with on your next project. Once you decide on who do you want to work with, take a closer look at their posts. Are they positive? What other products does the influencer promote? Do they align with your fintech business?

Remember about mobile

That might seem a trivial point because your fintech app is mobile friendly. Yet many companies still neglect the mobile user experience.

Not paying enough attention to mobile website and marketing can hurt you on many different levels — starting with SEO and ending with mobile apps and design.

Start with the basics — is your site mobile responsive? Are there any UX bugs you can easily improve?

Once you cover the basics, focus on more advanced problems, for example, time to first bite or image optimization.

More and more searches will be performed on mobile devices. If you want to get ahead of the pack, you have to keep improving your mobile site.

Create creative content

While creating content for your fintech digital marketing strategy remember about a few core principles.

First of all, your content should add value. Whatever type of content you produce, a blog post, a YouTube video, or an Insta story — the content should help the user. The content that solves a particular problem is your golden ticket.

Producing the right type of content will help you deliver the right message to the right audience at the right time.

Content creation will help you educate your potential customers and present the ins and outs of your app. You can highlight the benefits of using your fintech solution. Educating your audience is vital financial topics will establish your fintech as an industry leader.

The second principle in content creation is simple — be where your audience is. Test some types of content and analyse what works best.

Invest in branding

There are plenty of fintech apps on the market. You have to distinguish your app from the competitors.

To do that invest in branding.

Branding is the first thing your potential clients will see. You can provide an excellent fintech app, have awesome customer service, and content strategy. Yet without branding, this work will go down the drain.

Bold branding will help you build brand awareness and brand associations. That’s why you should take start with your branding strategy right at the beginning of your fintech journey.

Provide exquisite customer service

Customer service can be your secret weapon when it comes to fintech digital marketing strategies.

I know it sounds counterintuitive. Customer success and marketing are two different departments. But successful customers are your best marketing tactics.

Positive customer stories travel fast on the Internet. Never underestimate the power of personal recommendations.

Invest in reward systems

Rewards systems are another form of recommendations from satisfied users.

By sharing a unique link with their friends and family, both parties will receive a small gratification. That’s how many well-known companies boosted their brand visibility and attracted new customers.

One of the companies that implemented a referral program is Airbnb. According to their research, referral programs work because of… altruism. People want to feel good about themselves, and giving their friends a gift certainly helps them achieve this feeling.

The results of the referral program? Referred customers booked more reservations, become hosts more often, and they referred users of their own.

Be customer-centric

The last point is a pretty good summary of everything we have talked about previously.

If you want to succeed, and I assume you do, you should think about the needs of your customers first. Every business decision, every new feature, should be preceded by thorough research.

This is one of the most important points in this article, as it concerns the way you think about your business strategy. Put your customers first, and you will be able to develop a product that fulfills their desires and needs.

Customers must be the center of the decision-making process.

Fintech digital marketing strategies

Marketing services in fintech businesses are hard.

One the one hand, you had to attract your target audience. You have to choose the right channels to post, create engaging content, and, on top of that, analysis all the data.

But on the other hand, you need credibility. You ask people for money, you need them to trust you.

That’s why preparing a digital marketing strategy for your fintech should be a data-based process. Discover what people are already saying about you and use data to tailor the product and the messaging.

CONTEÚDO RELACIONADO SELECIONADO A DEDO

Como usar a análise de sentimento no mercado de ações?

Media monitoring analysis reports: what are they and how to create them?

10 ativos de marketing em que toda empresa deve investir

![O que é um webinar? Definição, benefícios e guia passo a passo [2024]](https://brand24.com/blog/app/uploads/2024/11/webinar_digital_marketing_blog_cover_615x345-600x335.webp)