Table of contents

5 Biggest Amazon Competitors in 2026 [Data-Backed Report]

Amazon is the king of online shopping and one of the most recognizable brands in the world. Billions see it every month – yet the battle for dominance in e-commerce isn’t over. In this report, we reveal five competitors that seriously threaten its crown.

- Although Amazon is an undisputed leader in e-commerce, its direct competitors continue to challenge its dominance in key markets.

- A detailed competitor analysis proves that while Amazon sets global standards for online retail, other platforms capitalize on their unique strengths – from physical retail presence, through niche specialization to aggressive pricing.

- The most noteworthy Amazon competitors are Walmart (the leader in physical stores), eBay (the dominant force in online auctions), Flipkart (dominant in India), AliExpress (offering affordable cross-border shopping), and Etsy (top in handmade and niche products).

Amazon is undoubtedly one of the most iconic brands of our time. A true “Big Tech” Avenger, shaping the way we shop, work, and spend our free time.

Jeff Bezos’ company has become a global leader across multiple industries:

- The largest online store in the world

- A dominant force in cloud computing through Amazon Web Services (AWS)

- A key player in streaming and digital entertainment with Amazon Prime Video and Audible

- An innovator in consumer electronics with devices like Kindle and Alexa.

Beyond that, it continuously pushes the boundaries of logistics, artificial intelligence, and even space technology.

With such a vast business empire, it’s nearly impossible to cover all of Amazon’s competitors in a single article.

That’s why I’ll focus on its core business – the online marketplace – and explore the brands that challenge Amazon on its home turf.

Let’s dive in!

How to discover major Amazon competitors?

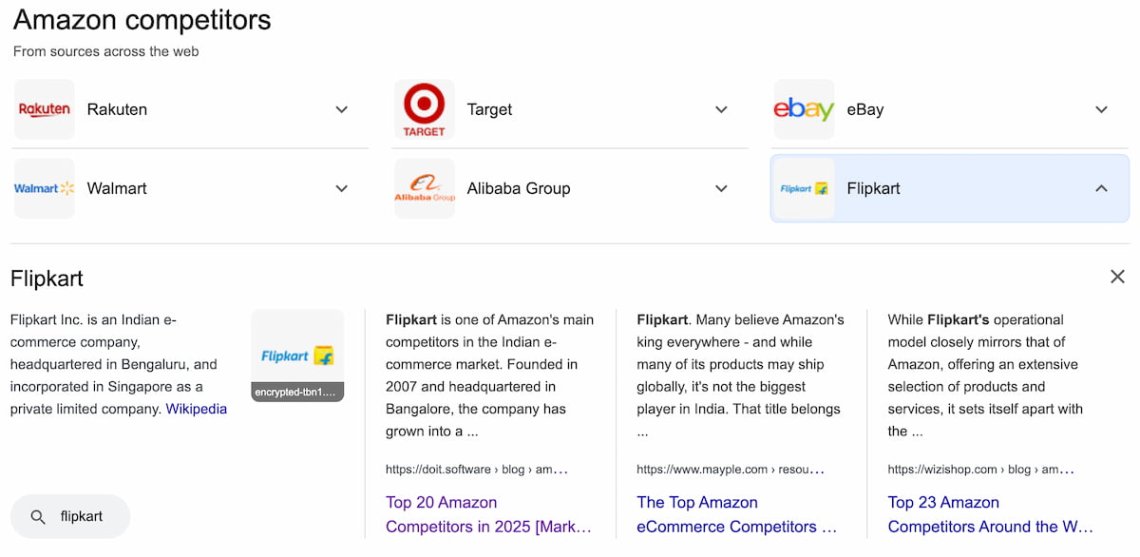

01 Ask Google and AI

Google is a good starting point for researching brands that compete with Amazon. It often shows a Competitor Carousel right at the top of the results.

The list is compiled from popular searches and publicly available data.

Below the list, you can also find a more descriptive summary of the AI Overview.

It summarizes Amazon’s main competitors and adds context by explaining why they’re seen as market rivals.

Now, let’s deepen our research with hard facts.

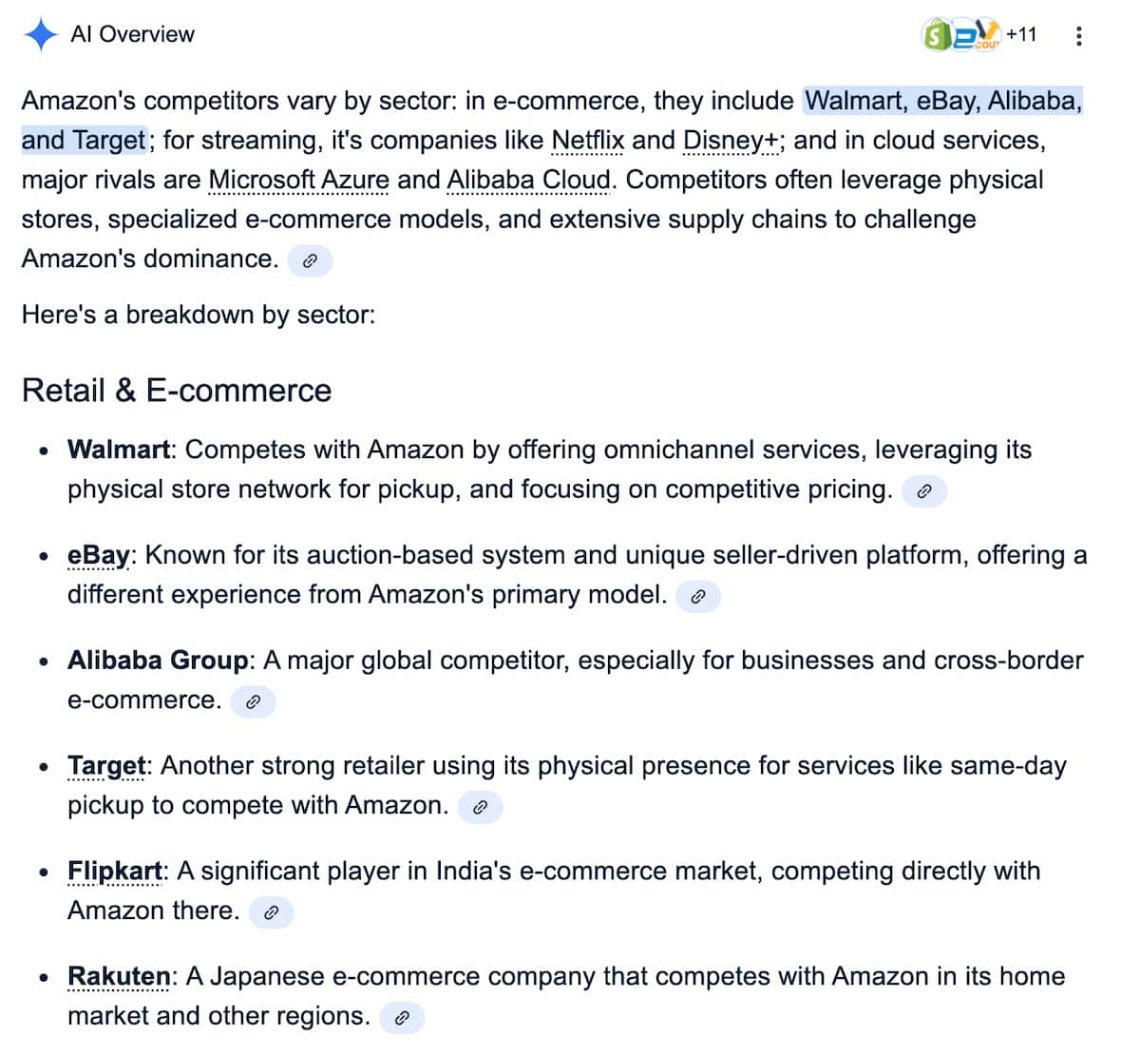

02 AI-powered media monitoring tool

A smart way to continue competitor research is to use an AI-powered media monitoring tool such as Brand24.

It’s a tool that collects and analyzes brand mentions across:

- Social media platforms like Facebook, Instagram, X (Twitter), TikTok, LinkedIn, Reddit, Telegram, Twitch, and Bluesky

- News outlets, blogs, video sites, podcasts, and other websites

- Newsletters and review platforms

The best feature to uncover Amazon’s direct competitors is the AI Brand Assistant.

Think of it as ChatGPT for brand monitoring – but even more specialized, as it accesses internal data sources that are invisible to publicly available AI chatbots.

According to the Brand Assistant’s analysis, which concludes from metrics like volume of mentions, reach, and sentiment analysis data, the top five Amazon’s main competitors are Walmart, Flipkart, AliExpress, eBay, and Etsy.

03 SEO research

Contrary to what many think, SEO research is not just about marketing.

In fact, it can reveal brands that struggle to increase their online visibility on the same phrases and queries as you do.

SEO tools like Semrush analyze organic & paid search traffic, similar keywords, and visibility trends to identify competitors that are actively struggling with Amazon in search engine results.

Such a wealth of data adds another layer to your competitive research, making it even more accurate.

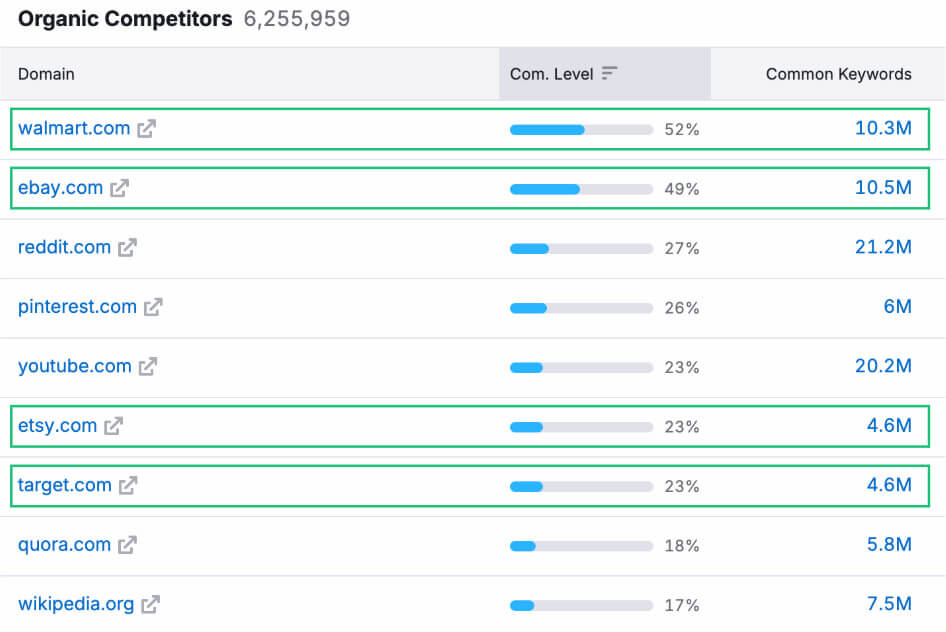

As you can see, according to Semrush’s SEO analysis, Amazon competes with Walmart, eBay, Etsy, and Target (let’s ignore social media platforms and Wikipedia, which remain outside the online marketplace industry).

How’s Amazon doing in 2026?

As I presented to you three tactics on how to identify the most significant players in the retail industry, let’s move to another step: what’s the condition of the Amazon brand in 2026?

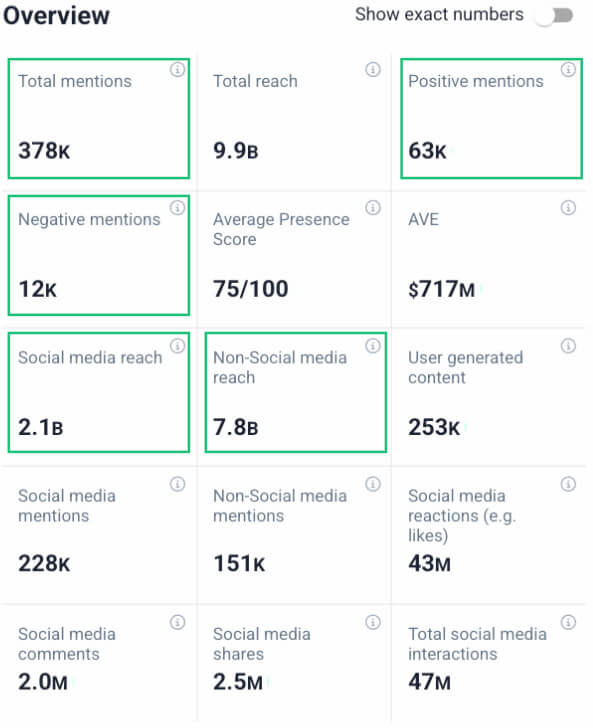

For that purpose, I used Brand24’s Analysis tab, which groups the most essential metrics for brand awareness.

Here is a quick overview of Amazon’s performance:

- Number of mentions – how many times the brand was referenced online. Amazon has 378,000 mentions.

- Number of positive mentions – how many times the brand was referenced positively. Amazon has 63,000 positive mentions

- Number of negative mentions – how many times the brand was referenced negatively. Amazon has 12,000 positive mentions

- Social media reach – the total number of people who could have had contact with social media content mentioning the brand. Amazon’s social media reach is 2.1 billion

- Non-social reach – the total number of people who could have had contact with non-social media content (i.e., news sites) mentioning the brand. Amazon’s non-social media reach is 7.8 billion

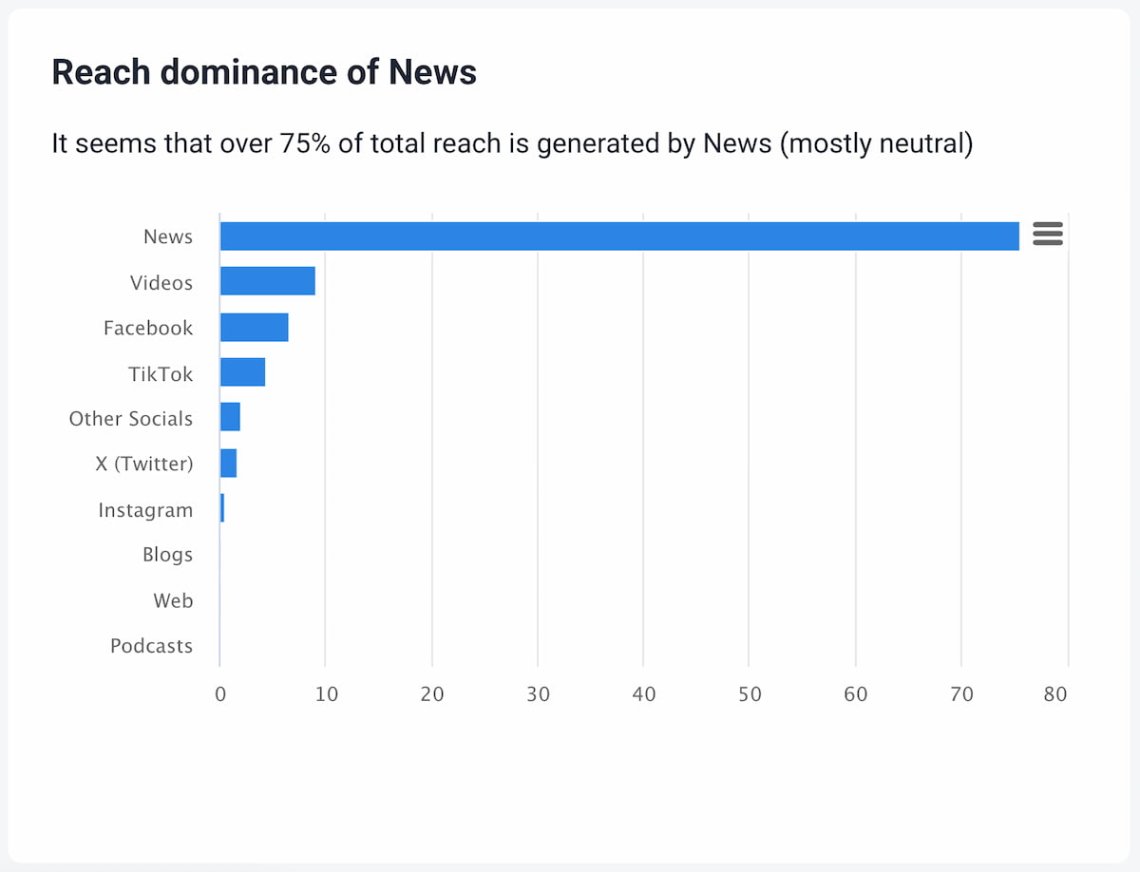

- Main source of reach – the medium that has the highest share in brand visibility. For Amazon, these are news sites generating about 75% of the total brand reach.

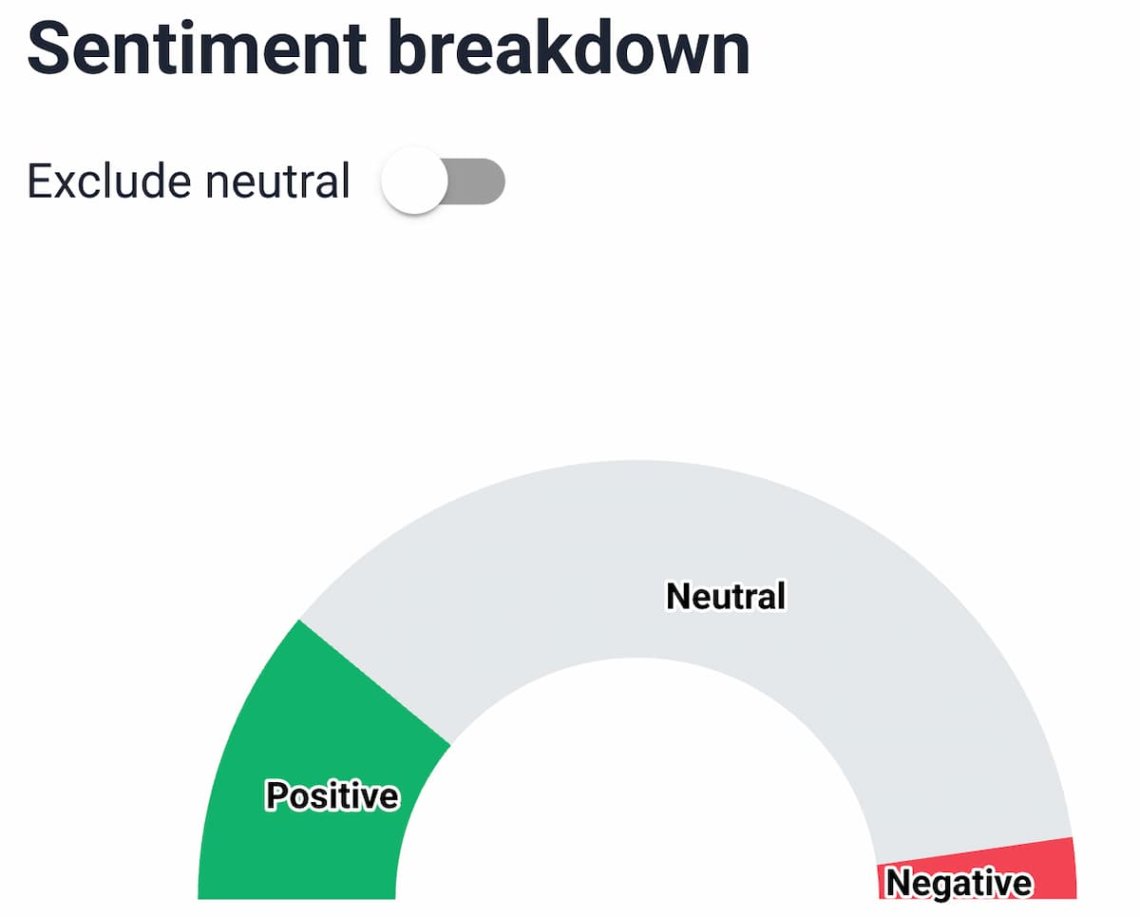

- Overall sentiment – an overview presenting the share of positive, negative, and neutral sentiment in all brand mentions. Amazon has 22% positive, 73% neutral, and 5% negative mentions.

- Main source of positive sentiment – the platform or channel with the highest share of positive mentions. For Amazon, the main sources of positive mentions are news sites.

- Main source of negative sentiment – the platform or channel with the highest share of negative mentions. For Amazon, the main source of negativity is X (Twitter) with 12% negatives.

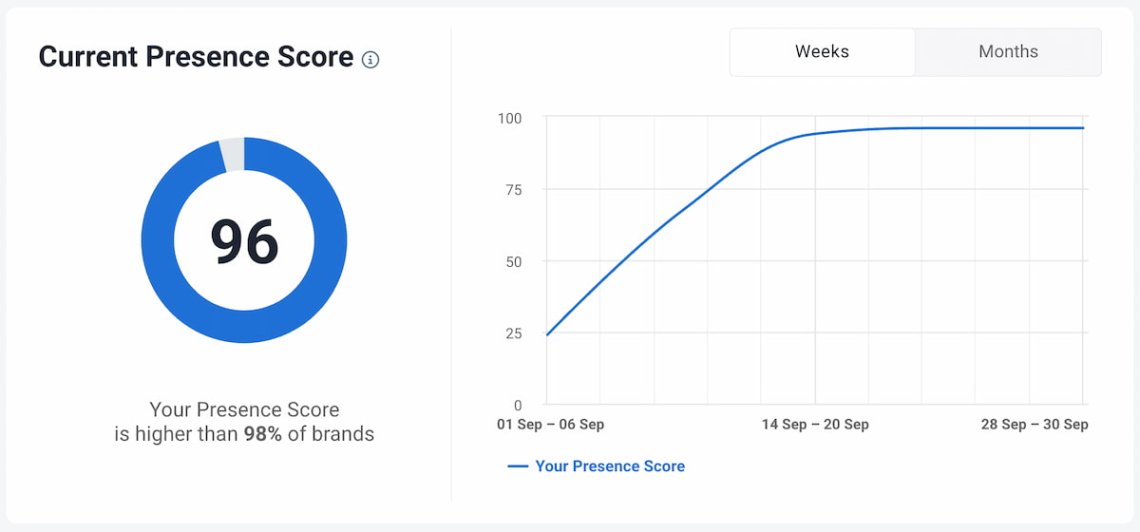

- Presence Score – a numeric metric that indicates a brand’s online popularity at a given time. Amazon’s Presence Score is 96, making it one of the top brands worldwide.

- Most popular topics around a brand – subjects that have the largest share in total discussions around a particular brand. In the case of Amazon, the top 3 are online shopping, books & literature, and beauty & skincare.

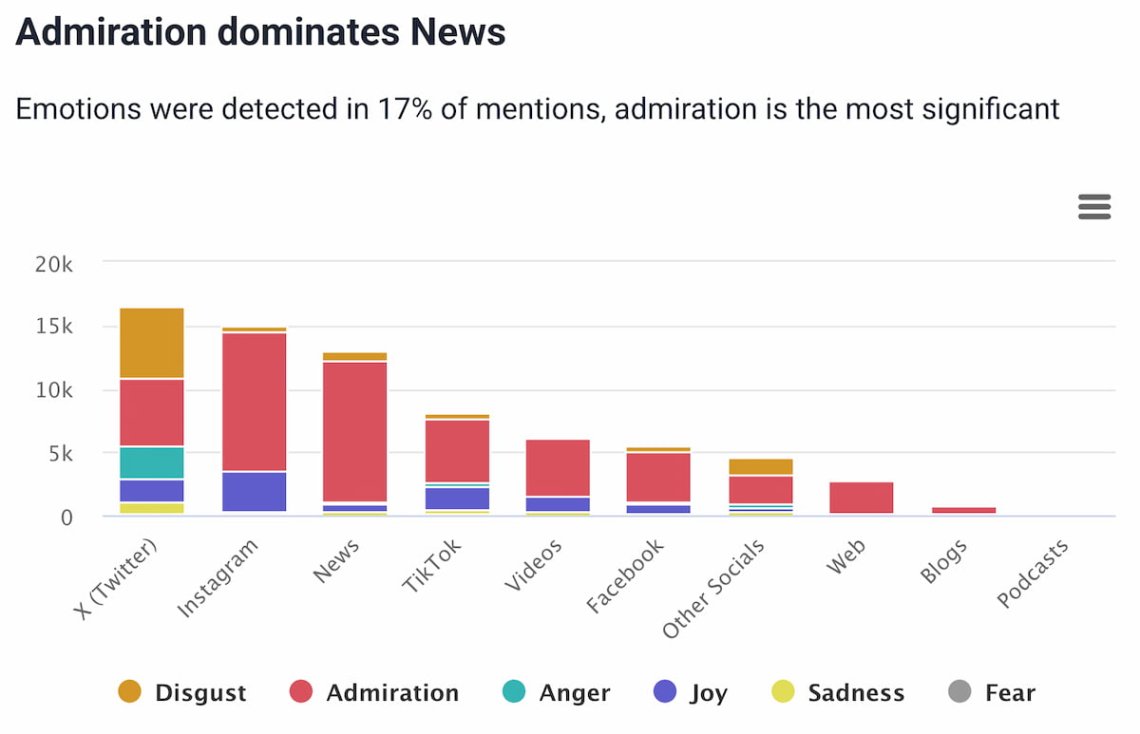

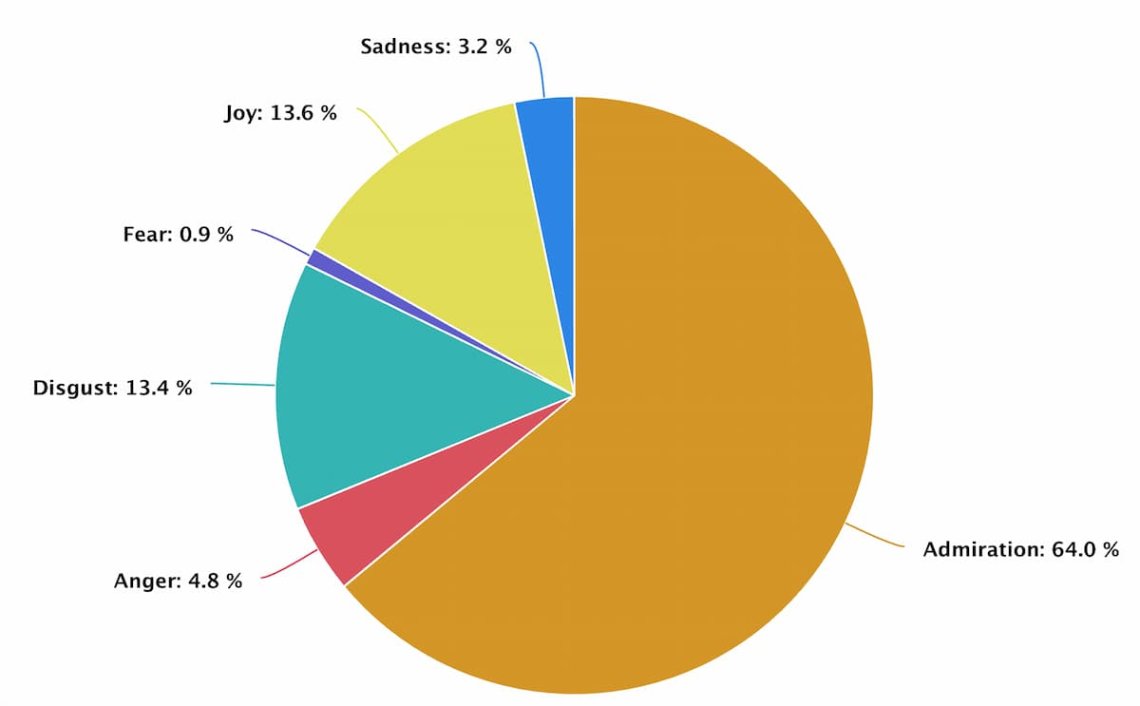

- Emotion analysis – breaking down sentiment into more detailed emotions. When people discuss Amazon, the three main feelings are admiration (64%), joy (13.6%), and disgust (13.4%).

Now that we have actual data about Amazon, let’s see how other e-commerce platforms are doing!

Top Amazon Competitors in 2026:

- Walmart

- eBay

- Flipkart

- AliExpress

- Etsy

01 Walmart

Walmart is a US-based multinational retail giant that has built dominance through brick-and-mortar stores. It’s so huge that it remains the largest private employer in the country.

When it comes to e-commerce in the U.S., Walmart is undoubtedly Amazon’s biggest competitor – a fact confirmed by my research with Google, AI, Brand24, and Semrush.

Here’s a quick snapshot of Walmart’s performance metrics:

- Number of mentions: 265,000

- Number of positive mentions: 36,000

- Number of negative mentions: 140,000

- Social media reach: 1.3 billion

- Non-social reach: 353 million

- Main source of reach: TikTok

- Overall sentiment: 53% negative, 14% positive, 34% neutral

- Main source of positive sentiment: TikTok

- Main source of negative sentiment: Instagram

- Presence Score: 85

- Most popular topics around brand: product recalls, security & safety concerns, shopping & deals

- Emotion analysis: disgust (81.2 %), admiration (11.5 %), joy (4.3 %), anger (1.6 %), sadness (0.9 %), fear (0.4 %).

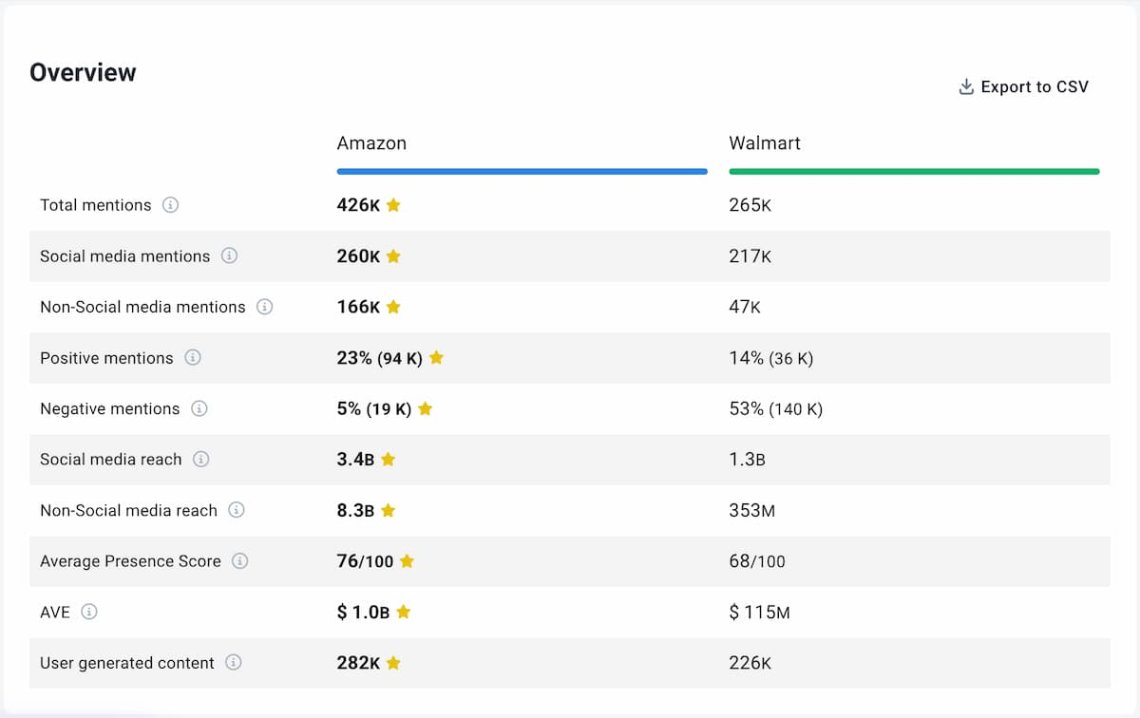

Amazon vs Walmart

The competitive analysis of Amazon and Walmart leaves no doubt – Jeff Bezos’ brand is not only more popular, but also enjoys an increasingly higher brand reputation!

In this clash of titans, Amazon emerges as the undisputed winner.

02 eBay

eBay is an e-commerce platform best known for its online auctions and consumer-to-consumer sales.

Unlike Amazon and Walmart, eBay primarily serves as a marketplace connecting millions of buyers and sellers worldwide.

While it’s much smaller than Amazon or Walmart in overall revenue, eBay remains a powerful niche player, particularly in second-hand goods, collectibles, and unique items.

Here’s a quick snapshot of eBay’s performance metrics:

- Number of mentions: 112,000

- Number of positive mentions: 17,000

- Number of negative mentions: 4,965

- Social media reach: 246 million

- Non-social reach: 303 million

- Main source of reach: News

- Overall sentiment: 15% positive, 4% negative, 80% neutral

- Main source of positive sentiment: Instagram

- Main source of negative sentiment: Reddit

- Presence Score: 81

- Most popular topics around brand: e-commerce platforms, electronics & gadgets, fashion

- Emotion analysis: admiration (71%), disgust (14.3 %), joy (8.7 %), sadness (2.9 %), anger (2.6 %), fear (0.4 %).

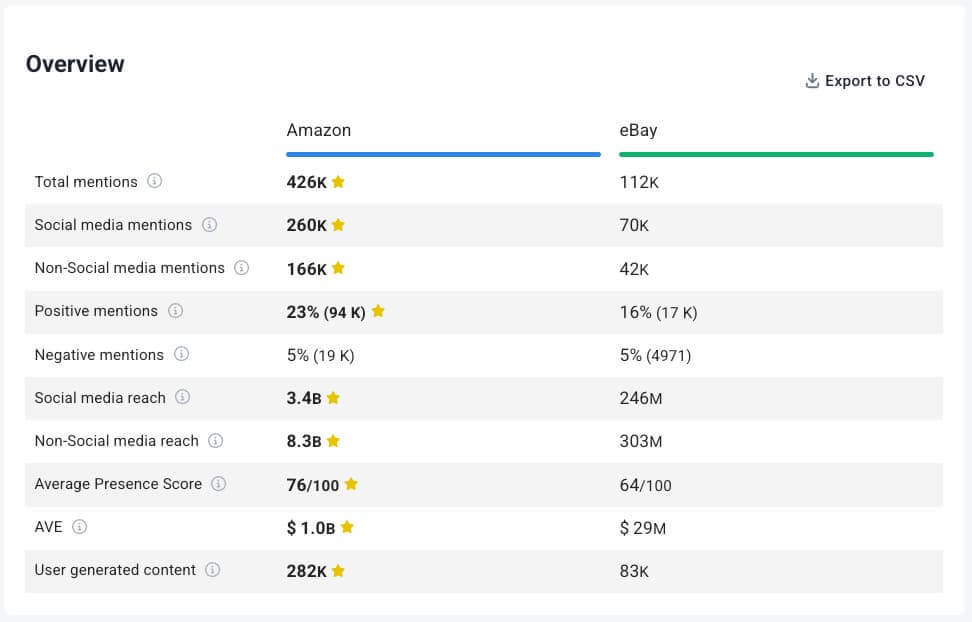

Amazon vs eBay

As expected, Amazon has nearly four times higher online presence. However, when it comes to its quality, the difference is not so big.

eBay enjoys a healthy reputation and has diversified its channels.

03 Flipkart

Let’s go beyond the US!

Flipkart is India’s leading e-commerce platform and Amazon’s most dangerous rival in South Asia.

Founded in 2007, it has grown into a digital powerhouse shaping online shopping habits in one of the world’s fastest-growing markets.

Unlike eBay, which plays a more niche role, Flipkart directly mirrors Amazon’s business model: a wide product assortment, a logistics network, and discount-driven campaigns.

Thanks to its local market knowledge and strong mobile-first approach, Flipkart holds a dominant position in India.

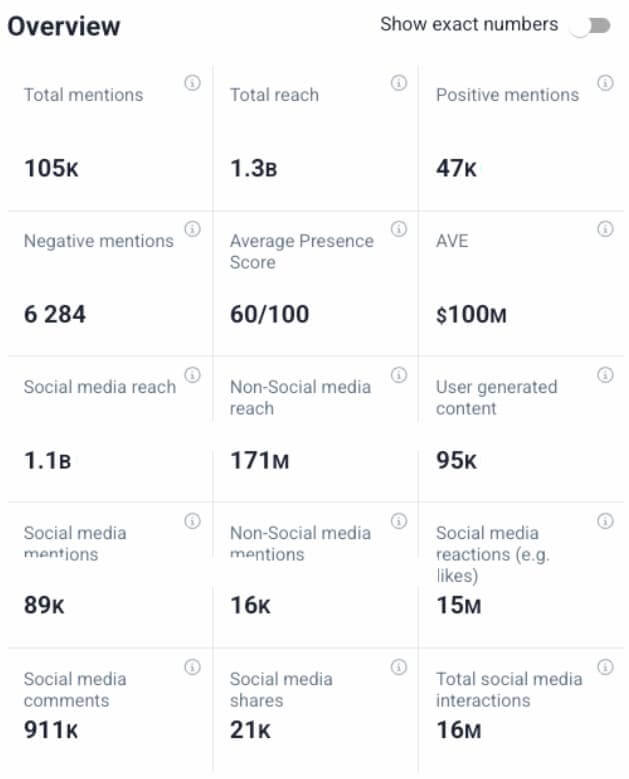

Here’s a quick snapshot of Flipkart’s performance metrics:

- Number of mentions: 105,000

- Number of positive mentions: 47,000

- Number of negative mentions: 6,284

- Social media reach: 1.1 billion

- Non-social reach: 171 million

- Main source of reach: video platforms (YouTube, etc.)

- Overall sentiment: 45% positive, 6% negative, 49% neutral

- Main source of positive sentiment: Instagram

- Main source of negative sentiment: X (Twitter)

- Presence Score: 80

- Most popular topics around brand: e-commerce, social media, smartphone sales & launches

- Emotion analysis: admiration (72.8 %), disgust (16.3 %), anger (4.2 %), joy (2.6 %), sadness (3.9 %), fear (0.2 %).

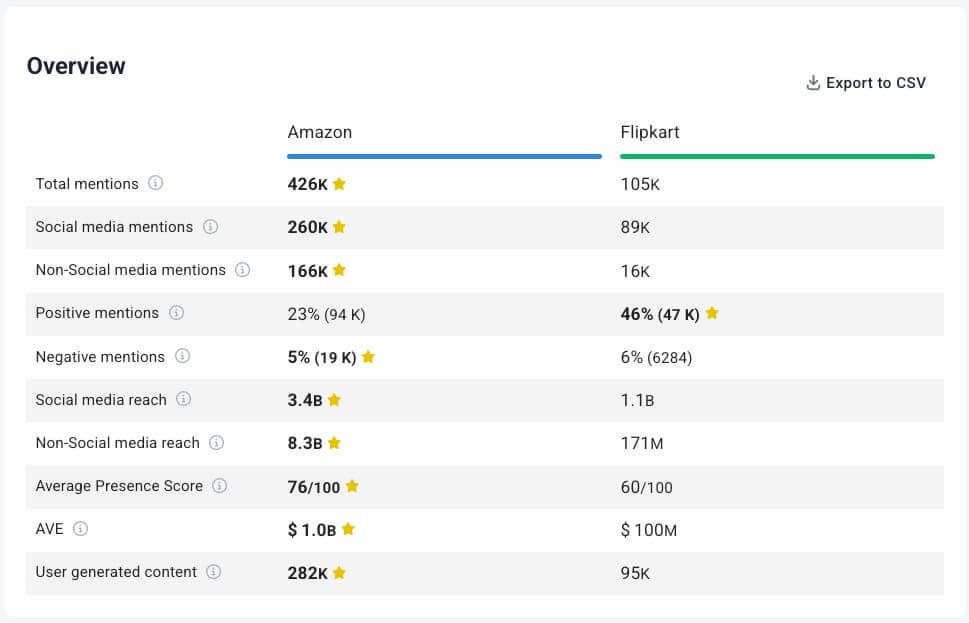

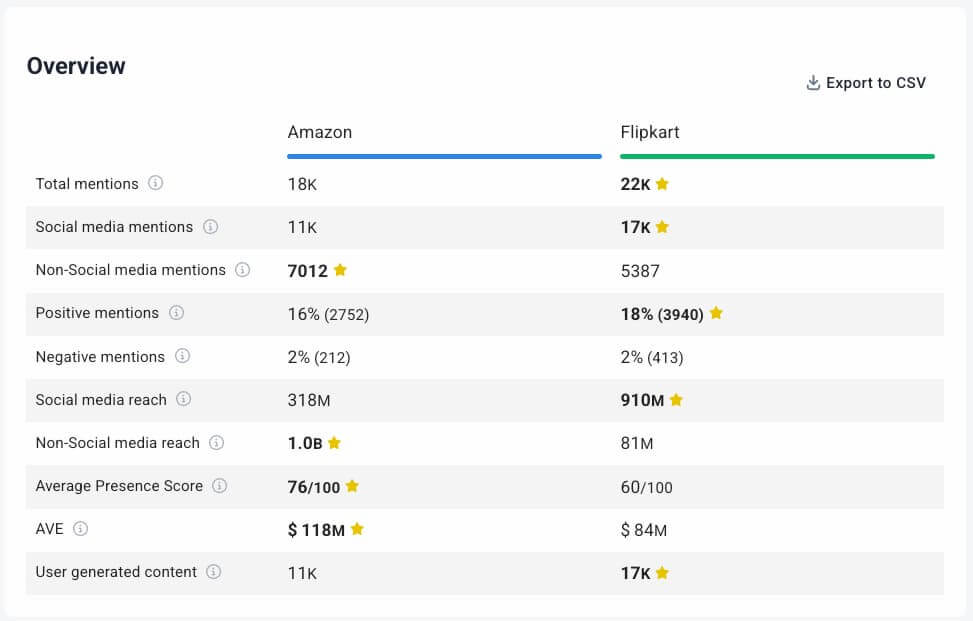

Amazon vs Flipkart

Globally, Amazon is a way more recognizable brand.

What caught my eye is that Flipkart enjoys an incredibly positive brand image – 46% of positive mentions is truly astonishing!

Things changed when I applied a geolocation filter to India only. Here, Amazon and Flipkart go head-to-head in most metrics.

Considering that India is a rapidly developing market and the most populous country in the world (with nearly 1.5 billion people), Amazon should pay special attention to its presence there.

04 AliExpress

AliExpress, owned by the Alibaba Group, is one of the world’s largest e-commerce platforms.

Unlike Walmart or Flipkart, AliExpress does not primarily focus on local dominance but rather on connecting Chinese manufacturers with global customers.

In Western markets, AliExpress is often associated with long delivery times and mixed product quality.

However, it remains a strong competitor because of its massive product range, aggressive discounts, and growing improvements in logistics.

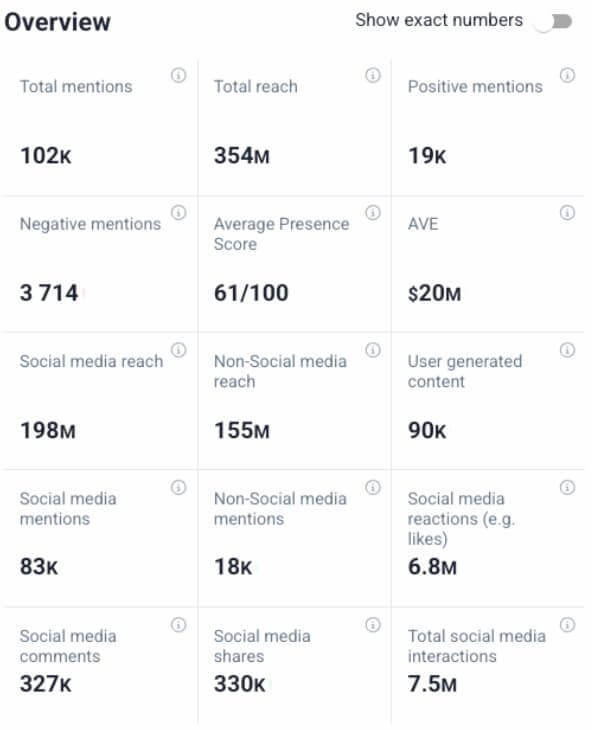

Here’s a quick snapshot of AliExpress’ performance metrics:

- Number of mentions: 102,000

- Number of positive mentions: 19,000

- Number of negative mentions: 3,714

- Social media reach: 198 million

- Non-social reach: 155 million

- Main source of reach: TikTok

- Overall sentiment: 19 % positive, 4 % negative, 77 % neutral

- Main source of positive sentiment: video streaming services

- Main source of negative sentiment: Reddit

- Presence Score: 78

- Most popular topics around brand: shopping deals, platform competition, product reviews

- Emotion analysis: admiration (65.6 %), joy (12.8 %), disgust (11.1 %), anger (6.5 %), sadness (3 %), fear (1 %).

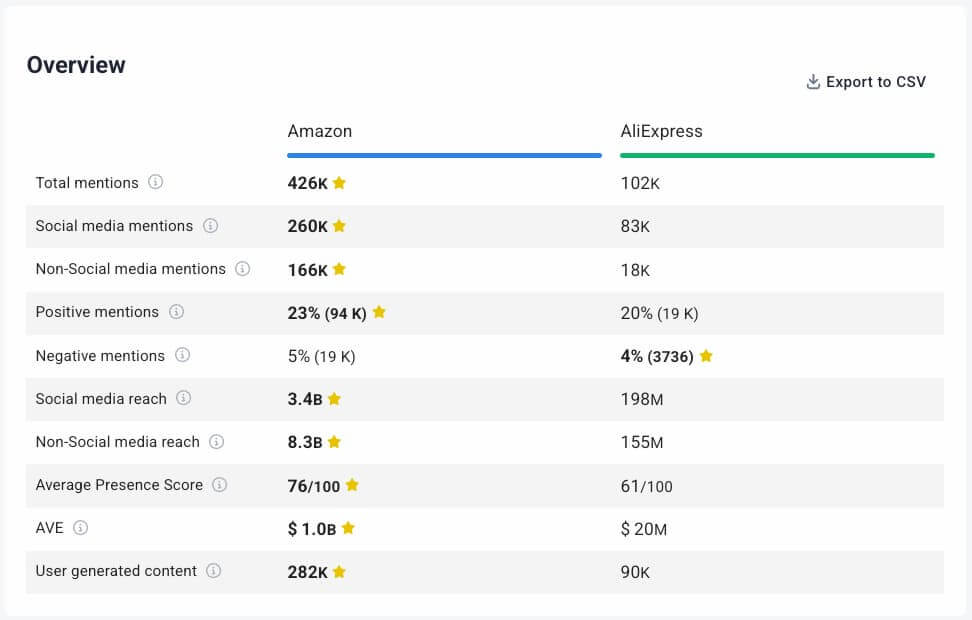

Amazon vs Aliexpress

Again, Amazon has an increasingly more significant online presence than its competitor. The difference is visible across all key metrics – especially the quantitative ones.

At the same time, AliExpress shows that price-driven offers and social virality (especially on TikTok) can still generate massive engagement.

05 Etsy

Etsy is an online marketplace that connects independent sellers with buyers worldwide and is focused on vintage, handmade, and unique goods.

Etsy doesn’t compete with Amazon on scale or price. Instead, it builds a community-driven e-commerce platform with niche specialization.

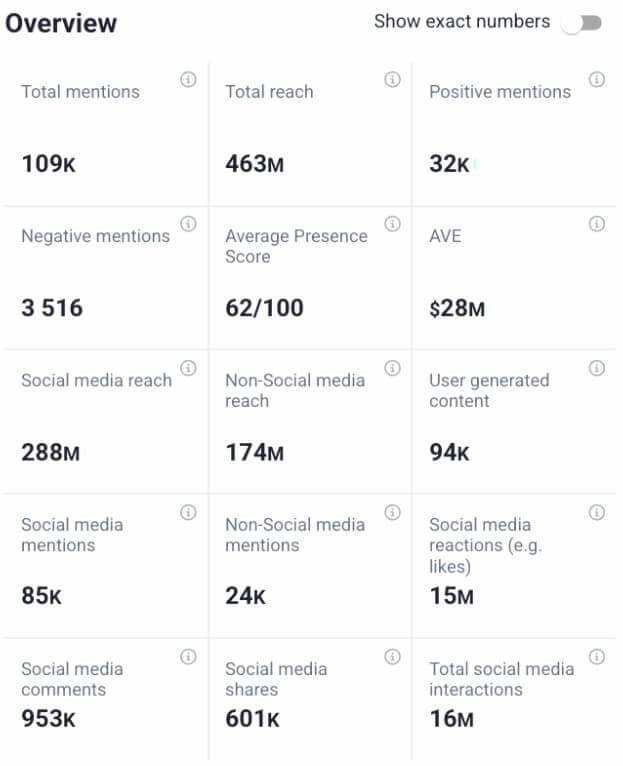

Here’s a quick snapshot of AliExpress’ performance metrics:

- Number of mentions: 109,000

- Number of positive mentions: 32,000

- Number of negative mentions: 3,516

- Social media reach: 288 million

- Non-social reach: 174 million

- Main source of reach: video platforms

- Overall sentiment: 19 % positive, 4 % negative, 77 % neutral

- Main source of positive sentiment: Instagram

- Main source of negative sentiment: Reddit

- Presence Score: 62

- Most popular topics around brand: online selling, handmade art & crafts, spiritual & mystical

- Emotion analysis: admiration (70.5 %), joy (18.8 %), disgust (7 %), sadness (2.2 %), anger (1.1 %), fear (0.4 %).

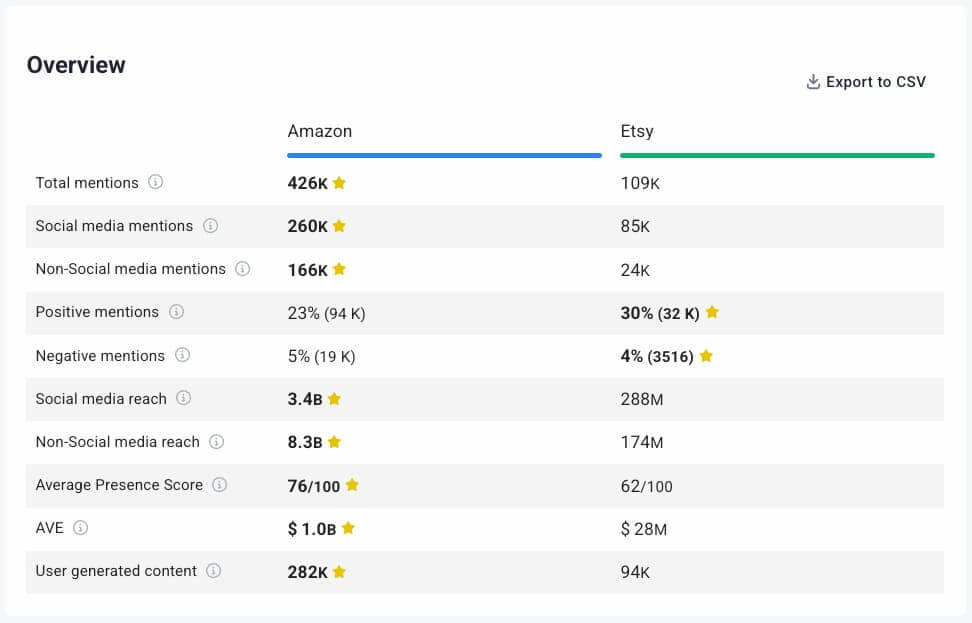

Amazon vs Etsy

Comparing the scale of Amazon and Etsy is pointless. Instead, pay attention to Etsy’s reputation and positioning.

Etsy thrives on the share of positive mentions (30%), proving that niche specialization is a great way to carve out one’s own slice of the cake owned by Amazon.

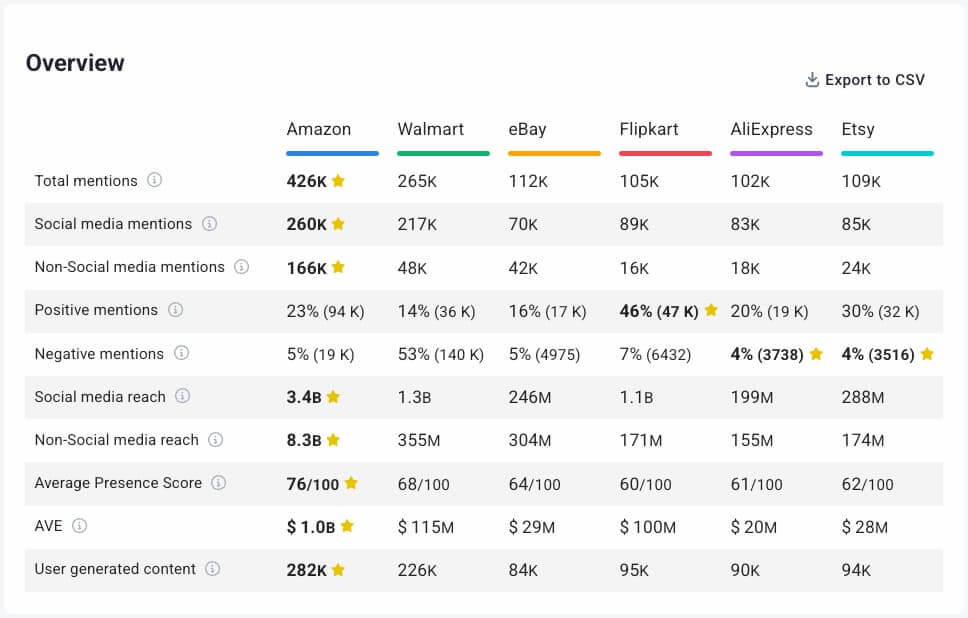

Detailed Comparison

Now, it’s time to take a look at the big picture of Amazon’s performance and its major competitors.

Below, you can see the comparison tab of Amazon, Walmart, eBay, Flipkart, AliExpress, and Etsy.

When it comes to mentions volume, reach, AVE, and Presence Score, Jeff Bezos’ company is the undisputed dominator.

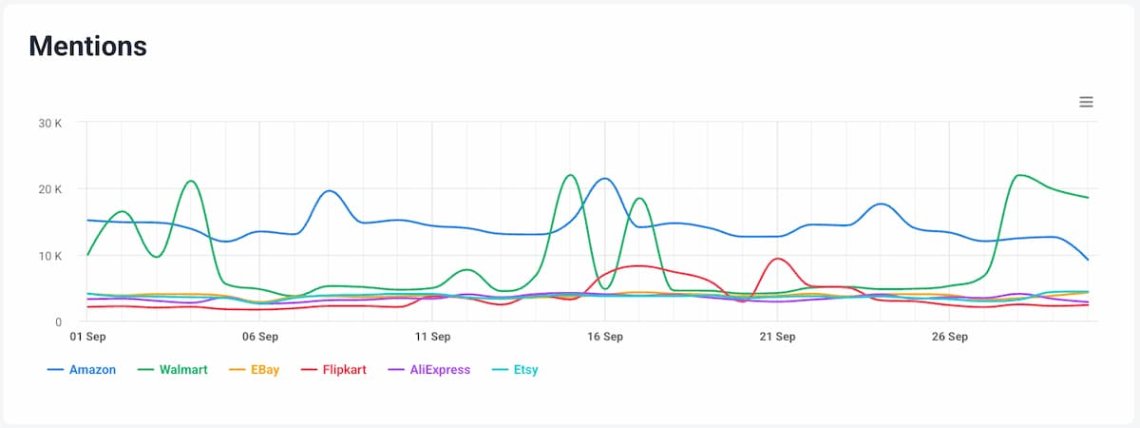

Mentions

The mentions chart confirms Amazon’s stability. The only brand that occasionally enjoys more online exposure is Walmart.

Amazon is also pretty stable in terms of positive and negative sentiment.

Share of voice

Share of voice charts confirm Amazon’s dominant role in the retail industry.

Especially when we consider the brand’s total reach, which is almost 4 times higher than Walmart, eBay, Flipkart, AliExpress, and Etsy combined!

Final thoughts:

- Amazon remains the undisputed leader in global e-commerce, but strong rivals continue to shape the market.

- Walmart, Flipkart, AliExpress, eBay, and Etsy each win by focusing on their unique strengths.

- Even in a market dominated by giants, niche strategies can build loyal audiences and real impact.

Start a Brand24 free 14-day trial and discover details about any competitive brand!