Table of contents

5 Most Important Uber Competitors in 2026 [Report]

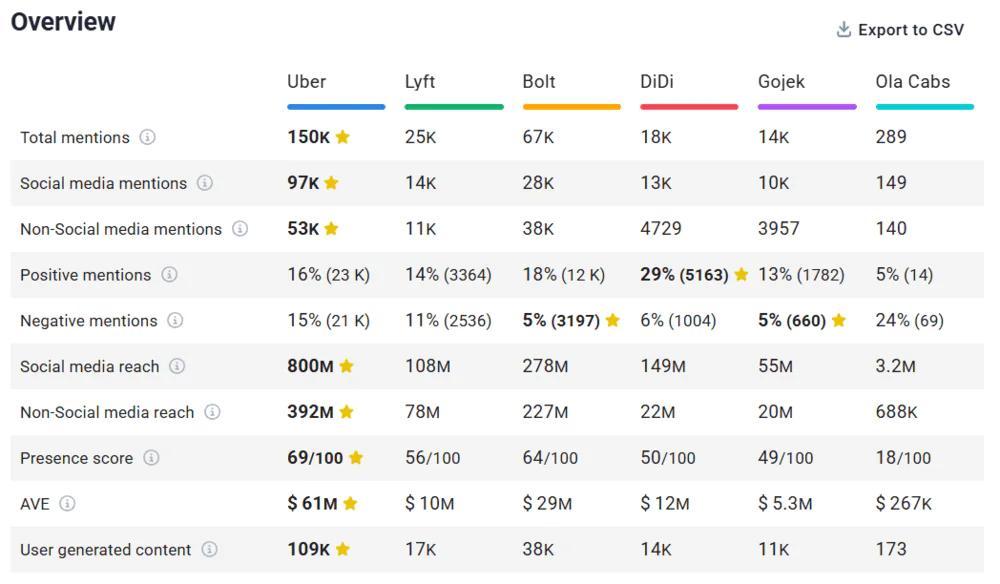

Uber revolutionized traditional taxi services by launching the first ride-hailing app in 2010. It remains the global ride-hailing market leader, but competition is growing. For example, Uber was mentioned online over 149,000 times last month, while its biggest rival, Bolt, had 67,000 mentions.

Uber is the leader in the ride-hailing industry, but its competitors aren’t slowing down. The three biggest ones are:

1️⃣ Bolt – 67k mentions, 505M reach, Presence Score 64/100

2️⃣ Lyft – 25k mentions, 186M reach, Presence Score 56/100

3️⃣ DiDi – 18k mentions, 171M reach, Presence Score 50/100

Now, let’s analyze Uber and its competitors.

How did I identify Uber’s most significant competitors?

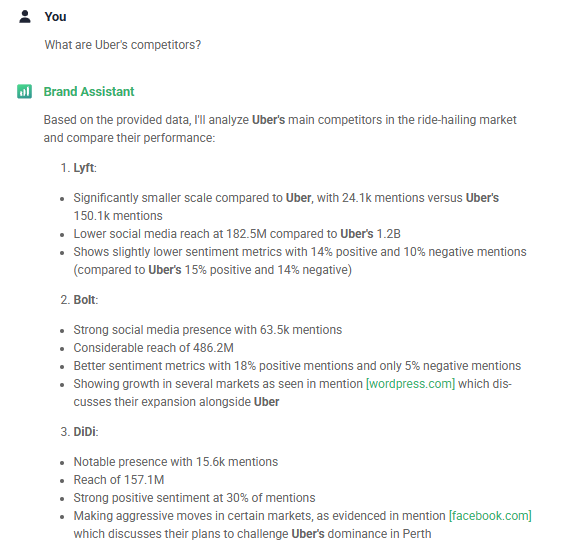

Well, I didn’t do it myself – the Brand Assistant did.

This AI chatbot specializes in brand analysis, combining ChatGPT’s knowledge with its own media monitoring data.

Here’s what “he” showed me:

Other competitor analysis tools, like Semrush, can also analyze information about your industry rivals.

Its Organic Research feature pinpoints brands that position themselves in Google searches for similar keywords as Uber:

However, Semrush is primarily an SEO tool, so it is less accurate than Brand Assistant when assessing real business competition.

📖 Read the Uber case study to learn how they increased online exposure by 24%!

How’s Uber doing in 2026?

Uber is an American company that revolutionized the transportation industry by creating a platform where independent contractors serve as drivers.

This business model changed the way traditional transportation companies operated. Additionally, the company is exploring the massive potential of autonomous vehicles.

🌍 Region: Global (operates in 70 countries in more than 10,000 cities)

🚗 Uber services: Ride-hailing, food delivery (Uber Eats), freight logistics, bike and scooter rentals

In 2024 (source: Uber Investor – Results for Fourth Quarter and Full Year 2024):

- Uber had over 11.27 billion trips (19% increase from 2023)

- Gross bookings grew by 18%, reaching almost $163 billion

- Revenue reached nearly $44 billion (18% rise from 2023)

Before we move on to the competition, let’s analyze how Uber is doing in 2026.

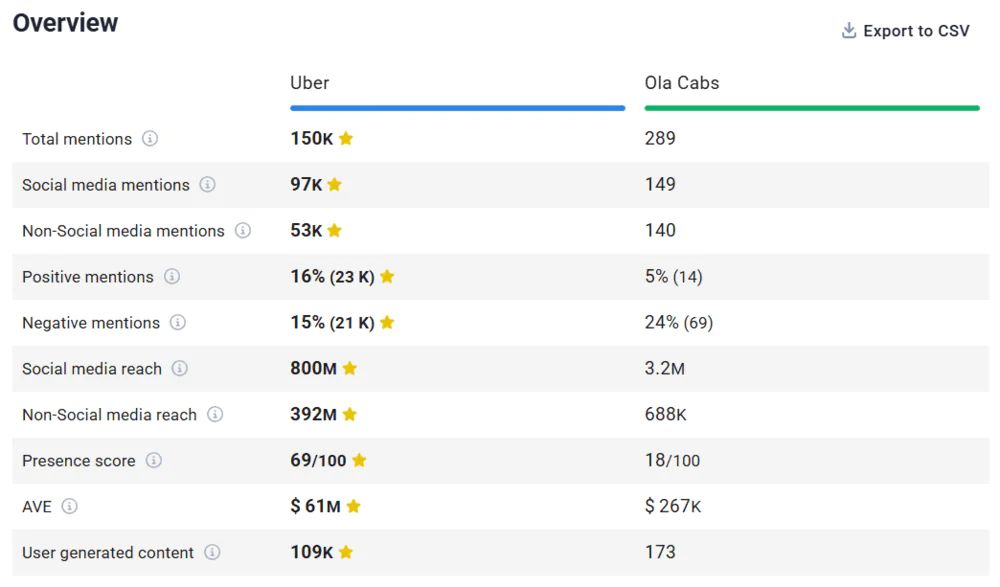

Below, I’ll show you all of Uber’s brand metrics from the last 30 days:

Number of mentions: Uber has been mentioned online 149k times in the past 30 days

Number of positive mentions: of these 149k mentions, 23k were positive

Number of negative mentions: there were 21k negative mentions

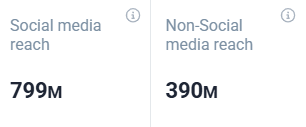

Social media reach: on social media, Uber’s mentions reached 799 million users

Non-social reach: beyond social platforms, the reach extended to 390 million people

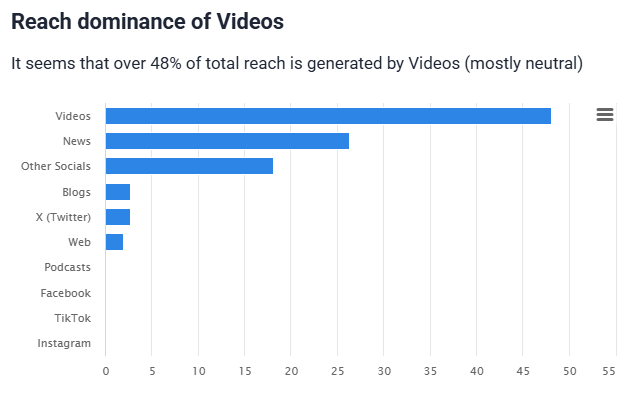

The main source of reach: videos account for over 48% of Uber’s total reach

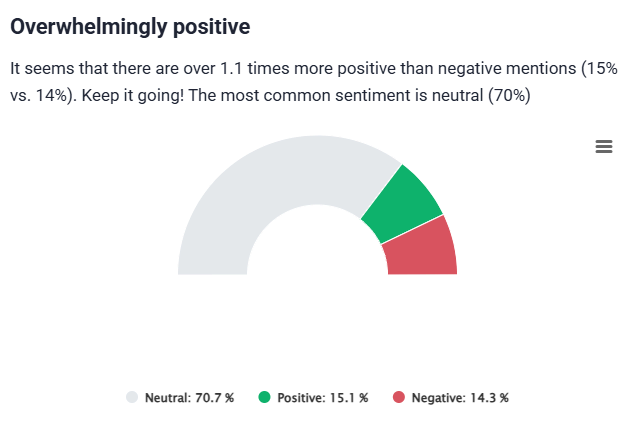

Overall sentiment: the sentiment is mostly positive, but just slightly – 1.1 times more positive than negative mentions

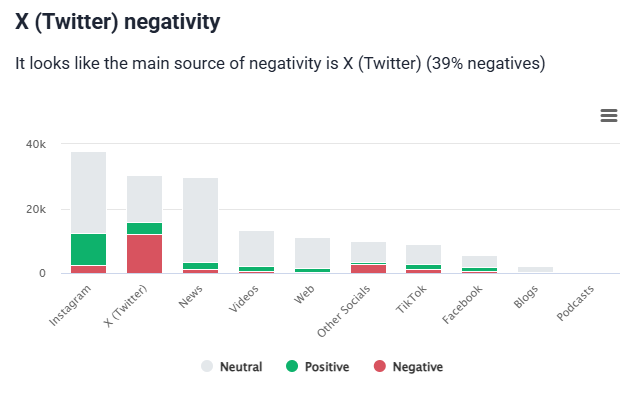

The main source of negative sentiment: X (Twitter)

Presence Score: 69/100, meaning that Uber has been quite popular in the last 30 days

Brand24: Presence Score – Uber

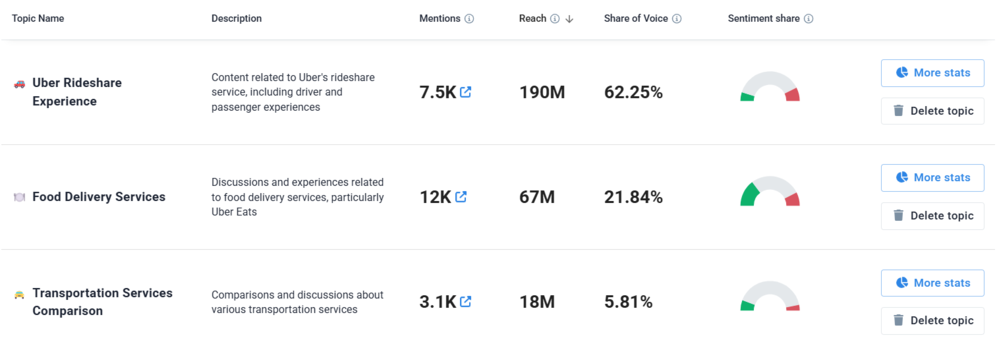

- Most popular topics around Uber:

1️⃣ Rideshare experience

2️⃣ Food delivery services

3️⃣ Transportation services comparison

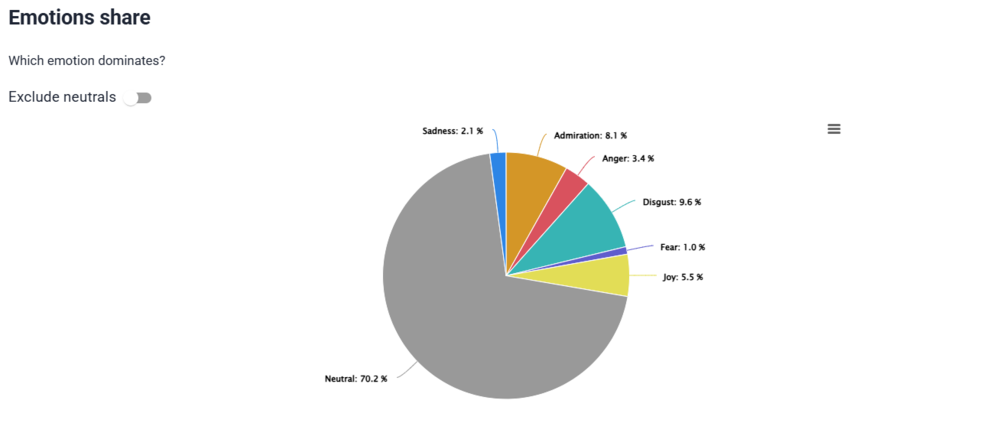

- Emotion analysis: the dominant feeling towards Uber is neutral (70.2%), followed by disgust (9,6%); if we don’t take into account neutrality, disgust is the dominant feeling (32.6%)

Check the performance of any brand you want!

Who are Uber’s competitors in 2026?

01 Bolt

Bolt was founded in 2013 in Estonia. It has grown quickly and now is Uber’s biggest global competitor, especially in Europe and Africa. However, it does not operate in the United States.

🌍 Region: Global (operates in over 45 countries in more than 600 cities)

🚗 Range of services: Ride-hailing, micro-mobility rental, food and grocery delivery (Bolt Food), and carsharing services

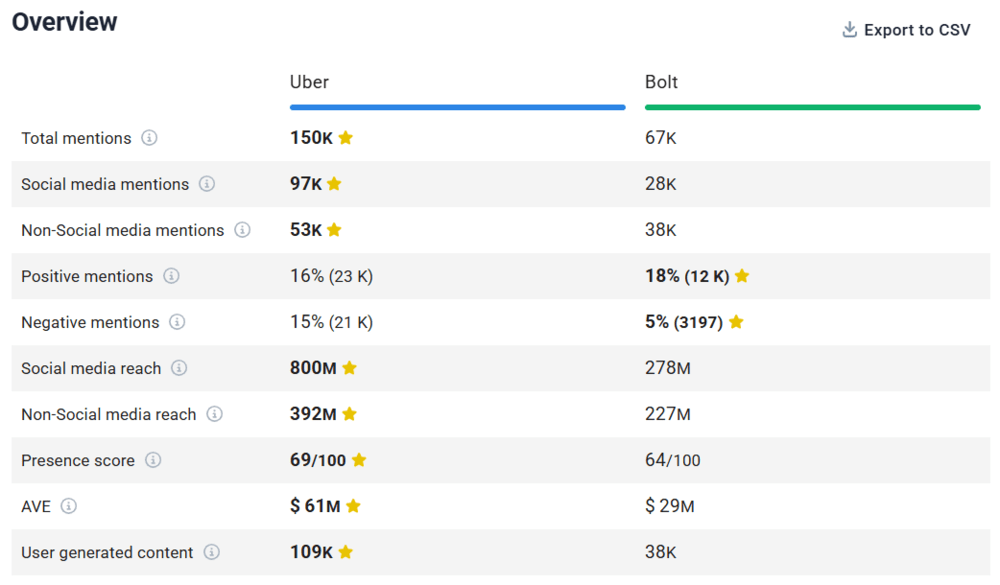

Here’s the highlight of Bolt’s performance in the last 30 days:

Number of mentions: 67k

Number of positive mentions: 12k

Number of negative mentions: over 3k

Social media reach: 278 million

Non-social reach: 227 million

The main source of reach: videos

Overall sentiment: overwhelmingly positive – over 3.7 times more positive than negative mentions

The main source of negative sentiment: X (Twitter)

Presence Score: 64/100

- Most popular topics around Bolt:

1️⃣ Food delivery

2️⃣ Mobility services news

3️⃣ Side income opportunities Emotion analysis: not taking into account neutrality, admiration is the dominant feeling (68.8%)

Uber vs. Bolt

Uber generally leads in every metric.

Over the last 30 days, it has gathered over two times more mentions than Bolt, which results in a significantly greater reach.

It’s no surprise that Uber also holds a higher presence score. However, Bolt is not far behind, scoring 64/100 – only 5 points less than Uber.

The only areas where Lyft outperforms Uber are the lower percentage of negative mentions and the higher percentage of positive mentions.

02 Lyft

Lyft was founded in 2012. It’s the second-largest ride-hailing service in the U.S., behind Uber – Lyft holds 24% of the U.S. ride-sharing market (March 2024).

It’s available only in this country and Canada.

🌍 Region: United States and Canada

🚗 Range of services: Ride-hailing, food delivery, bike and scooter rentals

In 2024, the company’s revenue reached $5.8 billion – 31% year over year (source: Lyft Reports Record Q4 and Full-Year 2024 Results).

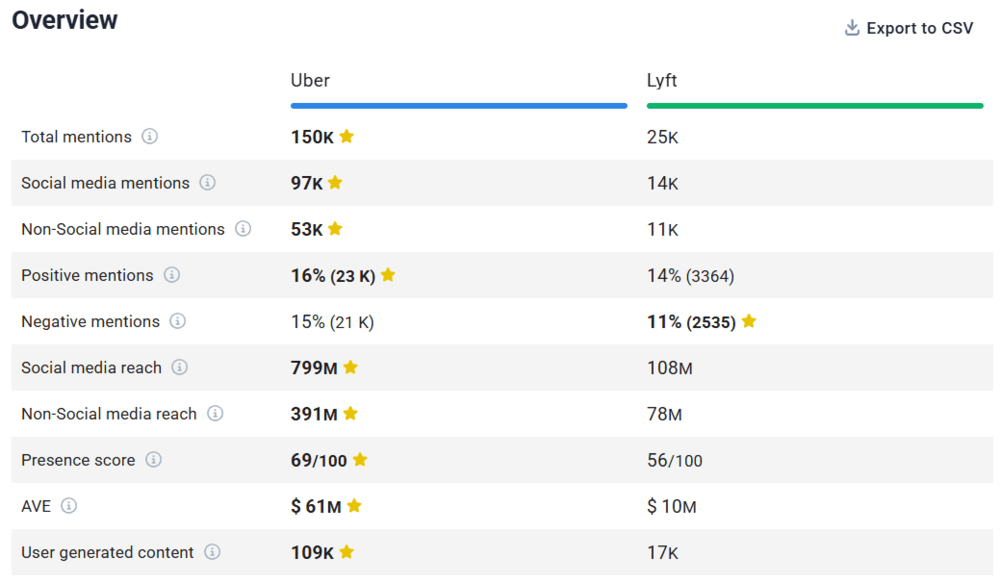

Here’s the highlight of Lyft’s performance in the last 30 days:

Number of mentions: 25k

Number of positive mentions: over 3k

Number of negative mentions: 2.5k

Social media reach: 108 million

Non-social reach: 78 million

The main source of reach: videos

Overall sentiment: overwhelmingly positive – over 1.4 times more positive than negative mentions

The main source of negative sentiment: socials other than Instagram, TikTok, Facebook and X (Twitter)

Presence Score: 56/100

Most popular topics around Lyft:

1️⃣ Rideshare company news

2️⃣ Financial market topics

3️⃣ Experience and earnings of rideshare driversEmotion analysis: not taking into account neutrality, admiration is the dominant feeling (40.7%)

Uber vs. Lyft

Here’s a comparison of Uber and Lyft based on recent data collected by Brand24:

It’s no surprise that Uber leads in every metric. It has received six times more mentions than Lyft.

Uber also holds a higher Presence Score, leading by 13 points.

The only area where Lyft outperforms Uber is the lower percentage of negative mentions.

03 DiDi

DiDi Chuxing (known as DiDi) is a Chinese ride-sharing and ride-hailing giant.

It was founded in 2012 and has 375 million monthly active users (data from November 2024).

🌍 Region: China, Mexico, Colombia, Chile, Costa Rica, Panama, Argentina, Ecuador, Peru, New Zealand, Australia, Japan, Egypt, Brazil, and the Dominican Republic

🚗 Range of services: Taxi hailing, food delivery (DiDi Food), bike and scooter rentals, and car-sharing

For the third quarter of 2024, DiDi reported a net income of 929 million yuan (approximately $128.42 million).

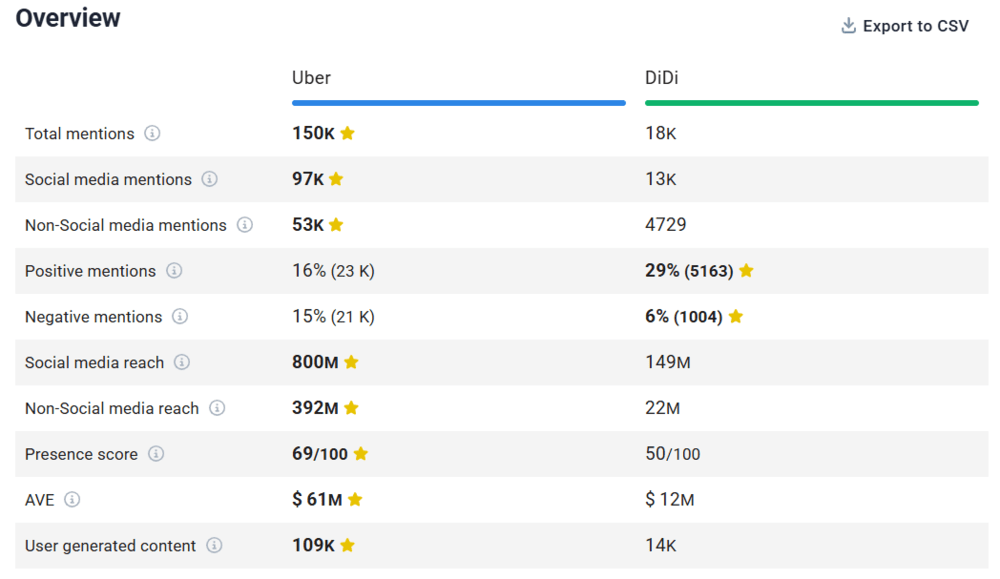

Here’s the highlight of DiDi’s performance in the last 30 days:

Number of mentions: 18k

Number of positive mentions: over 5k

Number of negative mentions: 1k

Social media reach: 149 million

Non-social reach: 22 million

The main source of reach: videos

Overall sentiment: overwhelmingly positive – over 5.1 times more positive than negative mentions

The main source of negative sentiment: X (Twitter)

Presence Score: 50/100

Most popular topics around DiDi:

1️⃣ Driver incidents, advice, and regulatory debates

2️⃣ Promotions and deals for food delivery

3️⃣ China travel tipsEmotion analysis: not taking into account neutrality, joy is the dominant feeling (38.1%)

Uber vs. DiDi

Despite its dominance in the Chinese market, DiDi has worse online performance than Uber.

It is mentioned much less than Uber – only 18k mentions.

However, its brand sentiment is significantly better than Uber’s – 29% of the mentions are positive, while only 6% are negative.

Get to know your competitors with Brand24!

04 Gojek

Gojek is Southeast Asia’s multi-service tech platform founded in 2009. It offers a wide range of services not only across transport but also digital payments.

🌍 Region: Indonesia, Singapore, Vietnam

🚗 Range of services: Ride-hailing, motorbike taxis, bicycle sharing system, scooter rentals, food delivery services

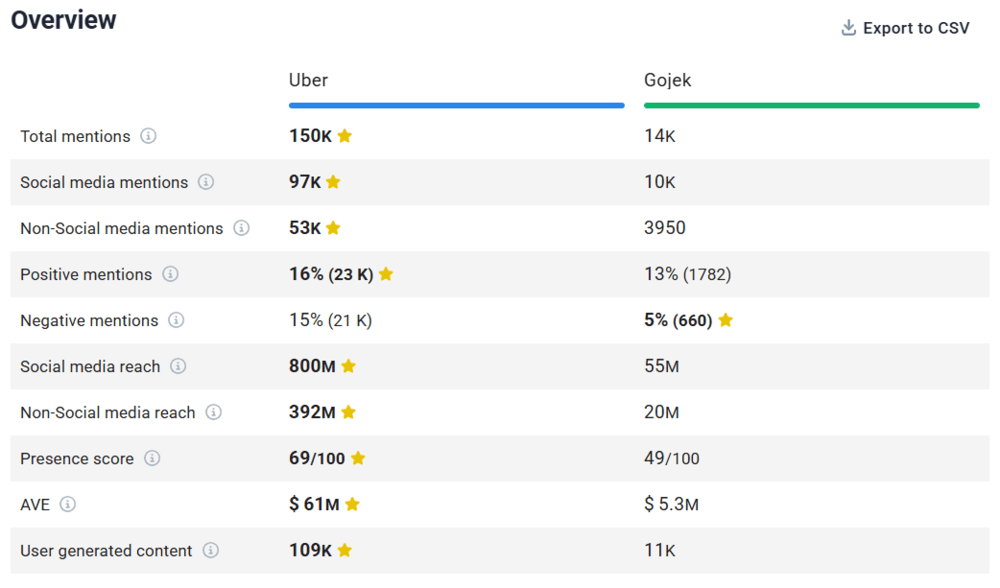

Here’s the highlight of Gojek’s performance in the last 30 days:

Number of mentions: 14k

Number of positive mentions: 1.7k

Number of negative mentions: 660

Social media reach: 55 million

Non-social reach: 20 million

The main source of reach: videos

Overall sentiment: overwhelmingly positive – over 2.7 times more positive than negative mentions

The main source of negative sentiment: X (Twitter)

Presence Score: 49/100

Most popular topics around Gojek:

1️⃣ Gojek driver content

2️⃣ Information about ride-hailing services and comparisons

3️⃣ Food and beverage offeringsEmotion analysis: not taking into account neutrality, joy is the dominant feeling (36.1%)

Uber vs. Gojek

Gojek is a much smaller player than Uber.

However, despite its relatively low number of mentions and reach, Gojek’s Presence Score is quite good (49/100), although it still falls significantly behind Uber.

The brand also performs well regarding negativity, with only 5% of mentions being negative.

05 Ola Cabs

Ola Cabs is another taxi app connecting customers with drivers. It was founded in India in 2010 and now is one of the dominant ride-hailing services in the Indian market.

Similar to Gojek, Ola does not limit its services to just transportation. It also offers other services, such as various financial products and Ola Maps (an alternative to Google Maps).

🌍 Region: India, Australia, New Zealand and the UK (operates in more than 250 cities)

🚗 Range of services: Radio taxi, ride-hailing services, food delivery, grocery delivery, bike sharing

Here’s the highlight of Ola’s performance in the last 30 days:

Number of mentions: 289

Number of positive mentions: 14

Number of negative mentions: 69

Social media reach: 3.2 million

Non-social reach: 688k

The main source of reach: videos

Overall sentiment: overwhelmingly negative – over 4.3 times more negative than positive mentions

The main source of negative sentiment: X (Twitter)

Presence Score: 18/100

Most popular topics around Ola Cabs:

1️⃣ Various vehicle types and booking options

2️⃣ Ola’s financial performance

3️⃣ User experiences and discussions about ride-hailing servicesEmotion analysis: not taking into account neutrality, disgust is the dominant feeling (65.9%)

Uber vs. Ola Cabs

Once again, another of Uber’s competitors performs worse. None of the metrics show better results than Uber.

In fact, Ola’s results from the last 30 days are very poor – the worst among the biggest Uber competitors.

Who is the top player in your market? Check now!

Detailed comparison

Uber undeniably dominates the global market.

Even though its competition is growing, no one comes even close to Uber’s level.

The top 3 strongest Uber’s competitors are: 🥇 Bolt, 🥈 Lyft, 🥉 DiDi.

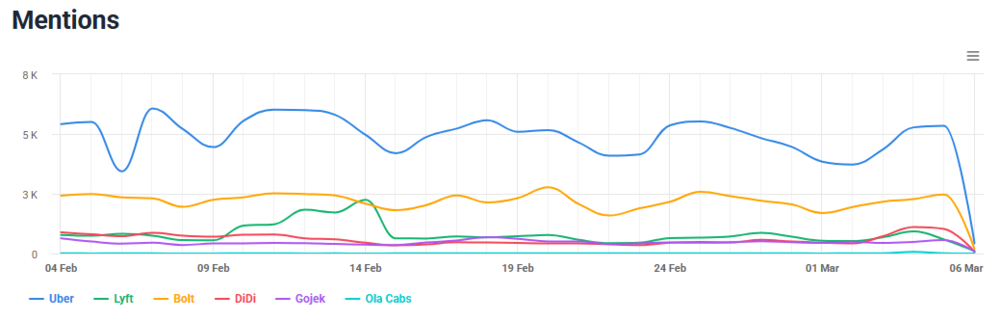

Mentions

Regarding mentions, Uber had an impressive number – almost 150K mentions!

In comparison, Uber’s competitors are far behind:

1️⃣ Bolt – 67K mentions (2.2 times less than Uber)

2️⃣ Lyft – 25K mentions (6 times less than Uber)

3️⃣ DiDi – 18K mentions (8.3 times less than Uber)

Here’s how these mentions were distributed over time:

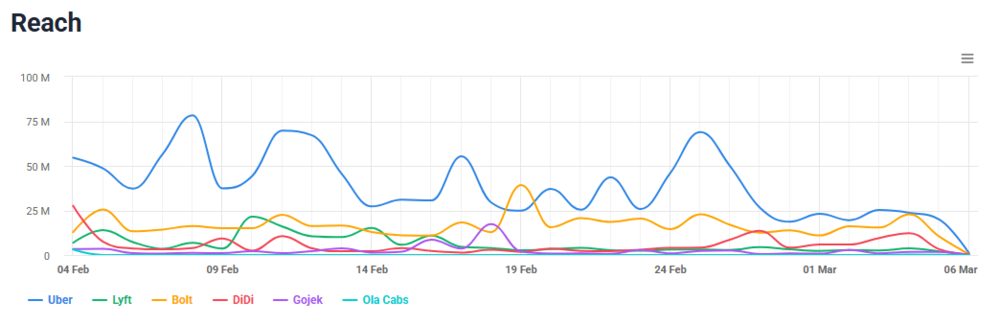

Reach

Uber reached nearly 1.2 billion people online!

And its competitors?

1️⃣ Bolt reached 505M people online

2️⃣ Lyft reached 86M people online

3️⃣ DiDi reached 171M people online

Video content was the largest source of reach for these three competitors. It shows the incredible power of this format.

Here’s how the reach was distributed over time:

Compare your brand with all your rivals!

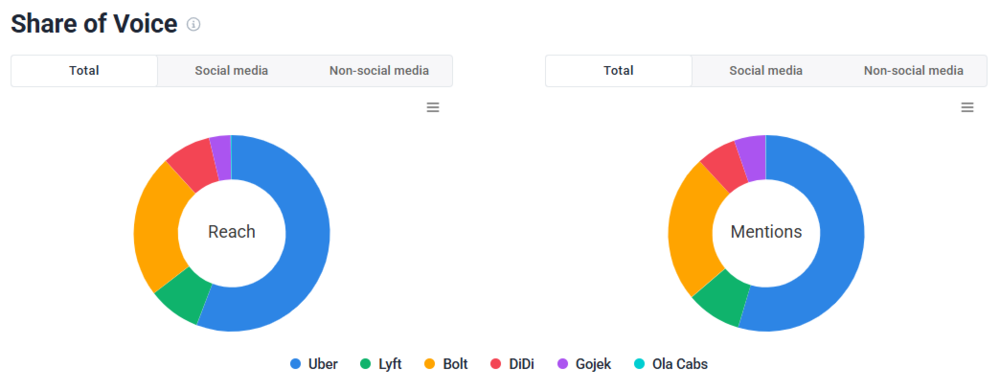

Share of Voice

Once again, no surprises – Uber dominates the online conversations, leading in both reach and mentions Share of Voice:

Share of Voice (total reach) – 56%

SOV (social media reach) – 59%

SOV (non-social media reach) – 51%

Share of Voice (total mentions) – 53%

SOV (social media mentions) – 57%

SOV (non-social media mentions) – 47%

Final thoughts:

Tracking your rivals is very important, especially in a highly competitive landscape like transportation services. It helps businesses stay ahead and refine their strategies based on real-time insights.

Uber’s most significant competitors are Bolt, Lyft, and DiDi – Bolt on a global scale, Lyft in the USA, and DiDi in China.

However, Uber remains the market leader – mainly thanks to its eco-friendly transportation options and user-friendly app.

Analysis shows that Bolt is Uber’s no. 1 competitor. In countries where both services are available, many people choose Bolt due to its more competitive pricing.

Curious about more real-world case studies? Dive deeper into how global giants like Amazon, Boeing, and Airbnb battle for market dominance.

Want to track any brand’s and its competitors’ performance?

👉 Start a free Brand24’s trial! 👈