Table of contents

Competitor Audience Analysis: Step-by-Step Guide for 2026

Don’t know who your competitors’ audience is? It’s a missed potential.

Competitor audience analysis helps you understand who similar businesses attract, where they engage, and why they choose them, so you can build a more competitive edge and win the market landscape.

In this guide, I’ll walk you through competitor audience analysis step-by-step, using practical methods and tools you can quickly apply as a marketer or business owner.

Why competitor audience analysis matters in 2026?

In 2026, businesses don’t lose because they have worse products, but they fail because they misunderstand who they’re competing for.

Here’s what’s changed:

- 81% of consumers research online before making a purchase, often across multiple platforms and touchpoints. (source: Invoca)

- 70% of marketers report that identifying and reaching target audiences across channels has become more difficult due to fragmented tools, data complexity, and algorithm shifts. (source: Search Engine Journal)

- Users now discover brands not only via Google, but through social media, AI-generated answers, communities, and recommendations (source: Meltwater report)

💡 Your competitors are constantly revealing who their audience really is through content, conversations, and visibility patterns.

Competitor audience analysis turns public signals into strategic insight.

Instead of guessing:

- 🎯 who your market is

- 📍 where to show up

- 🧭 how to position your offer

You learn who similar businesses already attract, why those people engage, and where opportunities are being missed.

In short: competitor audience analysis helps you stop competing blindly, and start competing intelligently.

Why keep reading?

By the end of this competitor audience analysis guide, you’ll be able to:

- Identify who your competitors are actually attracting, not just who they claim to target

- Understand where their audience is most active

- Uncover audience interests, pain points, and frustrations visible in real conversations

- Spot gaps and underserved segments your competitors overlook

- Position your brand differently instead of copying competitor messaging

This isn’t another theoretical market research guide.

It’s a practical, easy template you can apply whether you’re a marketer, founder, or business owner.

What is competitor audience analysis?

Competitor audience analysis is part of competitive market analysis and market research.

Unlike general competitor analysis, this isn’t about features or pricing plans.

It’s about people, their pain points, interests, expectations, and the decision-making context your competitors already operate in.

In simple words: Competitor audience analysis shows you who your competitors are selling to, why this particular group, and how they reach those people.

Competitor audience analysis consists of four core layers:

- Who the audience is

Demographics, income, education, and professional context - Where they engage

Social media platforms, search engines, communities, and AI-driven discovery - What they care about

Interests, motivations, objections, and recurring pain points - How they differ from your audience

Overlaps, gaps, and positioning opportunities

Each step builds on the previous one, and skipping any layer usually leads to shallow or misleading conclusions.

That’s why this guide walks you through competitor audience analysis step by step, starting with the fundamentals.

Let’s get into it!

How to analyze your competitor’s audience?

Step 1: Define your direct and indirect competitors

Before any competitive analysis, you need to define who counts as a competitor.

Competitive analysis helps you understand your competitors’ strengths and weaknesses in comparison to your own.

I know, it’s the basics, but it’s also an absolute must-have on this list.

So, if you don’t have a relevant, updated competitor analysis, look below.

If you’ve got this step covered, feel free to skip and move on to the next point.

What are direct competitors?

Direct competitors are brands that offer:

- Similar products or services

- To the same target audience

- Solving the same problem

They usually compete with you for:

- Market share

- Keyword rankings

- Lead generation and sales conversations

Simply said: Direct competitors sell almost the same thing to the same people.

What are indirect competitors?

Such competitors:

- Solve the same problem differently

- Target a shared audience

- Compete for attention, budget, or time

They are critical for understanding market entry risks and industry trends.

Simply said: Indirect competitors don’t sell what you sell, but they solve the same problem and target same audience.

Your first step in conducting a competitive analysis is to identify your key competitors.

| Aspect | Direct competitors | Indirect competitors |

|---|---|---|

| Product or service | Similar or the same | Different |

| Target audience | Same | Same or overlapping |

| Problem solved | Same | Same |

| Sales competition | High | Medium |

| Strategic importance | Immediate | Long-term |

| Common mistake | Copying them | Ignoring them |

Direct competitors market the same product to the same audience as you, while indirect competitors market the same product to a different audience.

Pro tip: You can start with 3-5 direct competitors and 2-3 indirect competitors. More than that might reduce clarity and make your first analysis hard.

You should choose a mix of both direct and indirect competitors to see how new markets might affect your company.

Step 2: Understand who your competitor’s audience is

This is the essence of competitor analysis. You want to really understand what’s inside the rival’s audience mind and try to build as accurate a persona as possible.

For this step, a tool that enables the analysis of online audience demographics is a game-changer.

Let’s say you’re a Tidal manager, so your biggest competitor is definitely Spotify.

I created a Spotify social listening project to show you this step based on a real example – let’s get into it!

Important note: This data relies on estimations. Therefore, it is not as accurate as analytics specifically linked to a particular domain (like Google Analytics). Brand24 focuses more on trends and distribution than on very accurate data.

Go to Brand24 dashboard > Demographics and check:

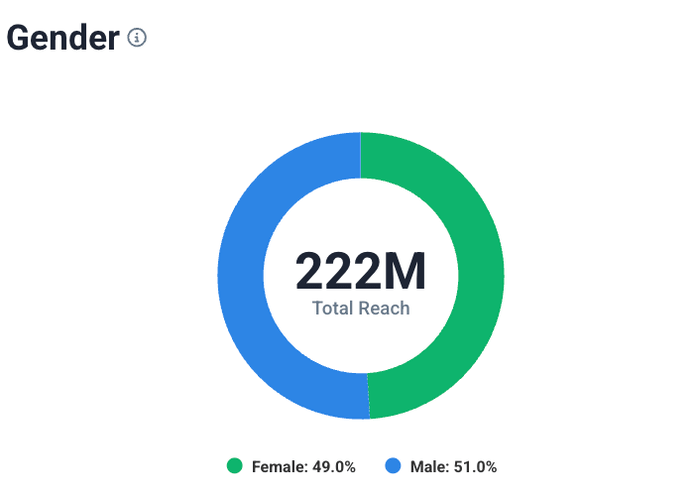

1. Gender distribution

The first and most crucial metric to learn is the gender of your competitor’s audience.

As you can see, in Spotify’s case, it’s almost even:

When conducting your research, make sure to look for:

- Dominant gender

- Balanced vs skewed audience

Why it matters?

- Messaging tone will be different for women and men

- Visual elements can also be tailored for a dominant gender

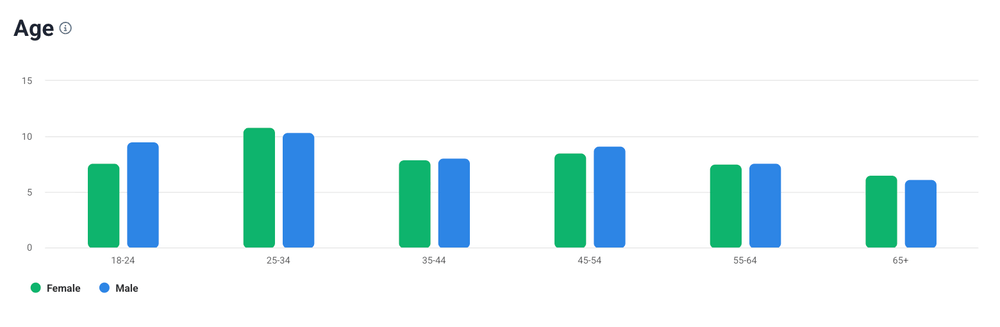

2. Age groups

The second crucial metric to check is the age of your competitor’s audience:

Age influences:

- Content strategy and marketing efforts (younger groups – short forms like TikToks, older – blogs or long YouTube videos)

- Specific social media presence

- Customer preferences and needs

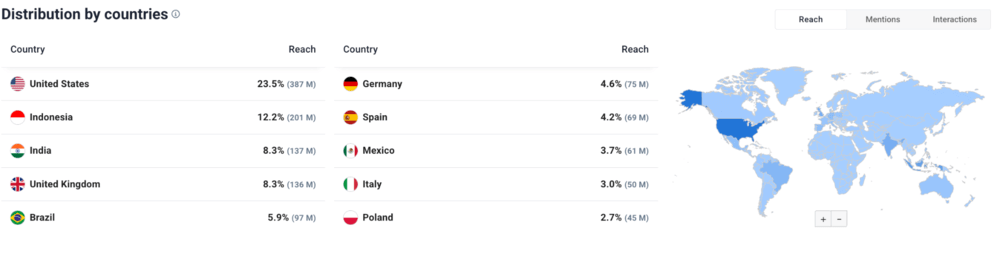

3. Location and market position

In terms of location, analyze:

- Countries and regions

- Local vs global reach

- Language usage

Here’s what it looks like for Spotify (the US is the absolute dominant):

This knowledge helps with:

- Target market analysis

- Competitive strategy

- Market expansion decisions

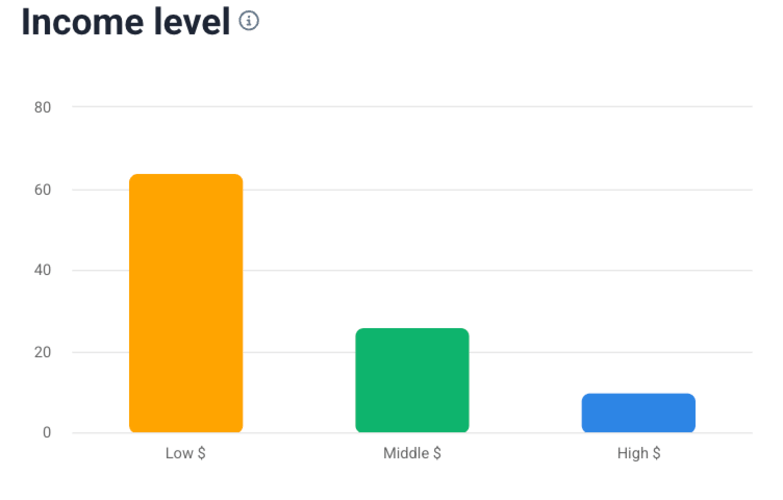

4. Income level

Income level strongly influences how people buy, how fast they buy, and what they need to feel confident before converting.

It’s crucial market data, perhaps your competitor’s audience is much wealthier?

This can be your growth opportunity.

Here’s what it looks like for Spotify:

Income level can impact, for example:

- Price changes sensitivity

- Sales cycle length

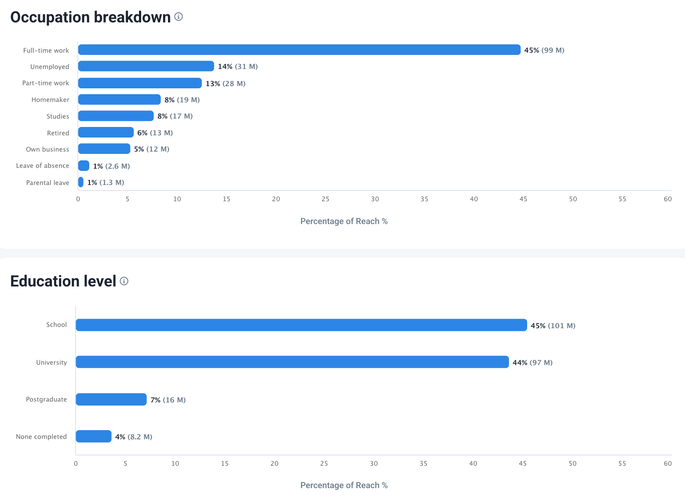

5. Occupation and education level

Occupation and education level describe what competitors’ customers do for a living and how educated they are.

Together, these customer insights determine the level of context, depth, and precision an audience expects from marketing strategies, sales, and content.

In Spotify’s case, most of its audience is mid-educated and working full-time:

You can use occupation and education insights to:

- Choose the right content depth

- Adjust messaging for clarity vs precision

- Avoid over-educating or under-explaining

Truth is, if competitors speak in expert language and you don’t, or vice versa, you won’t feel credible to the same audience.

How to understand who your competitor’s audience is?

Here’s a simplified table summary of the whole step:

| Look at | Analyze | Why it matters? |

|---|---|---|

| Gender | Dominant segments | Messaging & visuals |

| Age | Core age clusters | Channel & format choice |

| Location | Regions & languages | Market positioning |

| Income | Pricing signals | Offer structure |

| Occupation | Job roles | Sales & content tone |

| Education | Complexity tolerance | Messaging & content depth |

Step 3: Identify interests & pain points

Audience interests and pain points are recurring topics, frustrations, and motivations visible mostly through their customers’ comments and media mentions.

But, they’re also revealed through the way your competitor communicates (as long as they do the job right)

In simple words: Identifying competitors’ audience interests and pain points shows what their customers care about and complain about.

Analyze:

- Content themes your competitors create

For example, if a competitor repeatedly highlights “human expertise”, “real people behind the product”, or “not replacing humans with AI”, it usually signals:

- Customer anxiety around automation

- Fear of losing control or authenticity

- Resistance to rapid AI adoption

- Customers’ comments and reactions

Remember to focus on patterns, not individual opinions.

Customer comments and reactions expose how the audience actually feels, not how competitors want them to feel.

It’s this simple:

- Repeated questions → unclear messaging or friction

- Skepticism or pushback → trust gaps

- Positive comments → perceived strengths

For example, comments like “Finally, something simple” indicate:

- Market frustration with complexity

- Opportunity for clarity-first positioning of your brand.

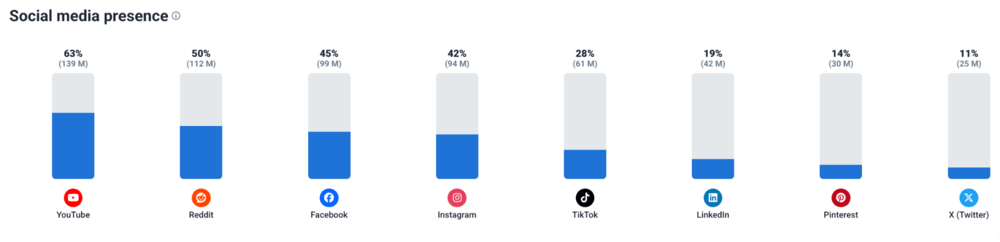

Step 4: Analyze social media platform presence

Is social media analysis important in terms of competitive analysis? Yes!!!

Social media reveals:

- Where the competitor’s audience is active

- How your competitors engage

- What formats work best for your industry

Spotify’s audience distributions look like this:

Remember: Audiences are often active on multiple social media platforms. One-channel assumptions are often inaccurate. That’s why using tools that gather data from different sources is so valuable.

Analyzing social media presence helps you spot:

- Platforms that your competitors ignore (low-hanging fruit)

- Audiences underserved on specific channels

- Messaging mismatches

These gaps are your opportunities to enter conversations early and build authority faster!

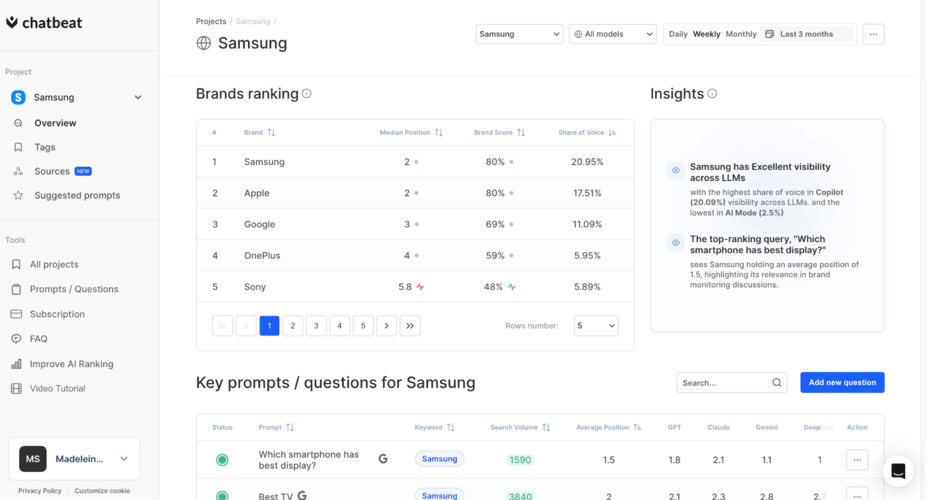

Step 5: Run AEO and SEO competitor analysis

SEO and AEO (Answer Engine Optimization) audience analysis identifies how competitors attract, educate, and convert audiences through search engines and AI-driven answer systems.

It examines keyword research, content formats, technical SEO, and how competitors perform in search engines.

Simply said: This step shows what competitors’ customers are searching for and how they ask questions both in Google and in LLMs.

Analyze:

- Their keyword rankings

- Content strategy

- Competitor website structure

- Google search rankings

- AI visibility

You can use Semrush, BuzzSumo, and Chatbeat for this step.

What is the best tool for conducting SEO and AEO competitor analysis?

- Semrush is a widely used technical SEO tool with keyword research and industry-leading competitor analysis features, enabling users to monitor their competitors’ traffic and rankings.

- Chatbeat will help you spot potential ideas for improving AI visibility by analyzing specific answers to the prompts your competitors appear in.

- BuzzSumo allows users to analyze top-performing content for relevant topics and specific competitors, helping identify industry thought leadership.

Step 6: Compare their audience to yours

Once you understand who your competitors attract, the next step is to put that audience next to your own.

This is where competitor audience analysis turns into insight.

Looking at competitor data in isolation is useful, but the real value comes from comparison.

Only by contrasting their audience with yours can you identify overlaps, gaps, and clear positioning opportunities.

Start by comparing the most important audience dimensions side by side.

Compare:

- Demographics

- Platform usage

- Content strategy

- Audience engagement

As you analyze the differences, ask yourself:

- Who are they attracting that I’m not?

- Where does our shared audience overlap?

- Where can I position differently?

To make this process easier and more structured, you can use a simple audience comparison table like the one below:

| Area | Tidal (your brand) | Spotify (competitors) |

|---|---|---|

| Core audience | Audio-focused listeners, artists, premium users | Mass-market users, casual listeners |

| Key platforms | Instagram, X, YouTube | Instagram, TikTok, YouTube |

| Content focus | Sound quality, artists, exclusives | Playlists, trends, personalization |

| Engagement level | Medium, niche but loyal | High, large-scale and viral |

| Differentiation | Artist-first, Hi-Fi audio | Algorithms, discovery, scale |

Such a competitive analysis template helps you organize findings clearly, spot patterns faster, and communicate insights more effectively across marketing, sales, and leadership teams.

Step 7: Turn insights into action

Competitor audience analysis only creates value when it leads to clear, strategic decisions.

At this stage, your goal is to translate everything you’ve learned into actions that directly impact growth, positioning, and revenue.

Without this step, even the most detailed analysis becomes just another document that no one uses.

Your competitor analysis insights should inform:

- Marketing tactics

- Pricing strategy

- Content creation

- Sales team messaging

- Overall business strategy

Use the insights you gathered to:

- Strengthen your unique selling propositions

- Adjust advertising campaigns to better match real audience expectations

- Focus on the highest-impact platforms instead of spreading efforts thin

- Build a sustainable competitive advantage based on audience understanding

What are the most common mistakes in competitors’ audience analysis?

The most common mistakes happen when teams focus on surface-level insights instead of meaningful audience understanding.

These include:

- Copying competitors’ marketing efforts

Mimicking what others do without understanding why it works often leads to wasted effort instead of real insight. - Ignoring less direct competitors

A competitive analysis that focuses only on obvious rivals can cause you to miss brands competing for the same audience in subtler ways. - Relying only on historical data

Past performance doesn’t always reflect current audience needs, behaviors, or emerging trends. - Over-analyzing without action

Collecting data is useful, but insights only matter when they lead to clear, strategic decisions.

FAQ:

How many competitors should I analyze?

5–8 competitors are usually enough for reliable market insight.

Do I need paid competitor analysis tools?

No, but competitor analysis tools speed up data collection and improve accuracy, especially for media monitoring and SEO. Also, they’re essential for AI visibility competitor analysis.

How often should I update competitor audience analysis?

Most sources suggest quarterly, or when:

- New competitors enter the market

- Industry trends shift

- Market position changes

Is the competitor audience analysis the same as SWOT analysis?

No. SWOT analysis focuses on competitor analysis for strengths and weaknesses.

Competitor analysis focuses on their customers.

Conclusion

Competitor analysis is a crucial part of competitor research that helps you understand:

- Who your competitors attract (their target audience)

- Why do those customers engage (marketing strategies)

- Where can you differentiate (competitive landscape and gaps analysis)

When you know your competitors’ customers, you stop guessing and start building marketing strategies grounded in reality.