How to use sentiment analysis for stock market?

Table of contents

Can you predict how the stock market will react to certain news, posts, and online conversations? Knowing how the financial market will behave can give you a competitive advantage and help avoid losses. An unexpected ally in predicting the changes in the stock prices are social media. Online news travels fast, making the stock market exchange even more susceptible to rapid changes.

If you look for an extreme example of how social media influences stock market, take a look at Kylie Jenners’ tweet about Snapchat.

Shortly after the message was posted online, the price of Snap, Snapchat parent company, fell by 8.5 percent.

Some investors were able to benefit from the social media turmoil, The Big Short-style, and made $163 million.

All of that fuzz was based on one tweet with negative sentiment. Social media have the power to influence the price of stock.

Imaging what could have been done, if you knew about the tweet moments after it was posted online.

You could’ve benefited from the knowledge in many ways – either selling the stocks before it all hits the fan or buying the stocks at a discount price.

That’s the power of stock sentiment analysis.

This example is consistent with the Efficient Market Hypothesis. According to the hypothesis:

stock market prices are largely driven by new information and follow a random walk pattern.

Sentiment analysis is a perfect addition to all technical parameters you use to assess stock market performance.

Market sentiment has an effect on short-term price fluctuations. Volatility is a part of trading on different markets. Thankfully, nowadays, there are plenty of tools that will collect the data you need.

Let’s crack the sentiment analysis for stock market.

Here’s what’s ahead of us today:

What is market sentiment?

The rise of social media platforms gave many people space to express their opinions. Everybody can discuss whatever topic they feel comfortable with, no matter whether they are experts in the field or not.

The development of smartphones, cellular networks, and widely available WiFi, made it easy for content to spread.

Today, information (also fake news and rumours) can travel with the speed of light, attracting attention of investors around the globe.

The amount of information, and the speed at which the information online spread, can have both a positive and negative effects on the price changes of stocks.

Including market sentiment in the analysis of stock portfolio will help you play the odds in your favour. Using sentiment analysis will help you succeed on the market.

Check out media monitoring and sentiment analysis! Try Brand24 for free (no credit card required).

How to monitor sentiment for stock market?

The quickest way to monitor sentiment analysis is to use a media monitoring tool. Media monitoring tools give you the best chance to spot the right mentions on time. They are a must-have tools for investors and traders.

I recommend Brand24, one of the most robust media monitoring tools, according to Buffer.

Brand24 collects all publicly available mentions containing your predefined keywords.

How to use sentiment analysis for stock market in practice?

Start with creating a project.

The project creation wizard consist of three steps. That seems like a lot, but it’s all to ensure you get the most accurate and relevant results.

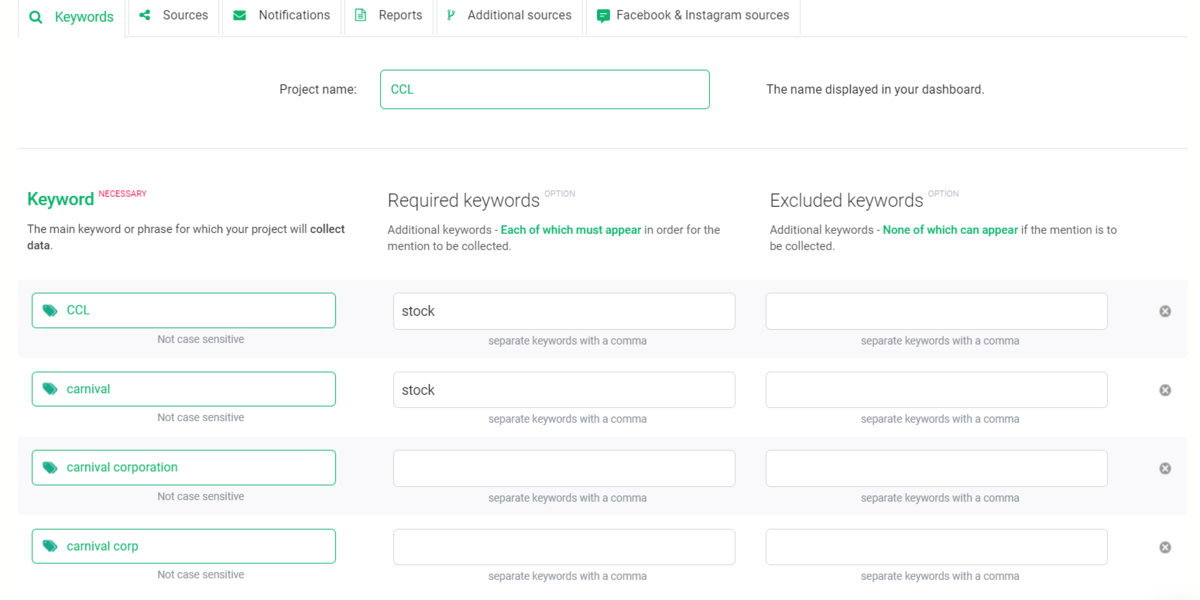

In the first step, choose the keywords you want to track.

Set up a sentiment monitoring project. No credit card required.

You can track any keyword you want.

Think about keywords used regularly in the same context of discussion as the companies you’re interested in. That could be the brand’s name, a hashtag used by some commentators on social media, or any other word that will help you collect the mentions you need.

In the last steps, you can specify the language you’d like to monitor and add some additional sources, for example, TripAdvisor. You can skip it, since you want to focus on sentiment analysis.

Let’s see how media monitoring and sentiment analysis work in practice.

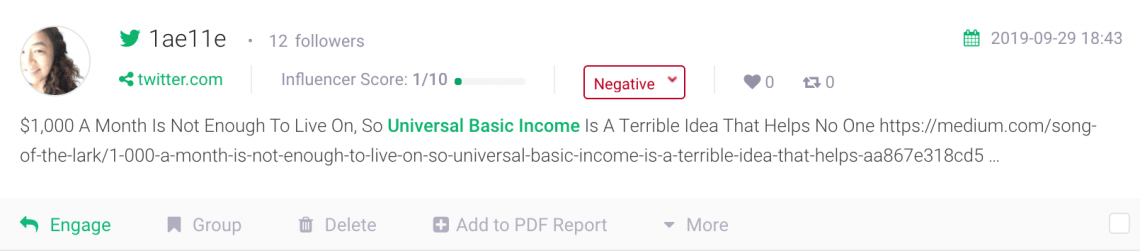

I set up a project regarding universal basic income. Brand24 collects all publicly available mentions containing my keywords. The tool analyses the results as well.

That’s why I know that this mention published on Twitter is a negative one.

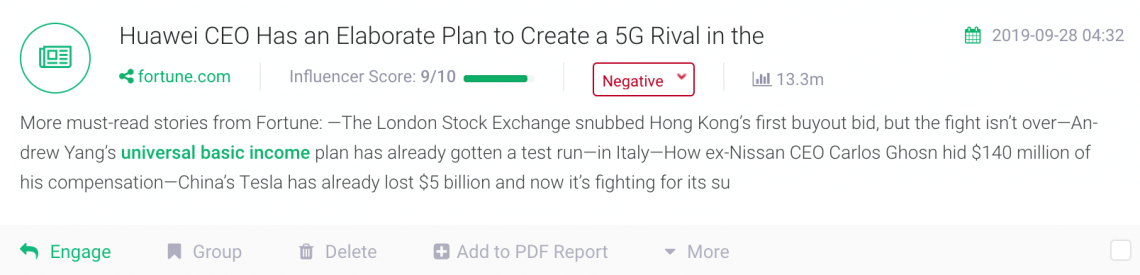

Brand24 will also collect news from media sites, for example this one, from Fortune.com:

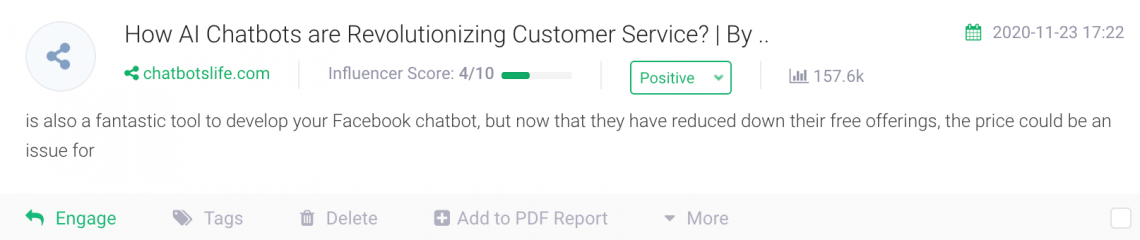

But you can easily spot positive mentions as well:

To spot the mentions you’d like to analyse in more detail, you can use a wide range of filter. You can filter the mentions by sentiment, author, influence, date, and much more!

Receiving your sentiment analysis results

When it comes to stock market, time is of the essence. You have to know about new comments and their sentiments right away.

To do that you need a robust notification system.

Brand24 offers three types of notifications:

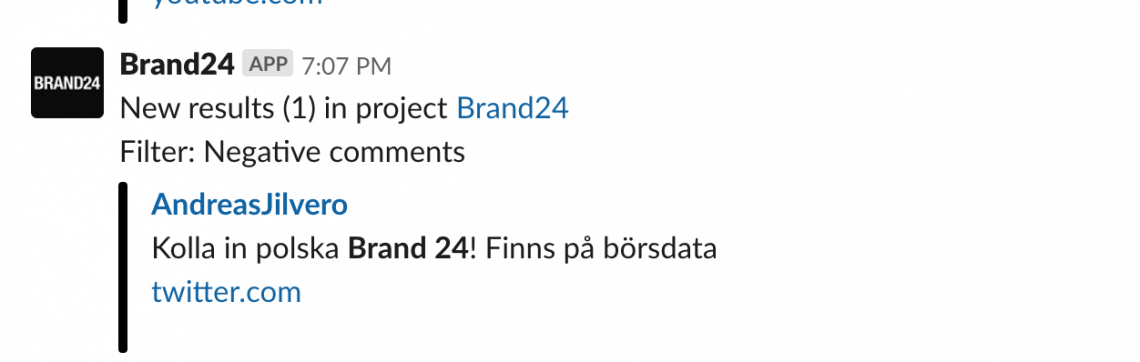

- Slack notifications. If you have a Slack account, I highly recommend connecting your project to one of your channels. You’ll receive a notification every time a new mention lands in your dashboard. You can set up filters and receive only negative mentions or all of them.

- In-app notification. Brand24 offers an app, both for iOS and Android. You can swiftly access your projects and examine the data you need.

- Email notifications. You’ll receive an email every time there’s a sudden surge in the number of mentions regarding one of your projects. Sentiment indicators are included in the message.

When it comes to sentiment analysis for stock market, I believe that Slack notification are the most reliable option, followed by the in-app notifications.

Does Brand24 sound interesting? Give it a spin! Test the tool for free for 14 days. We won’t ask for your credit card number!

How does sentiment analysis work?

Let’s take a look at how sentiment analysis works.

After all, the algorithm is going to be one of the factors in your decision-making process. It’s important to understand how it works and how reliable the sentiment analysis is.

The old approach to sentiment analysis

Sentiment analysis used to be a binary solution — sentiment analysis tools would detect certain words and attached positive and negative sentiment.

This kind of sentiment indicators had many drawbacks, and didn’t always assign right sentiment to the right mentions. It could have happened that an online post with positive sentiment is recognised as a negative one.

Another weakness of the binary solution are the language limitations. The algorithm deciphers the languages one by one, making it impossible to assess the results based on families of languages and the similarities between them.

Recent changes in sentiment analysis algorithms

As you can see, sentiment analysis, although very useful, had some serious drawbacks.

It has all changed recently.

Sentiment analysis algorithms became more sophisticated and more reliable.

I can show you how sentiment analysis works based on Brand24, a media monitoring tool.

The tool offers a state-of-the-art sentiment analysis algorithm for a reasonable price.

The algorithm is based on a deep learning solution. The AI works similar to human brain — the sentiment algorithm will assign similar sentiment to words with similar meaning.

Moreover, the tool analyses sentiment based on the families of languages. That not only makes the algorithm more accurate, it also allows the tool to analyse sentiment of different languages.

Sentiment analysis is available for more than 100 languages.

Sentiment analysis works both for mentions from news sites, forums, blogs, and social media, for example, Facebook, Twitter, or Instagram.

The social media platform of choice for financial journalists is Twitter. That makes it perfect for media monitoring and sentiment analysis for stock market.

Tweets regarding financial news are short, precise, and logical. Therefore, using sentiment analysis on Twitter us a piece of cake.

Can market sentiment help predict changes in stock prices?

Does it sound too good to be true?

In the constant news cycle it’s hard to distinguish between well-researched information and an unverified piece of content.

You might have some questions about the use of market sentiment to predict changes in stock prices.

Sentiment analysis and stock market is a well-researched problem.

Our intuition tells us that price and sentiment are at least correlated. What we didn’t know is which factor had a primary effect on the stock market.

Does negative sentiment influence the stock prices? Or is it the other way around — the stock prices increased thus creating positive sentiment? That’s not only part of technical analysis, but piece of information vital for investors and traders.

Applying sentiment analysis to predicting stock market returns has been studied widely by scholars from many universities, including Stanford University and University of London.

Every study confirmed a correlation between sentiment analysis and changes in stock market.

If there’s something to the theory, why not used it to your benefit?

Let’s see how to analyse sentiment quickly and efficiently.

Can sentiment analysis bring substantial value to your stock market plan?

It all comes down to money. Is investing in a sentiment analysis tool worth your money and time? Could professional traders benefit from the analysis? Will it have a positive impact on their companies?

Volatility is part of trading. Every piece of data can have a positive or negative effect on stock prices. The goal is to spot the indicators of change early and to be able to react to the market.

Because of the 24-hour news cycle, we’re constantly bombarded with information and data. At some point, it’s almost impossible to stay on top of things and distinguish important news from the less relevant one.

Media monitoring tool can help you stay on up-to-date. Based on the filters you set up, you’ll receive the news you’re most interested in.

Moreover, the world of social media is unpredictable. Even the most inconspicuous piece of information can snowball into a full-blown crisis.

Sentiment analysis and media monitoring will help you spot this kind of mentions in advance. You’ll be able to benefit from the positive news and shield yourself from the effects of negative ones.

Do you want to see the power of media monitoring in action? My colleague, Piotr, prepared a short case study for investors.

Getting started with Brand24 investing

I started my investing adventure about a month ago and having a premium max employee account at Brand24 has been tremendously helpful. As a newbie keeping up with the trends and opportunities made my head spin, so I chose a different tactic.

I’ve selected a couple of companies that seemed to have good potential either based on their line of business or pre-covid levels which they might be retrieving once the pandemic is under control. Then I set up simple projects using our social listening tool.

Here’s a sample setup for a cruise company, Carnival Corp (CCL).

This allowed me to gather all the data about those companies and keep in touch with the relevant information. Based on that, I could predict the behaviours of the market with much more accuracy vs having access to ‘traditional’ channels.

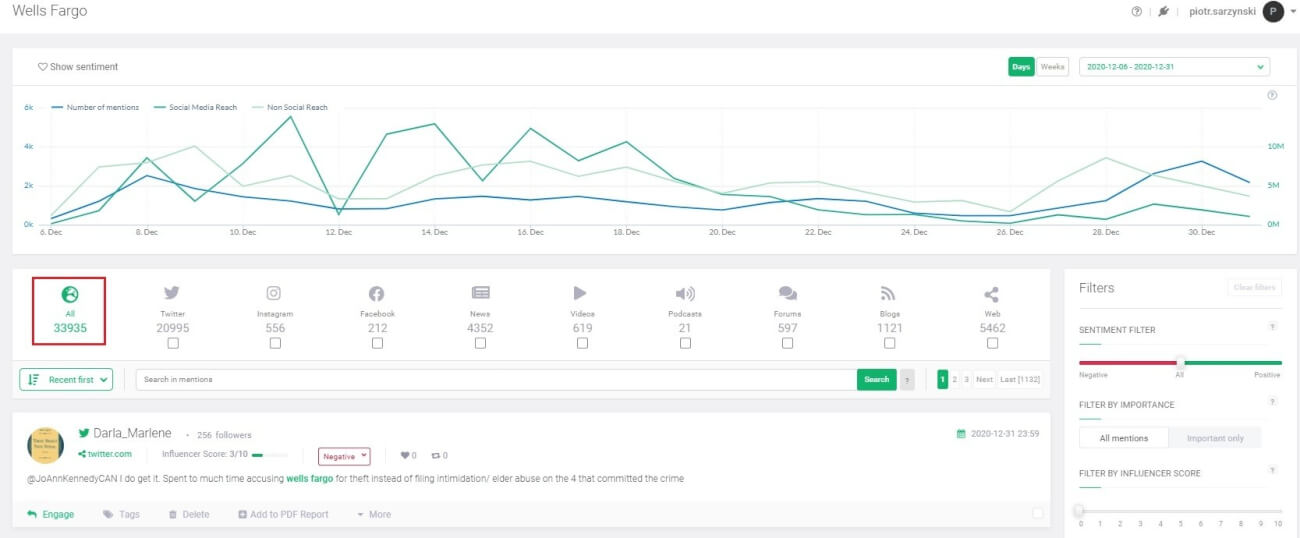

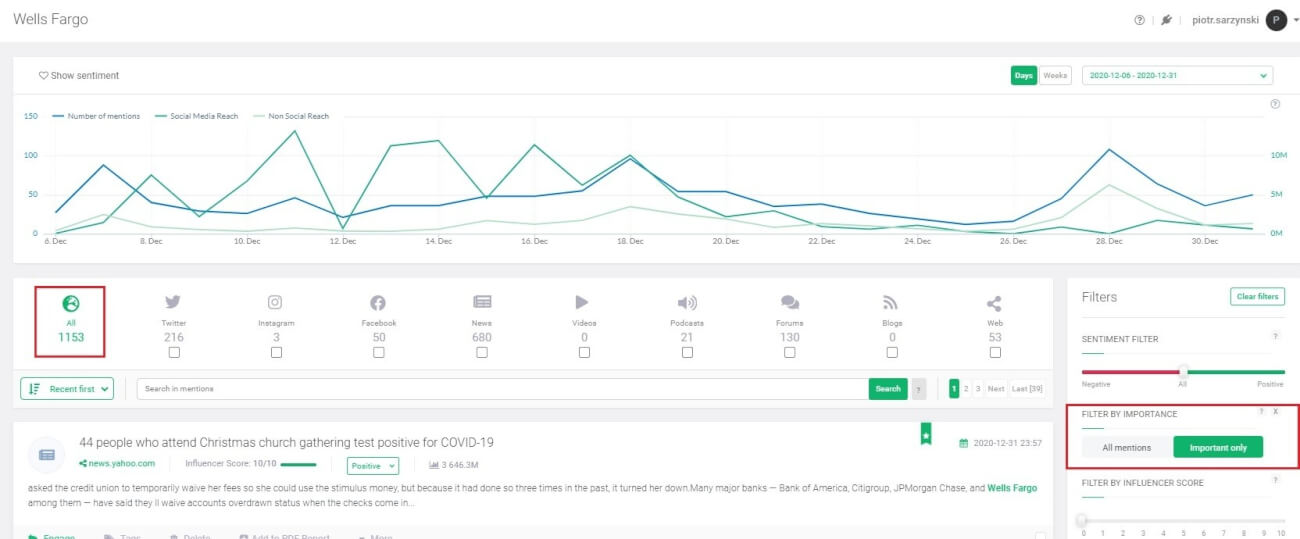

Did it give me answers on what to invest in, when and how much? Not really, but if you’re looking for easy answers, you’re on a clear path to losing money. Instead, I could select the most important information in a couple of clicks, using the importance filter.

Importance filter shows you the posts that are the most influential either because they come from authors with huge audiences, or because they are posted on investing sites with high reach. Using this filter allows you to cut out all the static around your searched phrase and really keep your ear to the ground. For another company on my list, Wells Fargo’s (WFC), the platform was able to skim the news over 30x in one click:

On the hunt for Palantir

Palantir. The meme stock. I was hesitant whether using it as a case study would be a good idea, since it’s been quite volatile over the last couple of weeks. Yesterday, though (Dec 7th) Palantir had raced over 21% up following their FDA / Greek government contracts. The official statement of Palantir regarding those deals was published at 9am Dec 8th, but the media quickly caught wind of the news and the reaction of the market was almost immediate.

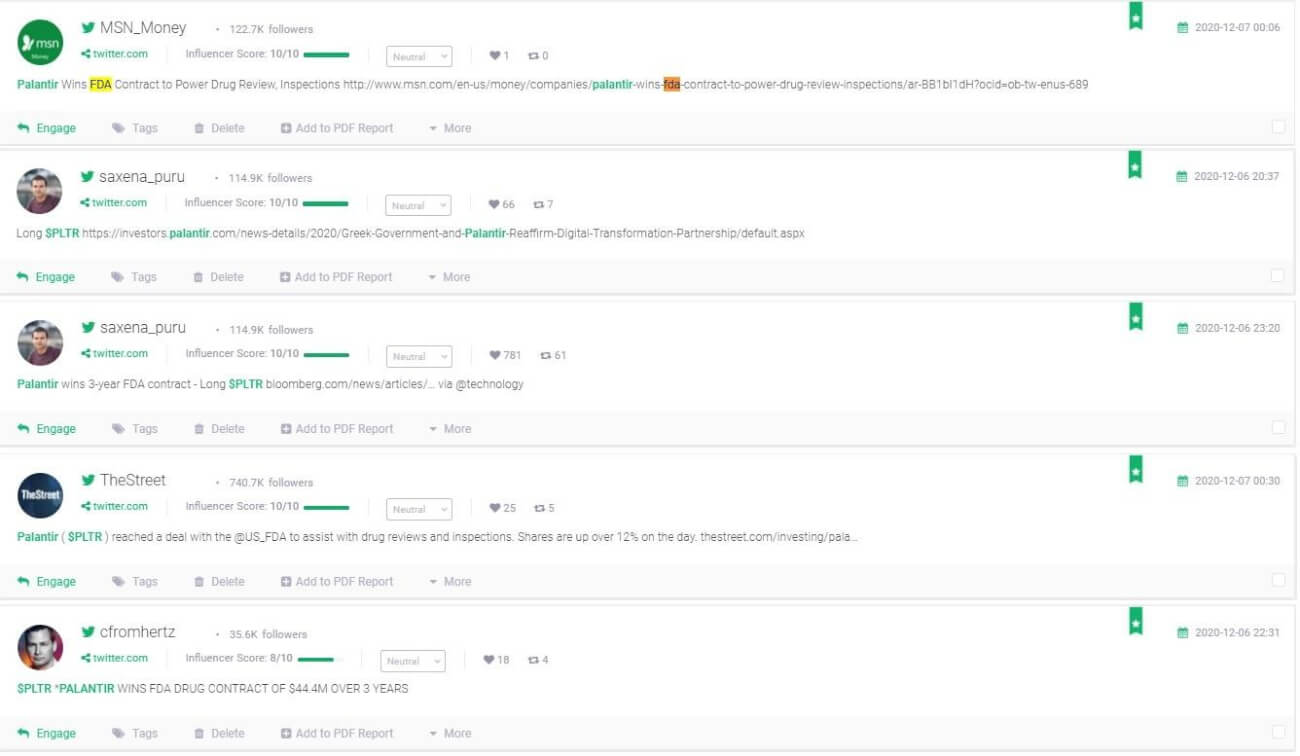

Here are some examples of the earliest Palantir mentions from that day that Brand24 was able to find for me and present quickly thanks to the importance filter:

[disclaimer: default timezone for Brand24 is PST, hence the time of mentions appear as Dec 6 in some cases]

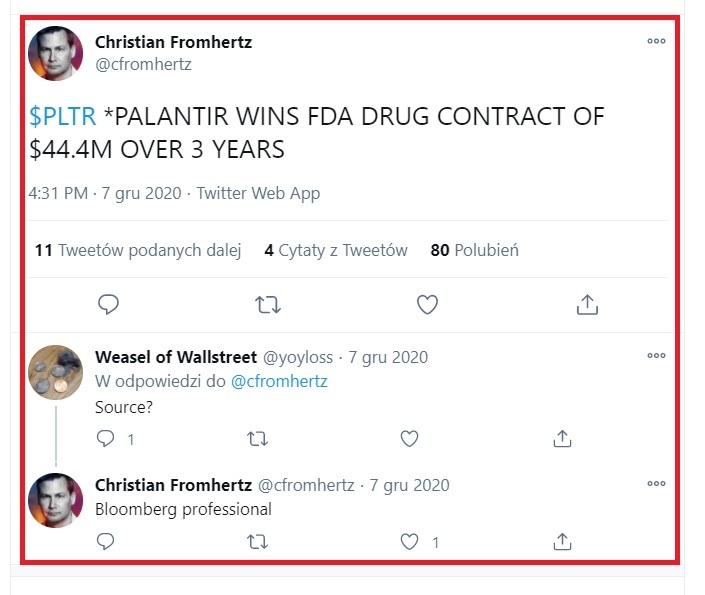

One of the mentions I’ve found was posted even before Bloomberg published their article that further accelerated Palantir’s growth:

Could I learn about that with traditional news outlets? Sure, but finding this information in the storm of other news would take time and the rocket with Palantir’s sticker on it wasn’t waiting for anyone.

Did I use the opportunity to the fullest and take home +21 percent of my input? Wish that I had, but truth be told, I’ve chickened out a bit early. Hopefully, experience will give me more courage. Still though, I’ve managed to make a fair bit in a single day.

Waiting for the storm

Another angle of using social listening in your trading is that big changes leave a trace. It might manifest itself as a boost in the overall number of mentions or a spike in social reach, should a company be mentioned by a significant name.

Whenever something like that happens, you will receive an email from Brand24, updating as close to real-time as physically feasible.

If you’re in long term and day trading is not your cup of tea, this way of media monitoring will allow you to keep your finger on the pulse without spending a minute in the panel of the platform.

![The 15 Best AI Sentiment Analysis Tools [Tested in 2024]](https://brand24.com/blog/app/uploads/2021/08/The-best-AI-sentiment-analysis-tools-in-2021.png)

![How to do Social Media Sentiment Analysis? [Guide]](https://brand24.com/blog/app/uploads/2020/11/What-is-social-media-sentiment-analysis_.png)