From facts to gains – a quick social listening guide for investors by a trading dummy

The Internet is flooded with investing advice. From seemingly safe stocks through riskier CFD contracts to cryptocurrencies promising six digits returns in no time. Who to trust in those troubling times of information overload and contradicting opinions?

Well, if you do find an answer to this question, hit me up. Meanwhile, here’s what we can learn from facts.

Stock market. The land of fantastic opportunities and lost fortunes. According to HSBC, citing data from the Bank of International Settlements (BIS) around $5,100,000,000,000 is traded daily in currencies only (source: Business Insider). That’s 5 trillion. Per day.

The biggest changes in the stock market come after groundbreaking news. The news about covid vaccine boosted american Moderna by 128% in just one month. Okay, but how to learn about those news, before they do break the ground and your ship, be that early retirement or a new car, has sailed never to return?

Well, there’s zacks, reddit, investing.com, marketwatch, business insider… or there’s the whole public internet in one place. If you’re a newbie in the investing world, you can take a look various guides for investors.

Getting started with Brand24 investing

I started my investing adventure about a month ago and having a premium max employee account at Brand24 has been tremendously helpful. As a newbie keeping up with the trends and opportunities made my head spin, so I chose a different tactic.

I’ve selected a couple of companies that seemed to have good potential either based on their line of business or pre-covid levels which they might be retrieving once the pandemic is under control. Then I set up simple projects using our social listening tool.

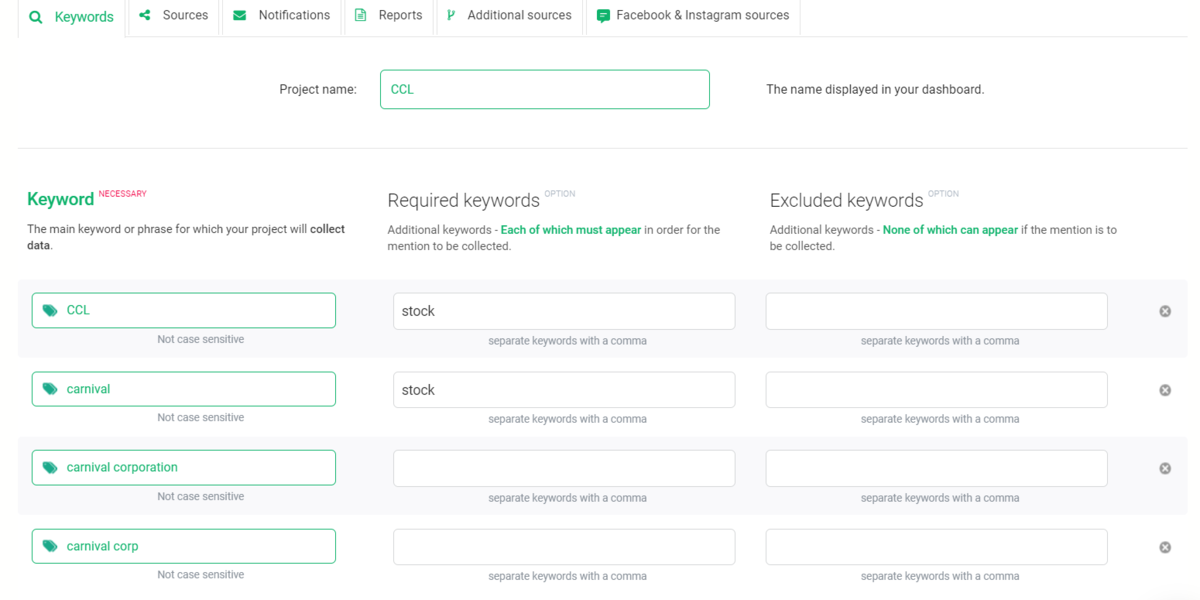

Here’s a sample setup for a cruise company, Carnival Corp (CCL).

This allowed me to gather all the data about those companies and keep in touch with the relevant information. Based on that, I could predict the behaviours of the market with much more accuracy vs having access to ‘traditional’ channels.

Did it give me answers on what to invest in, when and how much? Not really, but if you’re looking for easy answers, you’re on a clear path to losing money. Instead, I could select the most important information in a couple of clicks, using the importance filter.

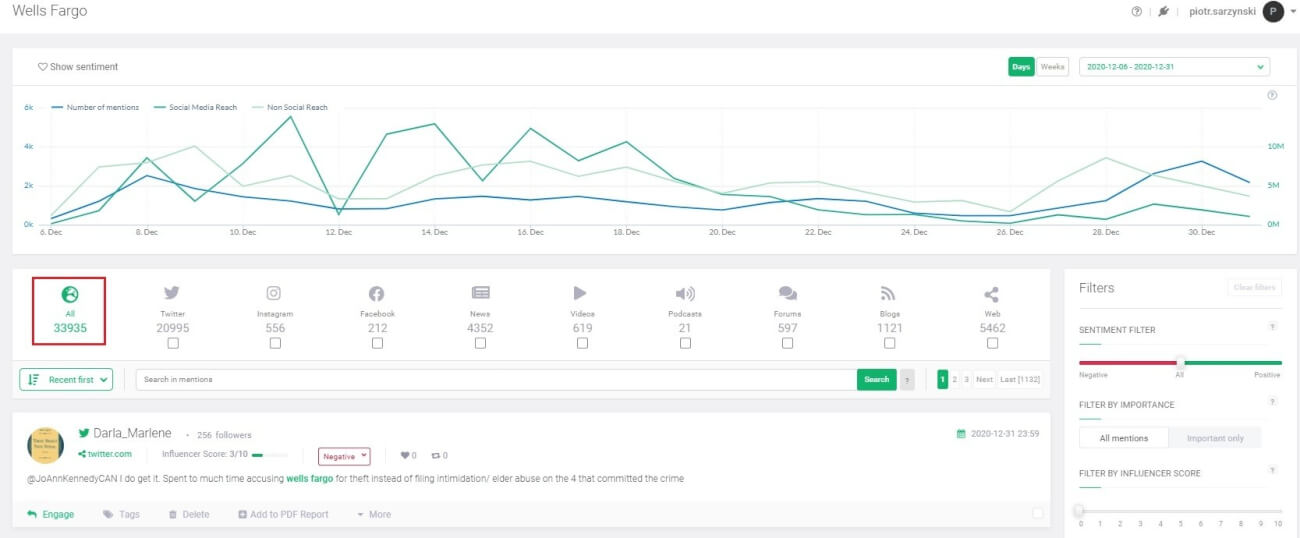

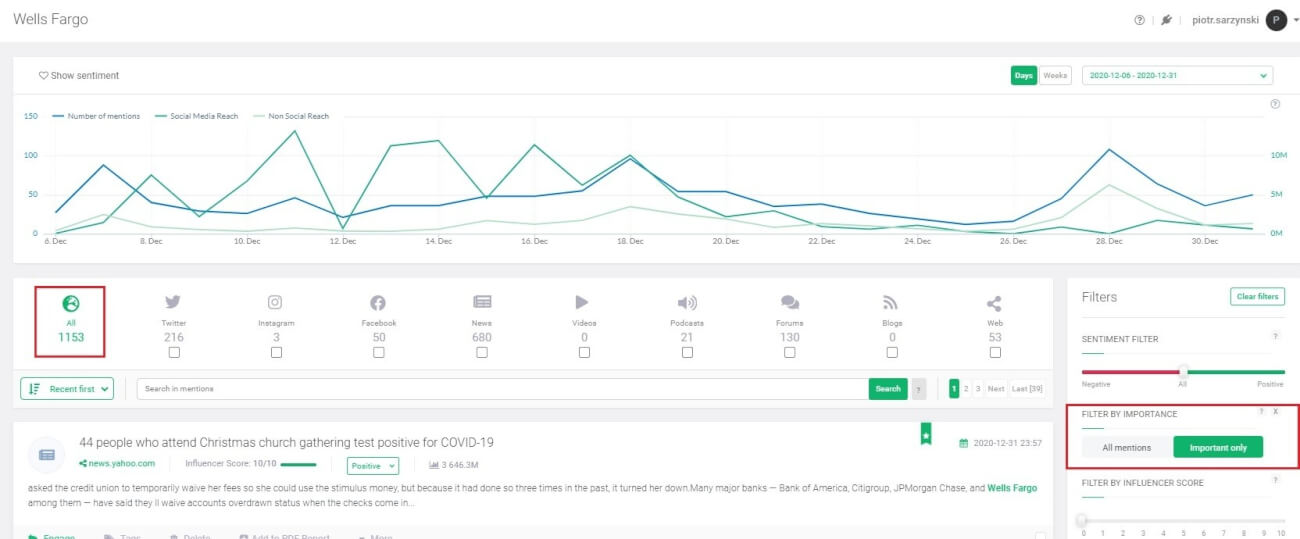

Importance filter shows you the posts that are the most influential either because they come from authors with huge audiences, or because they are posted on sites with high reach. Using this filter allows you to cut out all the static around your searched phrase and really keep your ear to the ground. For another company on my list, Wells Fargo’s (WFC), the platform was able to skim the news over 30x in one click:

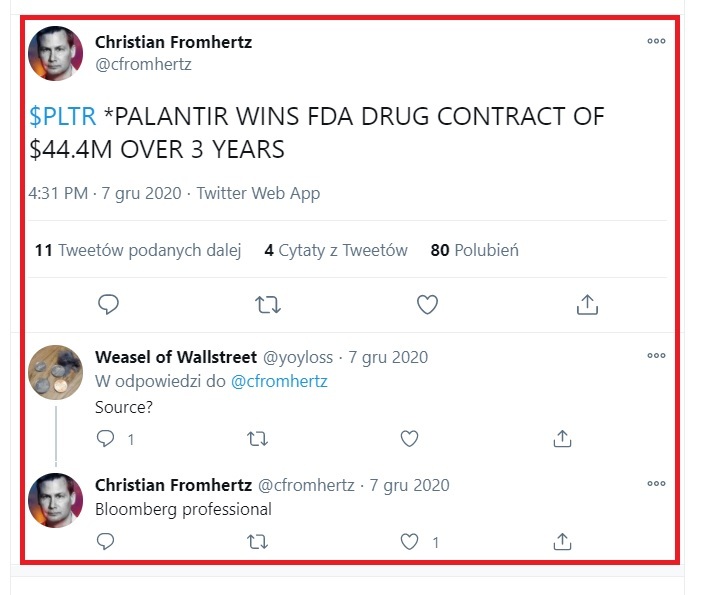

On the hunt for Palantir

Palantir. The meme stock. I was hesitant whether using it as a case study would be a good idea, since it’s been quite volatile over the last couple of weeks. Yesterday, though (Dec 7th) Palantir had raced over 21% up following their FDA / Greek government contracts. The official statement of Palantir regarding those deals was published at 9am Dec 8th, but the media quickly caught wind of the news and the reaction of the market was almost immediate.

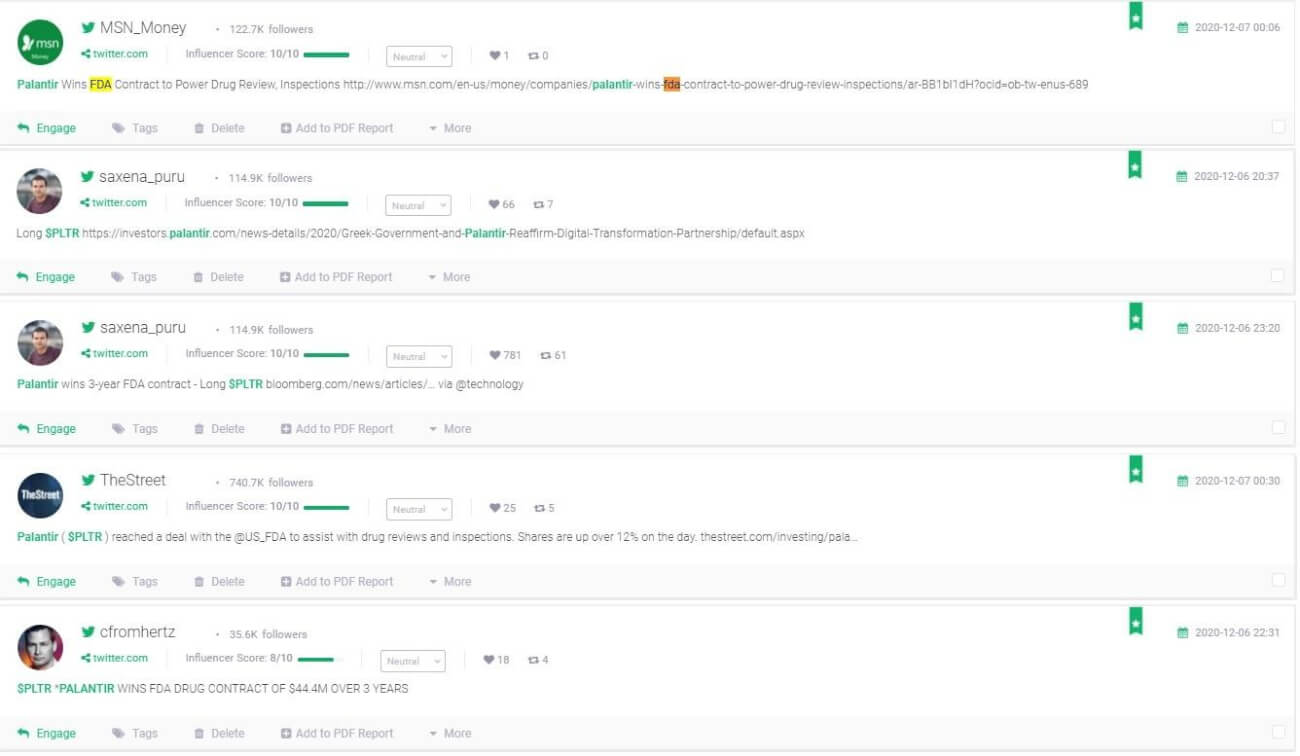

Here are some examples of the earliest Palantir mentions from that day that Brand24 was able to find for me and present quickly thanks to the importance filter:

[disclaimer: default timezone for Brand24 is PST, hence the time of mentions appear as Dec 6 in some cases]

One of the mentions I’ve found was posted even before Bloomberg published their article that further accelerated Palantir’s growth:

Could I learn about that with traditional news outlets? Sure, but finding this information in the storm of other news would take time and the rocket with Palantir’s sticker on it wasn’t waiting for anyone.

Did I use the opportunity to the fullest and take home +21 percent of my input? Wish that I had, but truth be told, I’ve chickened out a bit early. Hopefully, experience will give me more courage. Still though, I’ve managed to make a fair bit in a single day.

Waiting for the storm

Another angle of using social listening in your trading is that big changes leave a trace. It might manifest itself as a boost in the overall number of mentions or a spike in social reach, should a company be mentioned by a significant name (like Kylie Jenner’s post about Snapchat, that you can read about here: Sentiment analysis for stock market.

Whenever something like that happens, you will receive an email from Brand24, updating as close to real-time as physically feasible.

If you’re in long term and day trading is not your cup of tea, this way of media monitoring will allow you to keep your finger on the pulse without spending a minute in the panel of the platform.

What now?

Having all the information handy, without the need to trawl through tons of more or less useful sites, is crucial in making better decisions. Are you a beginning investor who hates to see inflation melt away their savings or a huge broker, who’d already accomplished great gains?

No matter, information is the key and with Brand24 you can get a hold of all public mentions in one place and a ton of analysis features to go with.

Discover our client’s success story — read the case study.

Curious to learn more? Here’s a link to set up a demo account, feel free to get in touch if you liked the article and or you’d like to have a chat about your adventure with social listening 🙂

DISCLAIMER

Investing is associated with risk. Brand24 is not a registered broker, dealer or legal/tax advisor. All financial opinions expressed by Brand24 website are based on personal experiences of the authors and are intended solely for educational purposes. Although best efforts are made to ensure that all information is accurate and updated, unintended errors may occur. Brand24 doesn’t take responsibility for the results of the investment decisions based on the information found in the platform or sites associated with it.

Related articles

![Share of Voice: Definition, Calculation, Tools [2025 Guide]](https://brand24.com/blog/app/uploads/2022/02/How-to-Measure-the-Share-of-Voice-min.png)