4 Most Important Boeing Competitors in 2025 [Detailed Comparison]

Table of contents

Boeing may still be flying high, but rival jets are catching up fast. In the last 30 days, Boeing reached 1.58 billion people, but Airbus wasn’t far behind, with 913 million in reach. Who’s really winning the aviation race in 2025? And who’s about to get pulled back down by gravity?

In this article, I’ll walk you through a detailed analysis of Boeing’s top competitors – complete with data, trends, and key insights.

Ready for takeoff? Let’s go!

Boeing is the leader in the aircraft industry, but its competitors are hot on its heels.

The main rivals are:

1️⃣ Airbus – 140K mentions, 913M total reach

2️⃣ COMAC – 5.4K mentions, 41M total reach

3️⃣ Embraer – 21K mentions, 91M total reach

4️⃣ Bombardier – 13K mentions, 197M total reach

Boeing leads with 158K mentions & 1.58B total reach

How to discover Boeing competitors?

I did a little competitor analysis and defined crucial competitors for Boeing with ChatGPT and AI Brand Assistant’s help.

Here are the key Boeing competitors:

- Airbus

- COMAC

- Embraer

- Bombardier

I used several criteria to find them, which included:

- Product range overlap

- Market share in commercial aviation

- Technological innovation

- & Global reach

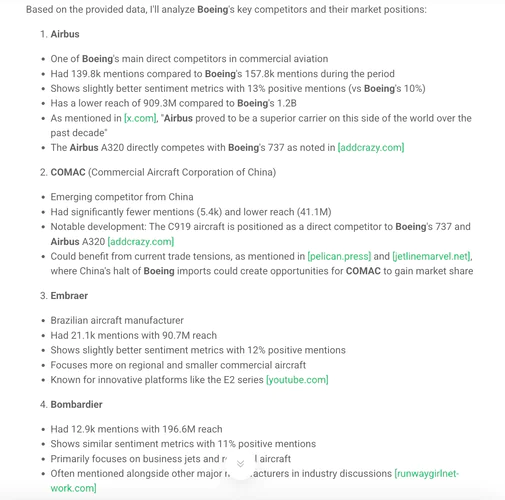

Each brand is a little different and focuses on different market segments. Here’s where they mainly compete with Boeing:

- Airbus directly rivals Boeing in large commercial aircraft. They offer comparable models across most segments.

- Comac, though newer, competes with Boeing in narrow-body aircraft, especially in the growing Chinese market.

- Embraer challenges Boeing in the regional jet sector.

- Bombardier (before selling its C Series to Airbus) competed in the small to mid-size aircraft segment.

Analyze your competitors!

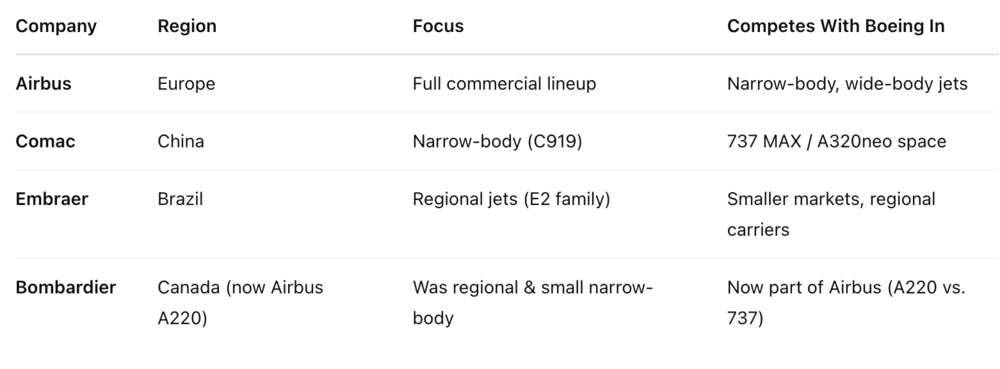

This is the analysis I got from AI Brand Assistant:

And this one I got from ChatGPT:

I also asked Semrush for the Boeing direct search competitors.

Here’s a list of sites that compete with Boeing in terms of keywords and organic search:

How’s Boeing doing in 2025?

Boeing is generally doing great in 2025. But, what does that mean?

Let’s get into the more detailed analysis of Boeing’s performance!

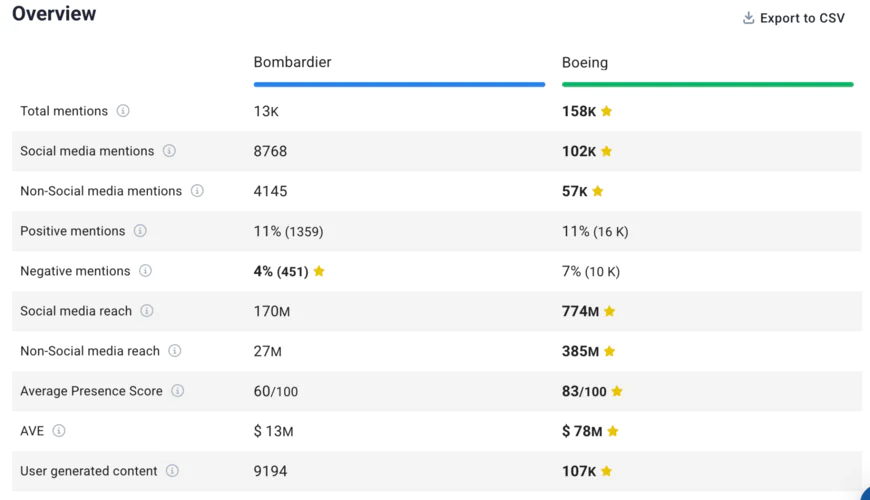

The brand metrics analysis below is from the last 30 days, and I used Brand24, an AI social listening tool, to get them:

If you feel the need, you can click on the blue “See detailed comparison in the top corner and compare the performance over specific periods.

Ok, let’s get to the fun stuff – which metrics should you analyse to understand Boeing’s performance?

- Total number of mentions – it’s the number of times the brand was mentioned. For Boeing, it is 158,000.

- Number of positive mentions – it shows the number of mentions with positive sentiment. Boeing has 16,000.

- Number of negative mentions – it shows the number of mentions with negative sentiment. Boeing has 10,000.

- Social media reach – it estimates the number of individuals who saw your content. Boeing reached 1.2B social media users.

- Non-social reach – analogically, this metric shows the number of people who saw your content beyond social media platforms. Boeing reached 384 million people beyond social media.

- Main source of reach – identifies the type of content or platform that garners the widest audience. For Boeing, these are videos.

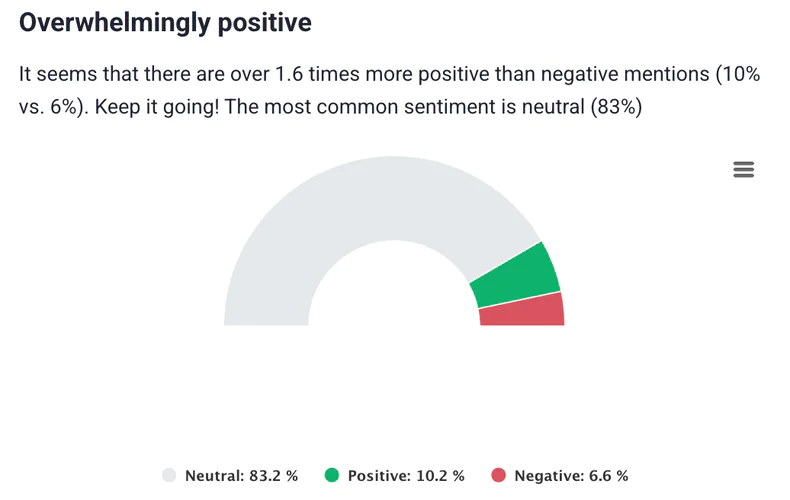

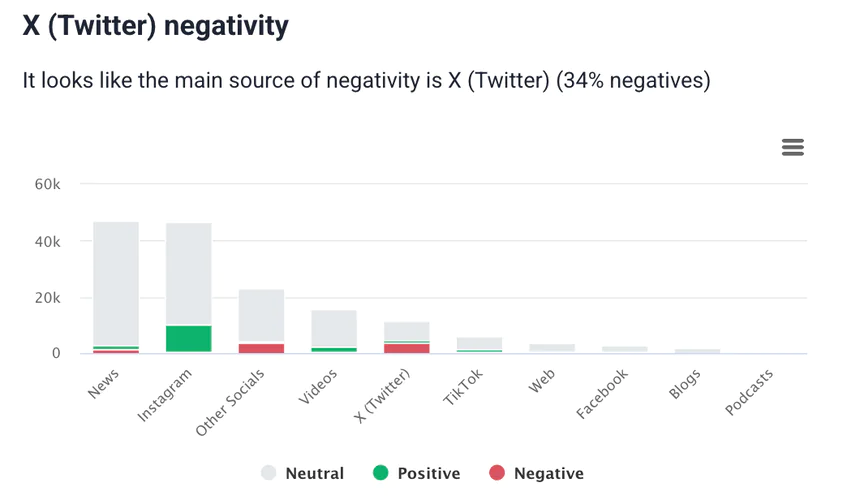

- Overall sentiment – offers an overview of public perception in digital conversations. In Boeing’s case, the sentiment breakdown is 83.2% neutral, 10.2% positive, and 6.6% negative.

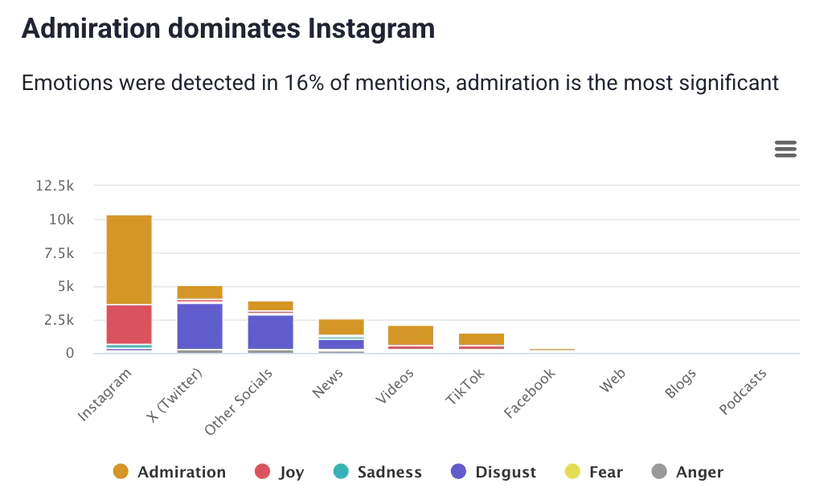

- Main source of positive sentiment – highlights the channel where the brand receives the most favorable mentions. For Boeing, Instagram stands out as the platform with the highest positive sentiment.

- Main source of negative sentiment – so the platform or channel with the highest share of negative mentions. Boeing has the most negative sentiment on X (Twitter).

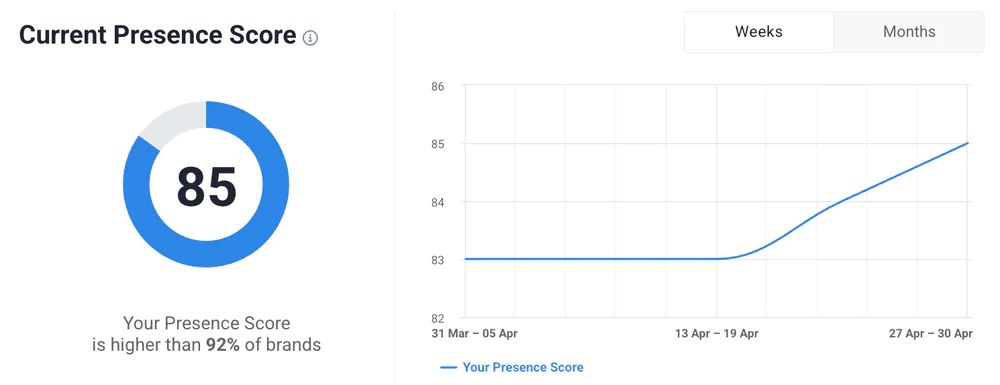

- Presence Score: 85/100, meaning Boeing has been more visible than 92% of similar brands in the last 30 days.

Check your Presence Score!

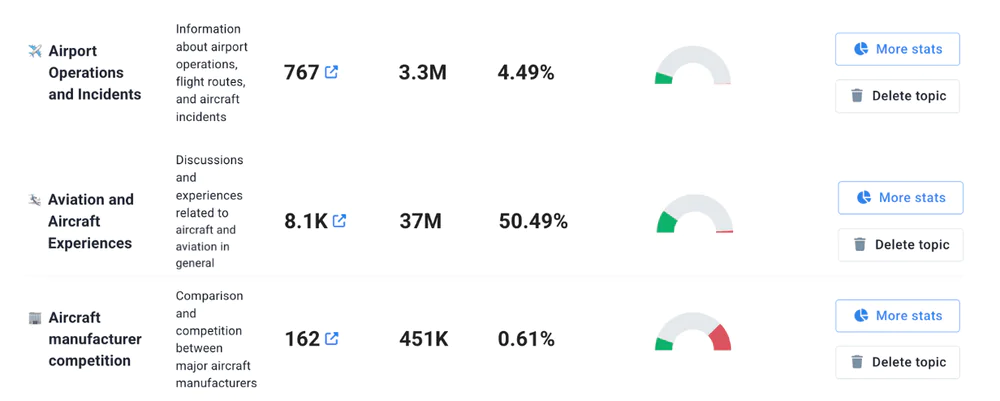

- Most popular topics around the brand – reveals the subjects that draw the most attention in discussions related to the brand. In the case of Boeing, these are airport operations and incidents, aviation and aircraft experiences, and aircraft manufacturer competition.

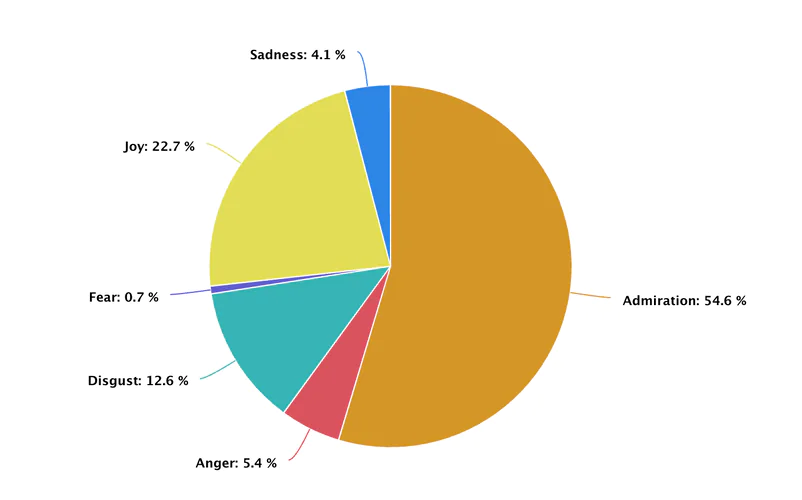

- Emotion analysis – a closer look at the emotions people express. For Boeing, the most common feelings are admiration (54.6%), joy (22.7%), and disgust (12.6%).

Now that you understand how the Boeing company is really doing, let’s check how it performs compared to other aircraft production!

Top Boeing Competitors in 2025:

01 Airbus

Airbus is a European aerospace giant and Boeing’s main competitor in the commercial aircraft market.

It offers a full range of aircraft, from single-aisle (A320 family) to long-haul wide-body aircraft (A350, A330). These are directly rivaling Boeing’s 737, 787, and 777 models.

Airbus also absorbed Bombardier’s CSeries program (now the A220), gaining an edge in the smaller aircraft segment where Boeing lacks presence.

It’s definitely an advantage for them!

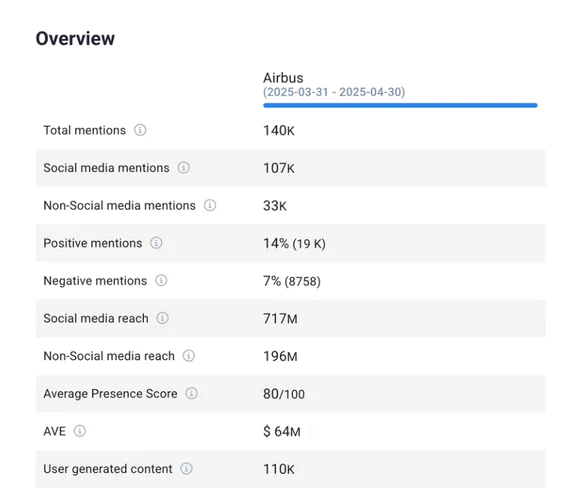

Here’s a quick overview of Airbus’s performance metrics:

- Number of mentions: 140K

- Number of positive mentions: 19K

- Number of negative mentions: 8758

- Social media reach: 717M

- Non-social reach: 196M

- Main source of reach: Facebook

- Overall sentiment: 13.2% positive, 6.2% negative, 80.5% neutral

- Main source of positive sentiment: Instagram

- Main source of negative sentiment: X (Twitter)

- Presence Score: 80

- Most popular topics around brand: aviation safety and incidents, market competition and trade relations, technical and operational content.

- Emotion analysis: admiration (52.7%), disgust (23.9%), joy (16.5%), anger (2%), sadness (2.7%), fear (1.1%).

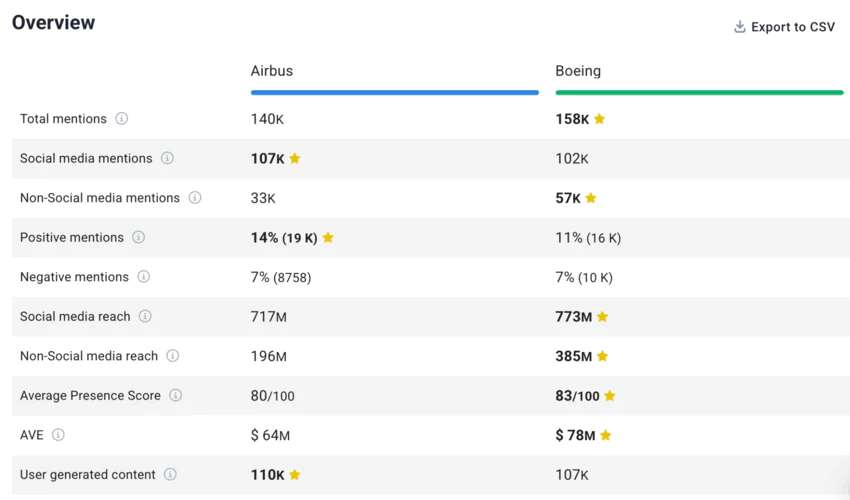

Airbus vs. Boeing

I compared the performance of Airbus and Boeing, and it proved Boeing to be a bit more visible and well-performing.

However, the competitor analysis also showed that Airbus is better at metrics like positive mentions, UGC, and social media mentions. Perhaps Boeing could use social media to improve those factors?

02 COMAC

Comac (Commercial Aircraft Corporation of China) is a state-owned Chinese aerospace manufacturer aiming to reduce China’s reliance on Western aircraft.

Its flagship business jet, the C919, is designed to compete with the Boeing 737 and Airbus A320 in the narrow-body market.

The brand is still developing in terms of global reach and certification. However, Comac benefits greatly from strong domestic government support and a large home market.

China focuses on major manufacturers and aircraft deliveries within the country, and COMAC proves it perfectly.

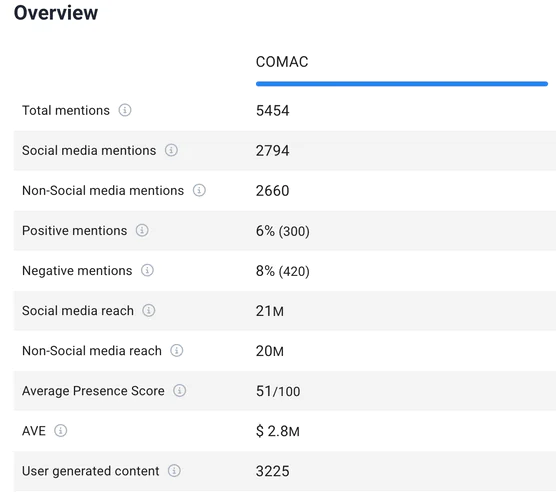

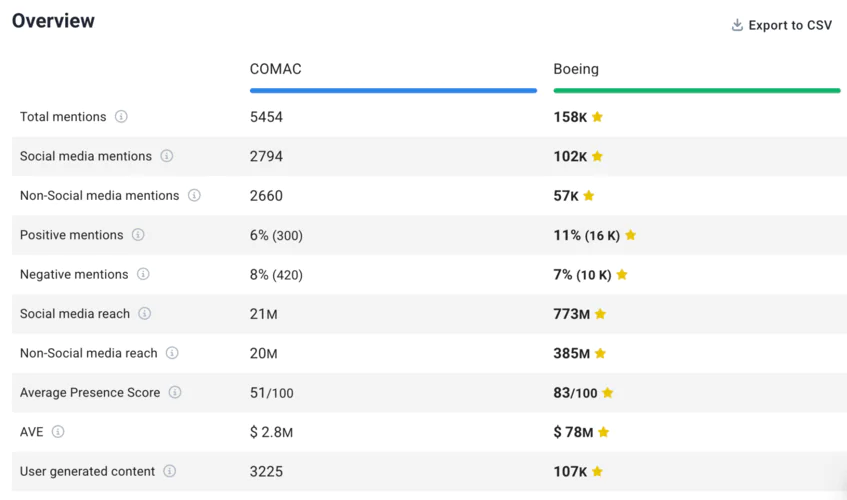

Here’s a quick snapshot of COMAC’s performance metrics:

- Number of mentions: 5454

- Number of positive mentions: 2794

- Number of negative mentions: 420

- Social media reach: 21M

- Non-social reach: 20M

- Main source of reach: Videos

- Overall sentiment: 5.5% positive, 7.7% negative, 86% neutral

- Main source of positive sentiment: Instagram

- Main source of negative sentiment: X (Twitter)

- Presence Score: 47

- Most popular topics around the brand: COMAC aircraft development, Vietnam aviation relations,

Company events and promotions. - Emotion analysis: admiration (36.8%), joy (13.6%), disgust (42.3%), anger (2.8%), sadness (2.3%), fear (2.4%).

Boeing vs. COMAC

This case is a little trickier.

As COMAC is a Chinese company, they also promote it mostly within the country, which has their own social media platforms and websites.

That’s why the difference is so enormous here.

The analysis below is a good overview of how visible the companies are on the non-asian markets.

03 Embraer

Embraer is a Brazilian manufacturer specializing in regional jets and small narrow-body business jets.

Its E-Jet and E2 series compete below Boeing’s typical commercial aircraft size. They are focusing on short-haul, high-frequency routes.

This company is not a direct threat to Boeing’s core models and market cap.

However, Embraer fills a strategic niche and had previously been targeted for acquisition by Boeing, a deal that ultimately fell through.

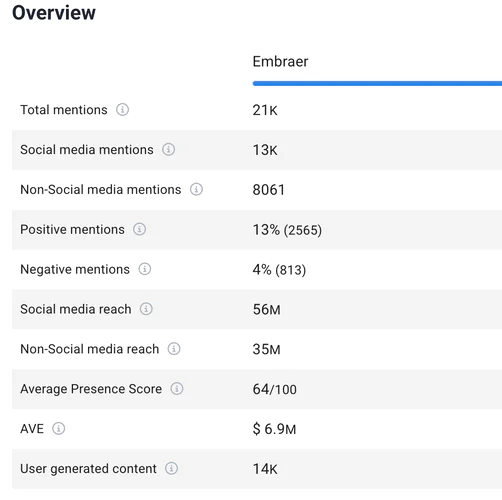

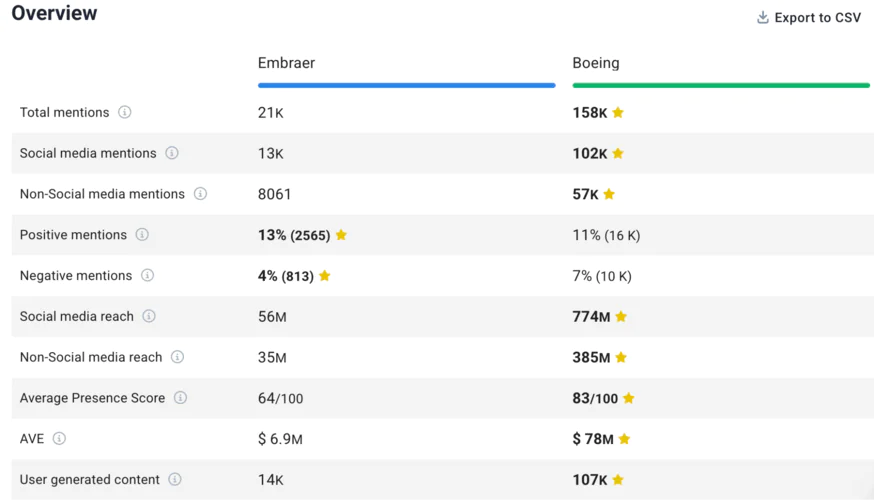

Here’s a quick snapshot of Embraer’s performance metrics:

- Number of mentions: 21k

- Number of positive mentions: 2565

- Number of negative mentions: 8061

- Social media reach: 56M

- Non-social reach: 35M

- Main source of reach: News sites

- Overall sentiment: 12.1% positive, 3.8% negative, 84% neutral

- Main source of positive sentiment: Instagram

- Main source of negative sentiment: X (Twitter)

- Presence Score: 63

- Most popular topics around the brand: Aviation and aircraft experiences, Embraer business performance, and Military aircraft collaborations.

- Emotion analysis: admiration (54.6%), joy (22.7%), disgust (12.5%), anger (5.4%), sadness (4.1%), fear (0.7%).

Boeing vs. Embraer

Boeing is performing better… again.

But Embraer has better sentiment (in both – fewer negative mentions and more positive ones), and that’s something Boeing could improve. It’s a very important factor impacting your brand visibility.

Benchmark your performance!

04 Bombardier

This company is a Canadian aerospace company that used to compete directly with Boeing in the regional jets and small narrow-body aircraft.

However, financial struggles led Bombardier to sell its CSeries program to Airbus, where it became the A220.

Bombardier has since exited the commercial aircraft market and now focuses solely on business jets.

So, what’s the overall brand awareness of this company?

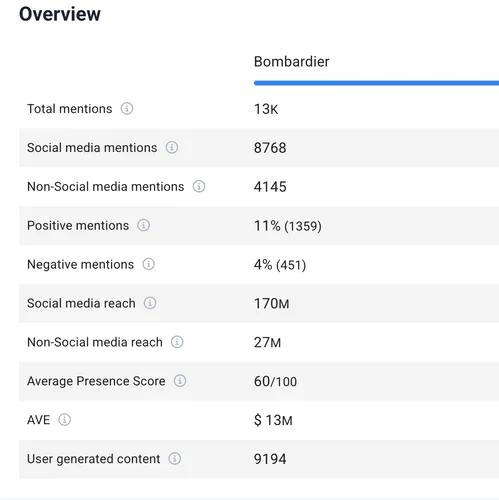

Here’s a quick snapshot of Bombardier’s performance metrics:

- Number of mentions: 13k

- Number of positive mentions: 1359

- Number of negative mentions: 451

- Social media reach: 170M

- Non-social reach: 27M

- Main source of reach: Other socials (Reddit, Quora, etc.)

- Overall sentiment: 10.6% positive, 3.5% negative, 85.9% neutral

- Main source of positive sentiment: Instagram

- Main source of negative sentiment: X (Twitter)

- Presence Score: 60

- Most popular topics around the brand: Aviation and aerospace, Bombardier corporate affairs.

- Emotion analysis: admiration (55.1%), disgust (13.9%), joy (23.9%), anger (1.8%), sadness (3.3%), fear (2%)

Boeing vs. Bombardier

Well, similar to other competitors, Boeing wins the convo.

It’s better performing among almost every metric… except the sentiment analysis (again).

That’s definitely something they could work on.

Detailed Comparison

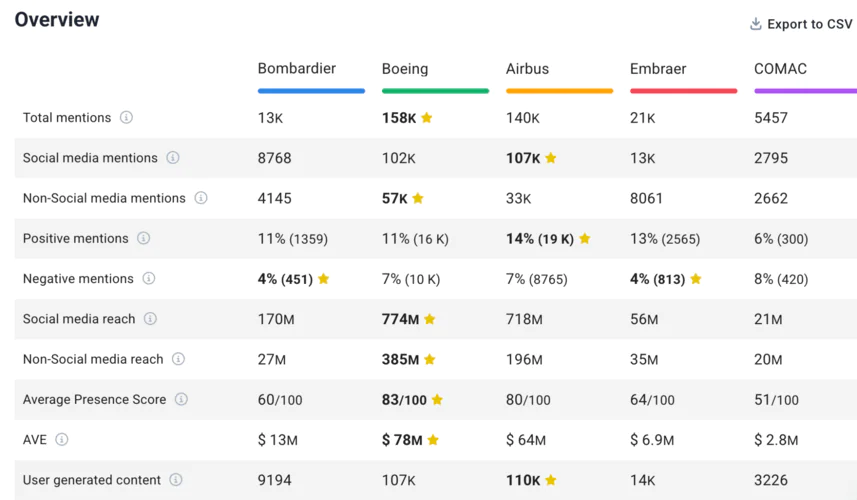

Now that we have all the main competitors covered, let’s take a look at all of the data gathered together.

I created an analysis of all four competitors vs Boeing.

As you can see, Boeing is the ultimate winner!

But, there are some categories to improve – more UGC content, more social media presence, and better sentiment.

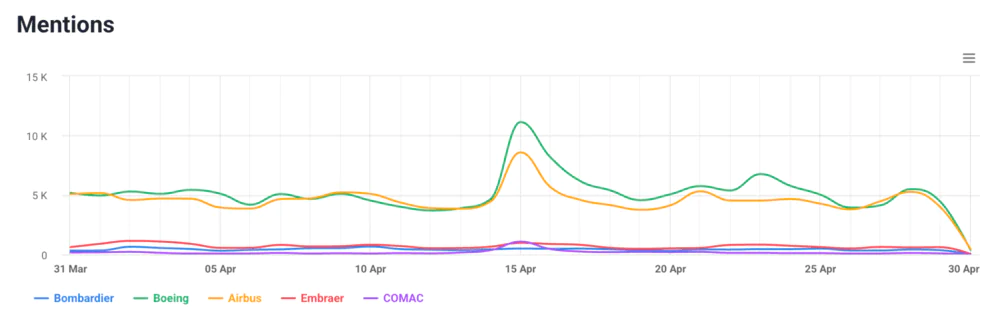

Mentions

Opisujemy kto ma najwięcej wzmianek. Można tez dodać info o wzmiankach pozytywnych i negatywnych.

Boeing has the most of the mentions (158K). But, they didn’t manage to keep their sentiment on the same level.

Airbus is the company with the best positive sentiment of mentions ratio – 14%.

And Bombardier and Embraer have the lowest ratio of negative sentiment, 4%.

Here’s what it looked like over the last 30 days:

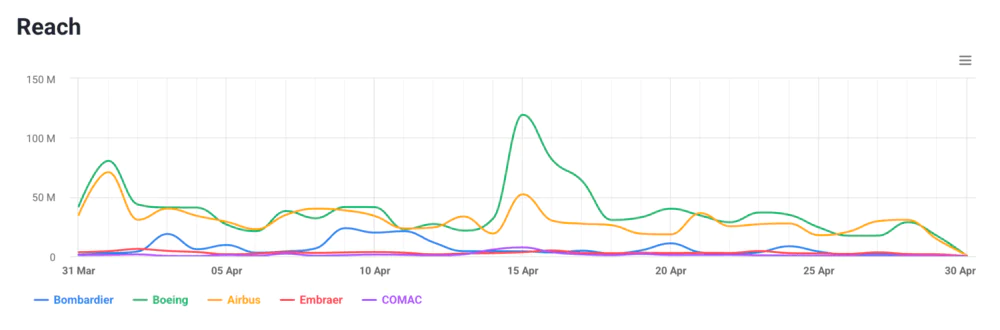

Reach

Boeing reached almost 1.2 billion people during the last 30 days!

Airbus is the one giving Boeing a run for its money.

Here’s how the reach changed over time:

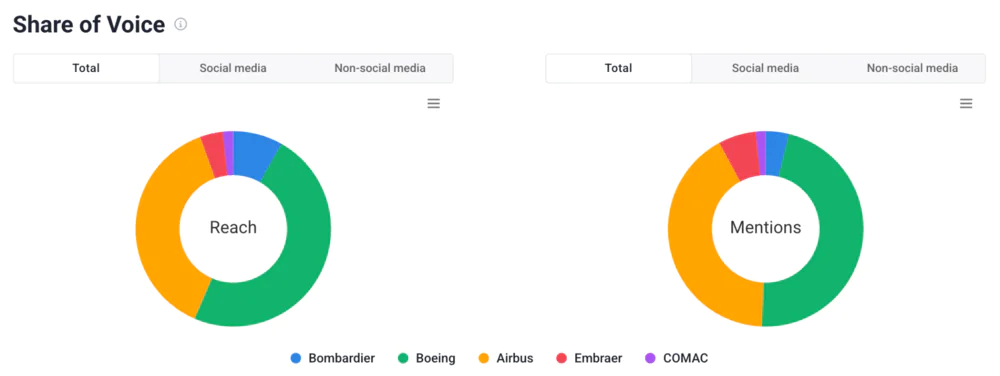

Share of voice

And finally, the share of voice.

The main battle is between Boeing and Airbus, but Boeing wins with:

- 38% for Airbus and 48% for Boeing in terms of Reach

- 41% for Airbus and 47% for Boeing in terms of Mentions

Benchmark your share of voice!

Final thoughts:

- Boeing’s biggest commercial aviation competitors in 2025 are clearly Airbus, Comac, Embraer, and Bombardier. Airbus is now the most direct and dangerous rival, with nearly identical product lines and a strong global presence.

- Competitor monitoring lets you stay ahead of industry shifts, spot emerging threats (like Comac for Boeing), and uncover new ideas for your brand strategy.

- Boeing has a great overall visibility, global reach, and presence. It dominates the conversation volume and stays at the top of mind worldwide. However, it struggles with lower sentiment, especially compared to Airbus and Embraer.

- Airbus is catching up fast, especially in terms of sentiment and community engagement. They put pressure on Boeing to innovate not only in advanced technology but also in communication and customer experience.

Want to analyse your competitors just like this? Start with a Brand24 trial and don’t let others surpass!