Table of contents

How to Do Product Research in Less than 30 Minutes?

Product research can feel like navigating through a dense jungle with no map. It’s time-consuming, complicated, and often downright frustrating. Sifting through endless data, analyzing competitors, and trying to understand what customers really want can take hours, if not days. We’ve all been there, lost in the chaos, wishing for a magic wand to make it all easier.

Well, guess what? That magic wand exists, and it’s called Brand24.

Product research is the process of market examination prior to a new product release. It aims to inform the creation of a new product to meet potential customers’ needs and introduce a competitive offer compared to other products available on the market. The product research process is time-consuming and complicated, but with the right tool, it can be done in under 30 minutes.

Imagine this: instead of spending countless hours bogged down in research, you could have all the insights you need in less than 30 minutes.

Yes, you read that right—30 minutes!

With Brand24, product research becomes a breeze. It’s so simple and efficient that you’ll wonder how you ever managed without it.

For instance, you are about to release new sneakers and want a competitive edge over the renowned New Balance 530 model.

What is the best way to do this?

Let’s check their biggest advantages and ensure your product also offers them.

As you can see, it’s very simple.

You ask your AI Brand Assistant a product research question, and it will provide a unique answer based on its own online research process.

Ready to transform your research game?

Let’s dive in and see how Brand24 can make your life infinitely easier.

What is product research? Definition

Product research involves gathering and analyzing data about potential products and markets. It’s about understanding customer needs, evaluating market trends, and scoping out the competition.

Done right, it provides invaluable insights that guide product development and marketing strategies.

But let’s face it, getting to those golden nuggets of information is no easy feat.

That’s why the right tool is needed.

Product research is also related to concept testing.

This practice relies on a soft launch and pre-release customer interviews. It’s safe and allows businesses to improve their offerings before the final release.

Thanks to the early-access user insights, the product team can work on a particular product and improve it to the audience’s liking before the official launch.

Purposes of product research

- Customer needs understanding: Discover what your potential customers expect from your product.

- Ideas validation: Validate your product ideas based on customer interviews.

- Market analysis: Check market demand, competitors’ products, opportunities, and market dynamics.

- Feasibility assessment: Evaluate the difficulty of the market and niche.

- Pricing research: Determine the optimal selling price based on other offerings available.

- Marketing and positioning evaluation: Define the target market, choose focus groups, and decide on positioning and targeting.

Benefits of product research

- Customer satisfaction: Improved satisfaction thanks to customer insights

- Cost efficiency & risk mitigation: Leverage concept testing and avoid losses.

- Competitive advantage: Gain a competitive edge with product and competitor research.

- Informed decision-making: Validate ideas and avoid unsuccessful products.

- Product market fit: Create profitable products reflecting the market demand.

- Long-term success: Overtake the market with continuous research and improvements.

How to do product research effectively?

Alright, let’s get into the nitty-gritty of doing product research effectively.

With the right approach and tools, you can transform what once felt like a daunting task into a streamlined process.

Here’s how:

Step 1: Ask AI-powered product research tools

AI tools are a treasure trove of knowledge for your product research!

Leverage their superpowers to get fast information about an existing product, your product ideas, potential focus groups, and more!

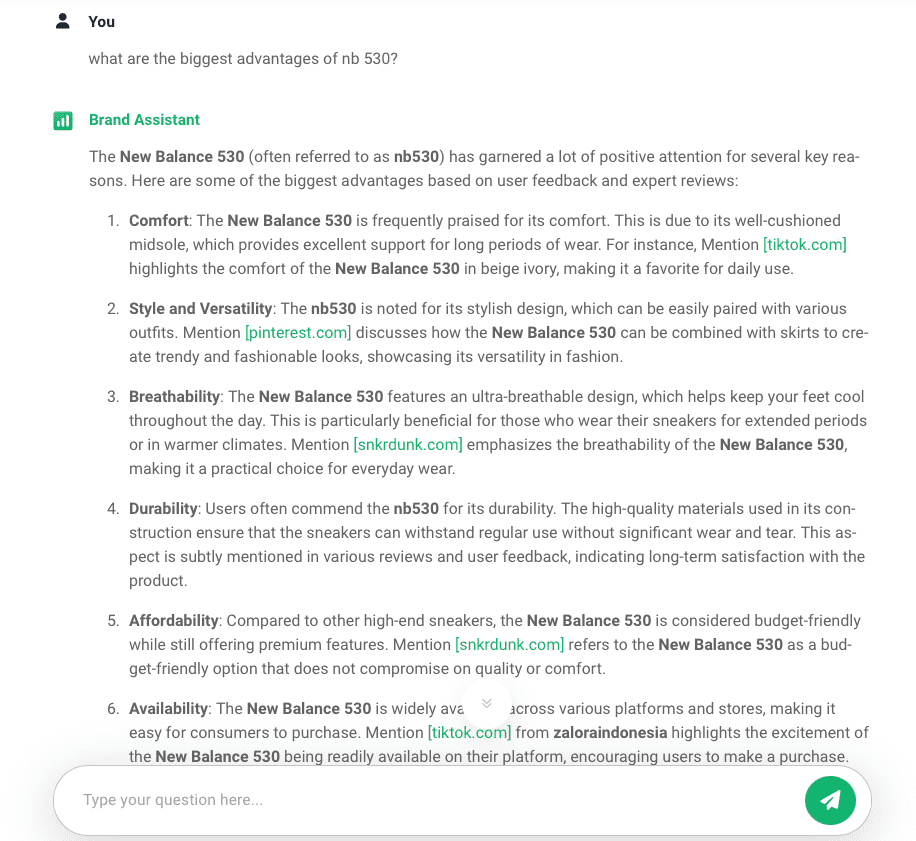

Let’s stick with the New Balance 530 example and compare what different AI tools have to say about them.

Let’s start with Chat GPT.

While the answer is quite informative, it does not provide precise insights into the performance in a particular time frame.

Additionally, ChatGPT doesn’t have the freshest data. All the sources it cites are at least one year old.

This makes the product research quite ineffective and poses a risk of erroneous results.

Not to say that Chat GPT checked only a small percentage of all online sources to provide its answer! 5 sites, to be precise…

But don’t worry; I have a better product research tool on offer.

It works similarly to ChatGPT – it’s also a chat-based tool, but it has way better product insights.

Namely, we’re talking about Brand24 and its AI Brand Assistant feature.

Why is our tool so much better?

Because it is connected to real-time media monitoring.

It works like this: You provide a relevant keyword that you want to track online and set up a media monitoring project.

All the insights regarding your keyword will be collected and available for you to check.

However, you don’t need to review several dashboards to find relevant insights.

To streamline the research process, we introduced the AI Brand Assistant. He knows everything about your project and can answer in seconds.

Let’s try this out.

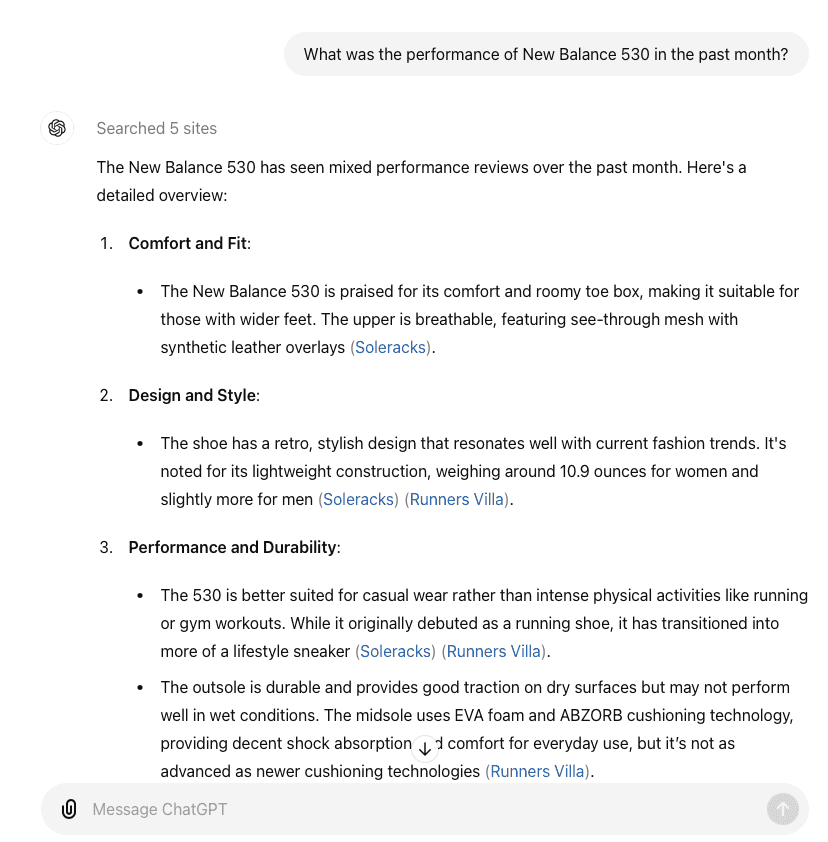

I’ll ask the same question that I’ve asked Chat GPT.

First, I set up a media monitoring project using the keywords New Balance 530 and NB530.

Now, I can go to the AI Brand Assistant tab and ask my question.

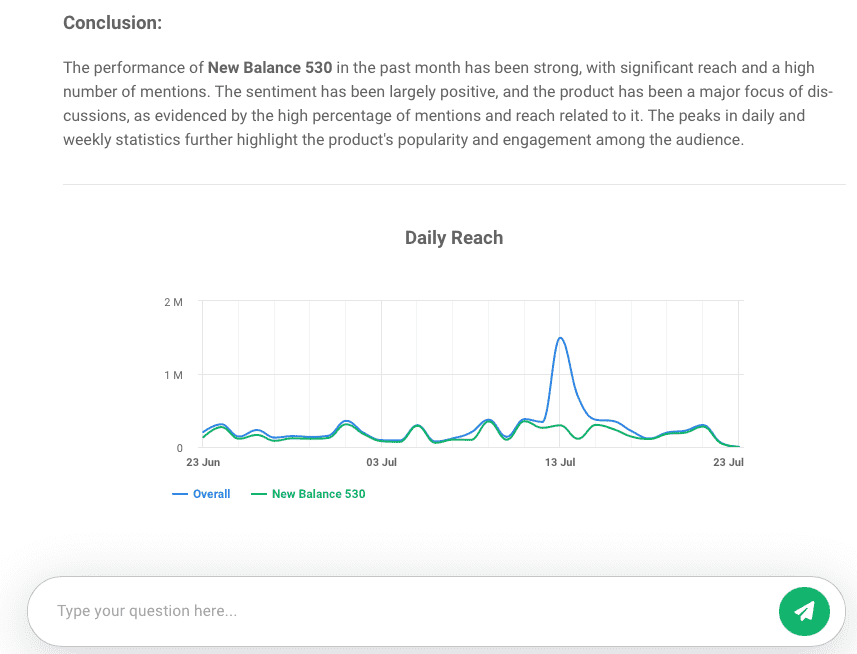

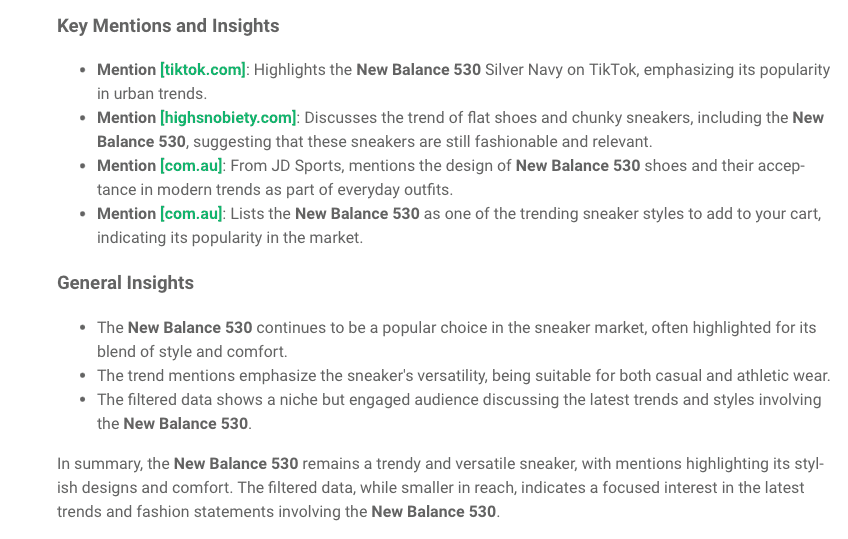

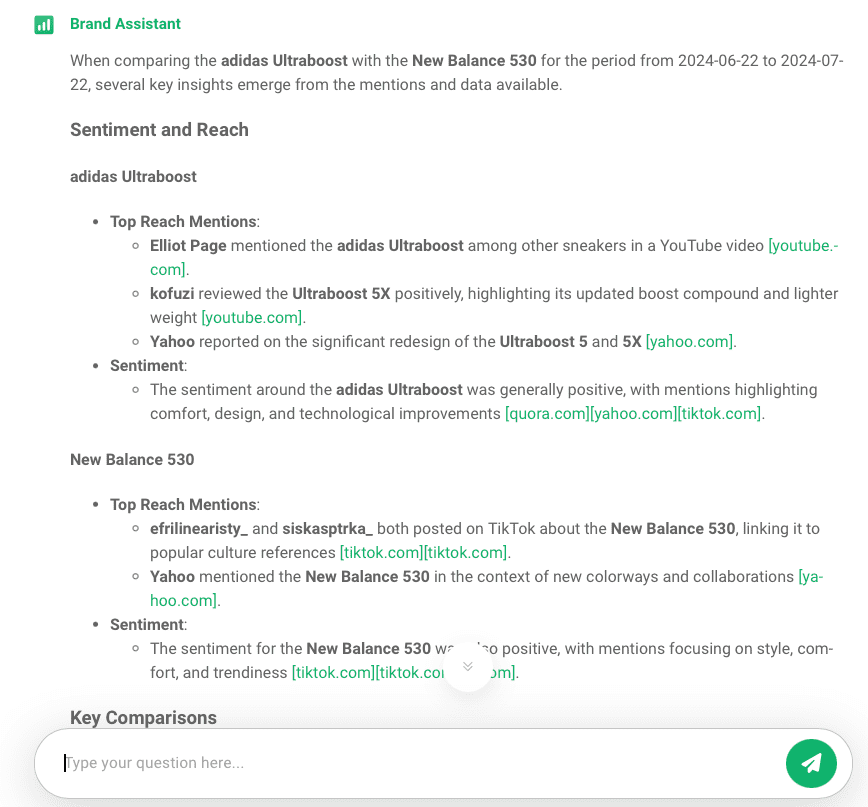

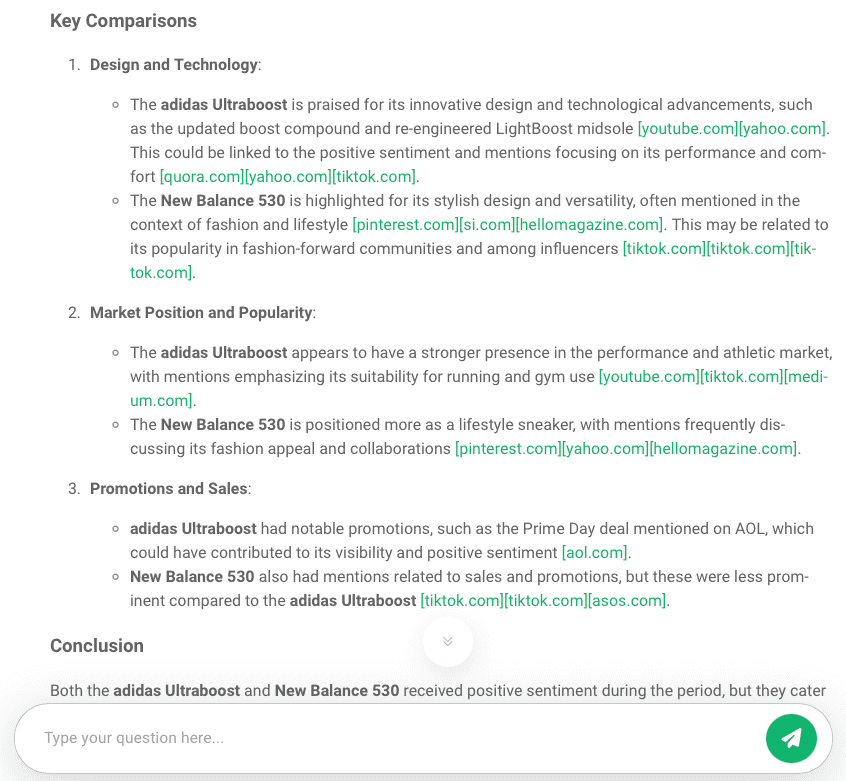

As you can see, the tool answers by providing precise data regarding the product’s performance online.

Additionally, when you scroll down, you’ll find a concise conclusion of the answer with a visual.

This clear presentation of insights allows you to easily conduct product research and validate ideas.

The visual representation is a huge facilitation, especially when comparing the success of several products.

This is a unique Brand24 feature that you won’t find in other AI chatbots.

Let’s try one more question.

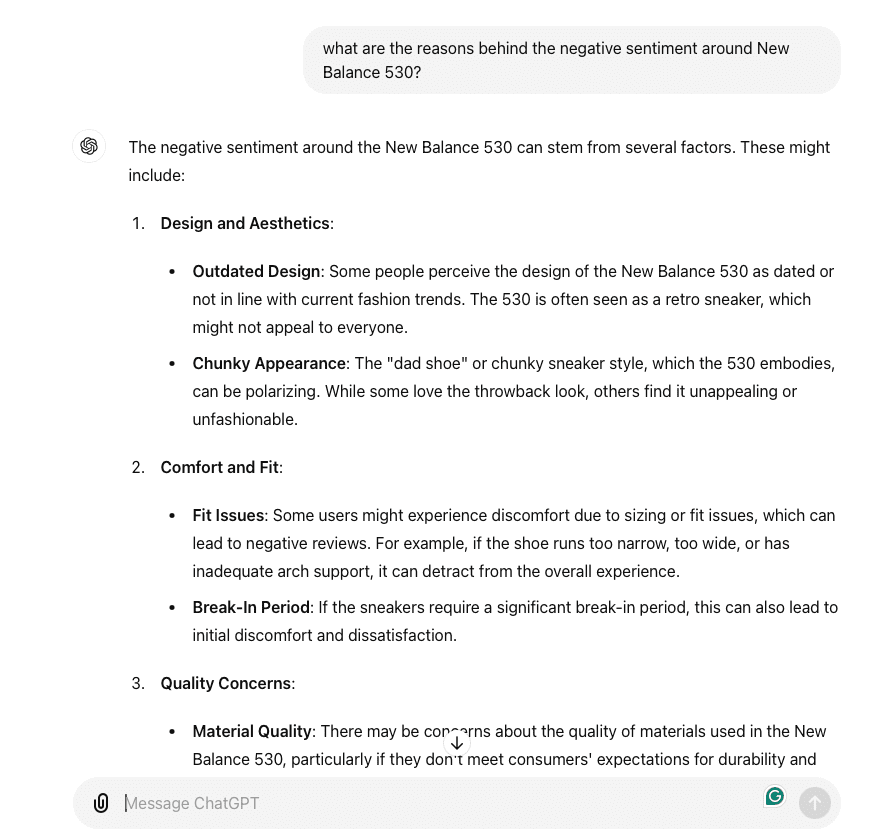

Imagine that you observe a spike in negative sentiment around your product. Let’s ask our chatbots about the reason for this situation.

I’ll stick to the New Balance 530 example.

The answer seems quite specific, but I see one problem.

Chat GPT doesn’t link to the source from which these insights come.

This generates 2 issues:

- You cannot be sure if the answer is truthful. It may be a random hallucination or a mix of opinions about different shoe models.

- Supposing the answer is genuine, it’s impossible to easily find unhappy customers and compensate them for their bad experience with your product.

While Chat GPT’s answer seems detailed, it is not necessarily truthful and definitely not actionable.

To leverage these insights, you would need to conduct user research to identify customers who left negative feedback and ask follow-up questions to improve your product.

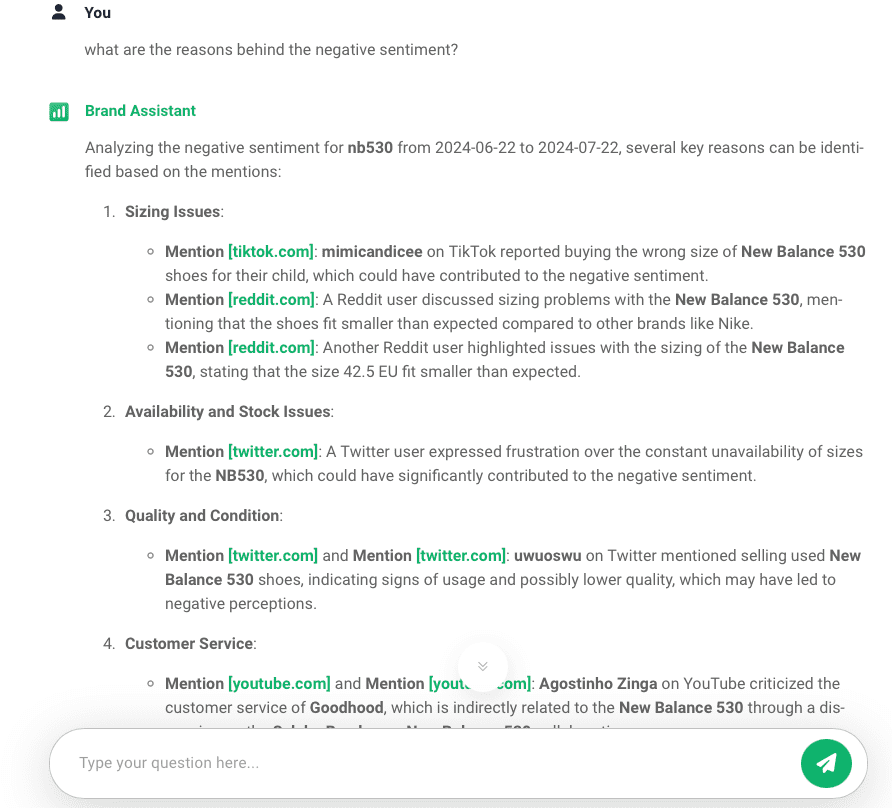

Now, let’s see what Brand24 says about the same product.

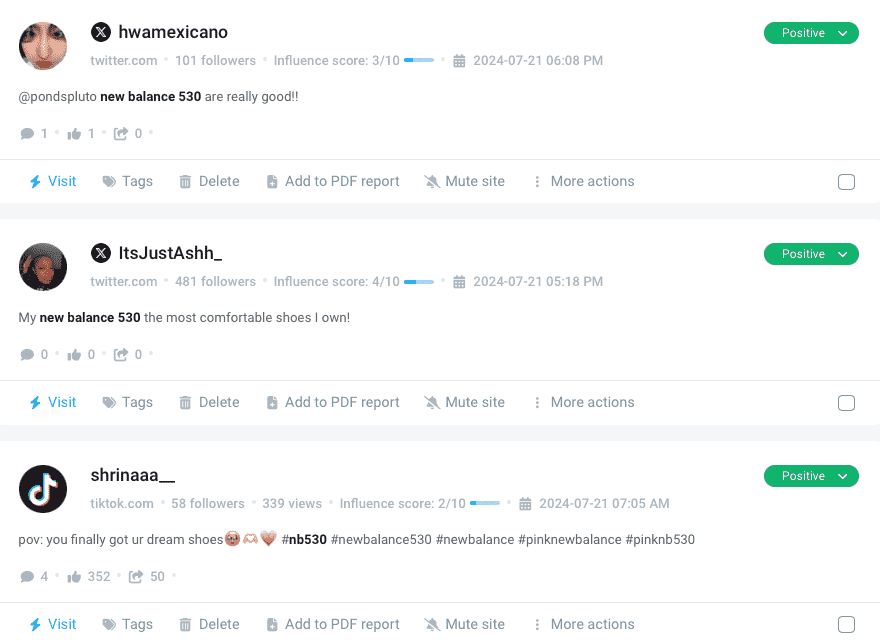

As you can see, Brand24 relies on particular mentions to support its answer.

Thanks to the reference, you can go directly to the mention, contact the customer, address the issue, and ask follow-up questions.

This way, you not only learn about your product’s performance, but you can also take action to improve the experience of dissatisfied customers.

With Brand24, you can efficiently conduct thorough product research and engage in building brand loyalty.

Here are some more product research questions you can try:

What is the primary source of mentions for New Balance 530? – This insight is useful to become competitive on social media and other online channels.

How many mentions did the brand receive in the last 30 days? – This way, you know how many people know about a particular product and discuss it online.

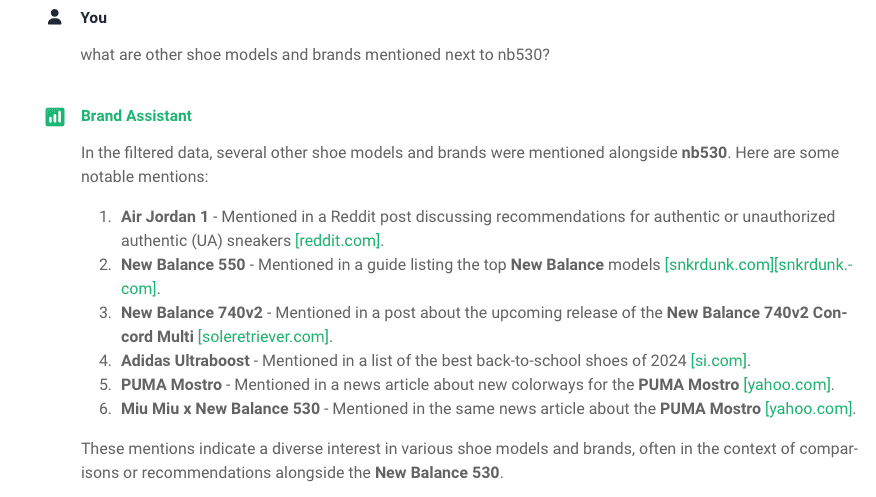

What other brands and shoe models appear in the NB530 mentions? – This is a helpful hint on which other products are the biggest competitors or offer similar features. Thanks to this prompt, you don’t need to wonder which brands you should benchmark – the answer is clear.

How do customers feel about New Balance 530? – Are they satisfied? Angry? Disappointed? It’s good to know before potential issues escalate to the rank of a PR crisis.

What are the latest trends for New Balance 530? – Do a quick checkup on the target customer reactions. Get quantitative and qualitative data regarding user feedback online.

What is the most trending topic? – Learn which topics are broadly discussed online in relation to your brand.

What time is the target audience most active on Instagram? – This insight allows you to adjust your posting time for maximal reach and user engagement.

How do customers perceive New Balance 530 compared to New Balance 550? – Analyze your best-selling products and repeat their success.

What is the share of voice of New Balance 530 compared to Adidas Ultraboost? – Discover how many existing customers discuss your product compared to a competitive product.

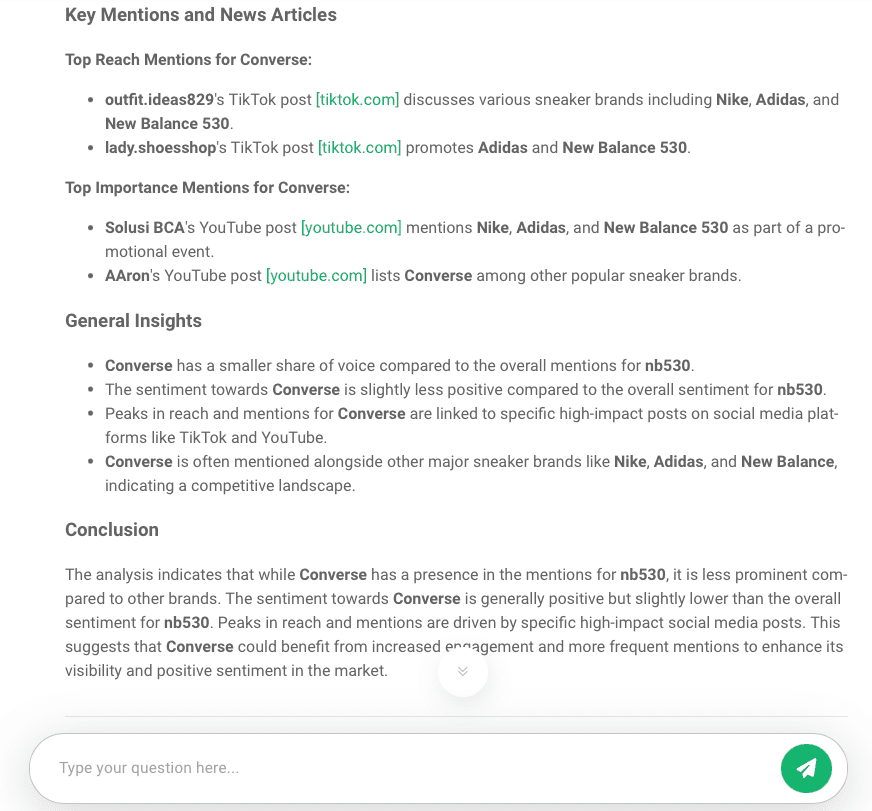

Conduct competitor analysis of Converse – Choose a competitor and easily compare your results.

Present customer insights – This prompt will summarize your customers’ online chats with metrics.

Conduct a SWOT analysis of my product – Provides valuable information about strengths, weaknesses, opportunities, and threats regarding your product.

Are you interested in more Brand Assistant’s answers? Start a free trial and ask him yourself!

Step 2: Ask the target audience

When it comes to asking your target market about their preferences and needs, you have several effective options, each with its own pros and cons.

01 Live interviews:

Live interviews offer a direct, personal way of conducting product research.

They allow you to dive deep into customer needs, exploring nuances that might be missed through quantitative research and other product research methods.

This face-to-face (or virtual face-to-face) interaction helps build rapport and can lead to more candid responses.

However, the downside is that live interviews are time-consuming with significant costs involved, especially if you’re aiming for a diverse or large sample size.

They also require skilled interviewers to avoid bias and ensure the conversation remains productive.

02 Surveys

Surveys are a versatile tool for customer research, allowing you to reach a broad audience quickly.

They can be distributed through various channels, like email, social media, or your website, making it easy to gather data from a wide range of survey respondents.

Surveys are particularly useful for quantitative product research, which can be analyzed statistically to inform product ideas and decisions.

On the flip side, designing a good survey requires careful consideration to avoid leading questions or survey fatigue.

Additionally, the responses can be less detailed than live interviews, limiting the depth of insight.

03 Social listening tools

Social listening involves monitoring social media and online forums to understand what your target customers are saying about your products.

It’s a non-intrusive way to gather genuine, unfiltered feedback and observe trends and sentiments as they naturally occur.

Social listening has the advantage of providing real-time data and a broad spectrum of opinions without requiring direct interaction.

Media monitoring is an effective way to perform product research. It collects all publicly available opinions about your product and turns them into actionable insights.

As you can imagine, the amount of data can be overwhelming.

However, with valuable metrics and quantitative representation, product teams and product managers can quickly draw conclusions from the monitoring results.

Remember our AI Brand Assistant!

Whenever you feel lost in the data burden, chat with him to learn about your online performance, plan your product development process, or brainstorm a new product idea.

Product research tips: How to collect customer feedback effectively?

- Use specialized tools for qualitative research. These tools improve the experience of your survey respondents and the survey’s efficiency. Try Zoho Survey, Survey Monkey, and Google Forms.

- Leverage social listening tools to see what your customers are saying about your products online. Brand24 offers quantitative and qualitative data, ensuring successful product research.

Step 3: Benchmark with competitor

Benchmarking with competitors is crucial in the product research process because it clearly explains where your product stands in the market relative to others.

By analyzing competitors’ strengths, weaknesses, pricing strategies, and buyer feedback, you gain valuable insights that can guide your own product development and marketing strategies.

This competitive analysis helps identify market trends, gaps, improvement areas, and potential opportunities for differentiation.

This ensures your product remains relevant, competitive, and aligned with customer expectations.

Benchmarking is an indispensable part of the product research process.

We know it at Brand24 and provide useful features to support your competitor analysis.

The best way to do competitor research is to set up projects for their products and compare them in the Comparison tab.

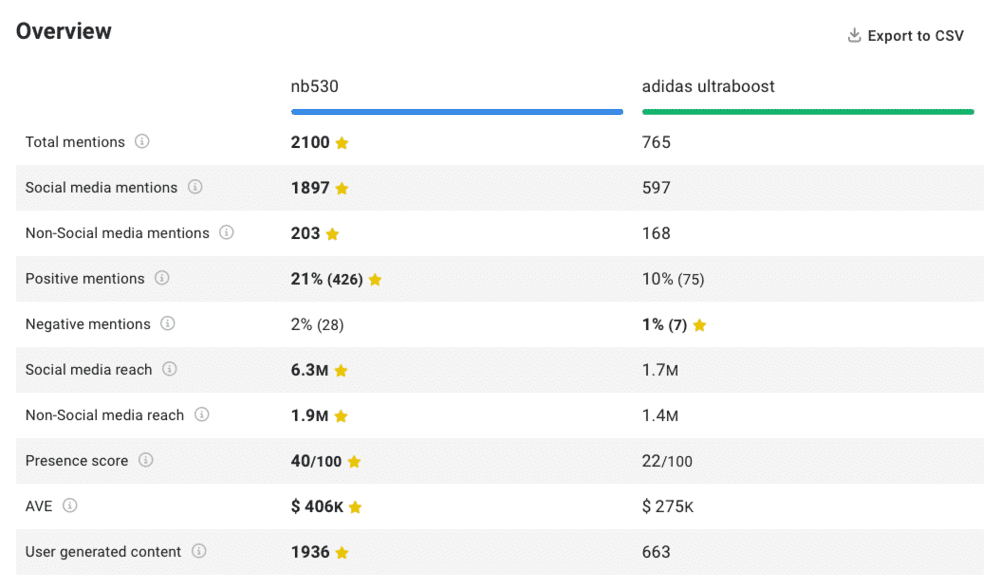

As you can see, the New Balance 530 is way more present online than the Adidas Ultra Boost. NB530 gets more mentions, reach, UGC, better Presence Score, and AVE.

However, Adidas Ultra Boost has slightly fewer negative mentions than NB530.

For a more complex comparison, you can use our AI Brand Assistant.

Step 4: Continue market research after the product release

Launching a product is just the beginning of its journey in the market.

Post-launch market research is crucial to ensure your product not only survives but thrives.

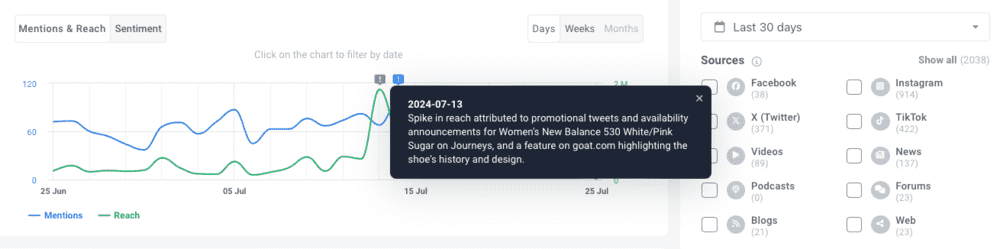

After your product hits the shelves, you should regularly monitor its online performance.

Key metrics to track are:

- Sentiment Score

- The volume of mentions

- Social media reach

- Presence Score

- Reputation Score

- Share of Voice

It’s also good to browse through mentions to have an overview of the online discussions.

Challenges in the product research process

The product research process is critical for understanding market needs, identifying opportunities, and ensuring a product’s success.

However, it is fraught with several challenges that can impact its effectiveness.

Here are some of the key challenges faced in the product research process:

Data collection and quality

- Access to data: Obtaining relevant and up-to-date data can be difficult, especially in niche markets or when dealing with proprietary information.

- Data reliability: Ensuring the accuracy and reliability of the data collected is crucial. Inaccurate data can lead to incorrect conclusions and misguided strategies.

- Data overload: Managing and analyzing large volumes of data can be overwhelming. Distilling actionable insights from vast datasets requires robust analytical tools and expertise.

Solution

Use a trusted and professional tool to collect the product research data for you.

You can rely on Brand24 not only for data collection but also for analysis and delivery.

This way, you don’t need to worry about data overload as the product insights are presented in an accessible and comprehensive way.

Market dynamics

- Rapid market changes: Markets can evolve quickly, making it challenging to keep market research current and relevant.

- Consumer behavior: Understanding and predicting consumer behavior is complex due to its variability and the influence of external factors.

- Competitive landscape: Keeping track of competitors and their strategies requires continuous monitoring and analysis.

Solution

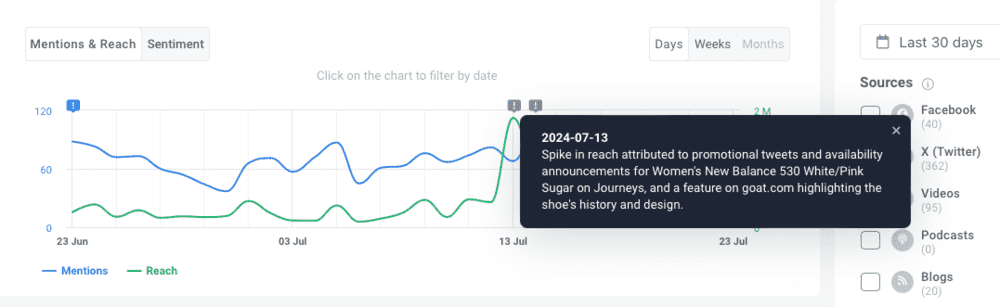

Brand24 addresses the issue of unpredictable market dynamics with the Anomaly Detector feature.

It detects any sudden changes in the project’s reach and number of mentions and attributes a reason based on all the mentions collected on that day.

This way, you don’t need to be afraid of changing markets. Brand24 monitors them and is ready to alert you at any time.

Technological advancements

- Integration of new technologies: Adapting to new research tools and methodologies can be daunting. Integrating these tools into existing workflows often requires training and adjustment periods.

- Data privacy and security: With increasing concerns about data privacy, ensuring compliance with regulations while collecting and using data can be challenging.

Solution

Choose one trusted and innovative tool for your product research.

Brand24 product team constantly works on new features and improves the existing product according to the user’s needs.

This way, the tool keeps up with technological advancements and stays ahead of the competitors.

At the same time, Brand24’s dashboard is straightforward, and new feature updates don’t require new training and user skills.

Resource constraints

- Budget limitations: High-quality research can be expensive. Budget constraints may limit the scope and depth of research activities and user insights.

- Time constraints: Conducting thorough research takes time, and there is often pressure to deliver results quickly to meet business goals and timelines.

- Skilled personnel: Finding and retaining skilled researchers and analysts can be difficult, impacting the quality of research.

Solution

Brand24 is an affordable and effective solution.

Plus, it’s straightforward, so you won’t need a skilled analyst to interpret the results—you can easily do that yourself!

Internal challenges

- Stakeholder alignment: Aligning different stakeholders’ objectives and expectations can be difficult. Conflicting priorities may lead to compromised research outcomes.

- Interdepartmental collaboration: Effective product research often requires collaboration across multiple departments (marketing, sales, R&D). Ensuring smooth communication and collaboration can be challenging.

- Resistance to change: Organizations may resist adopting new research findings if they challenge existing beliefs or require significant changes in strategy.

Solution

Establish regular communication and shared goals among stakeholders to ensure alignment and resolve conflicts efficiently.

Form cross-functional product teams and utilize collaboration tools to enhance interdepartmental communication and cooperation.

Implement change management programs with strong leadership support to ease resistance, starting with pilot projects to demonstrate success and gradually introducing changes to allow time for adjustment and acceptance across the organization.

Globalization

- Cultural differences: Conducting research in different geographical regions involves understanding and accounting for cultural nuances.

Solution

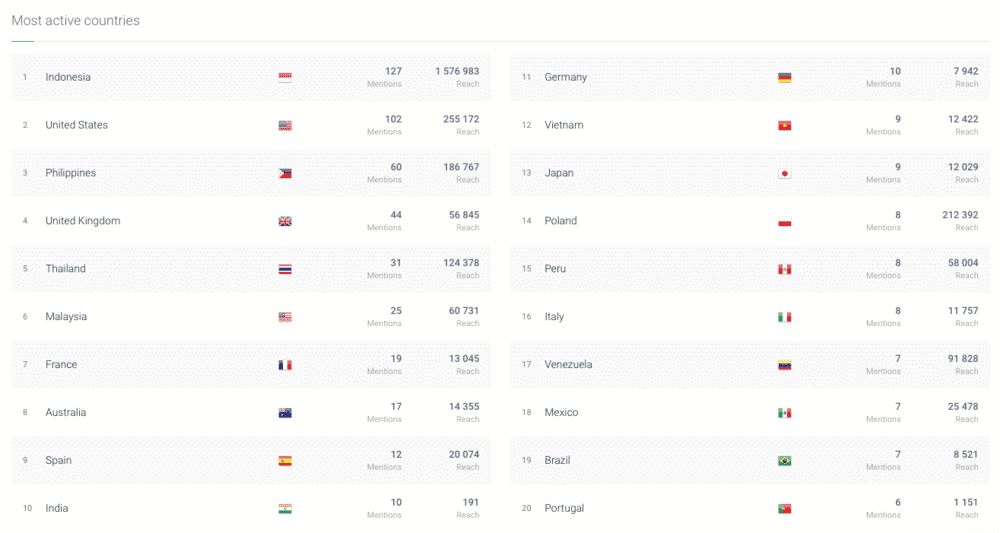

Use Brand24 to get country-specific insights and adjust your product ideas for particular markets.

Go to the Analysis tab and check the popularity of your product per country.

For more insights, ask our AI Brand Assistant.

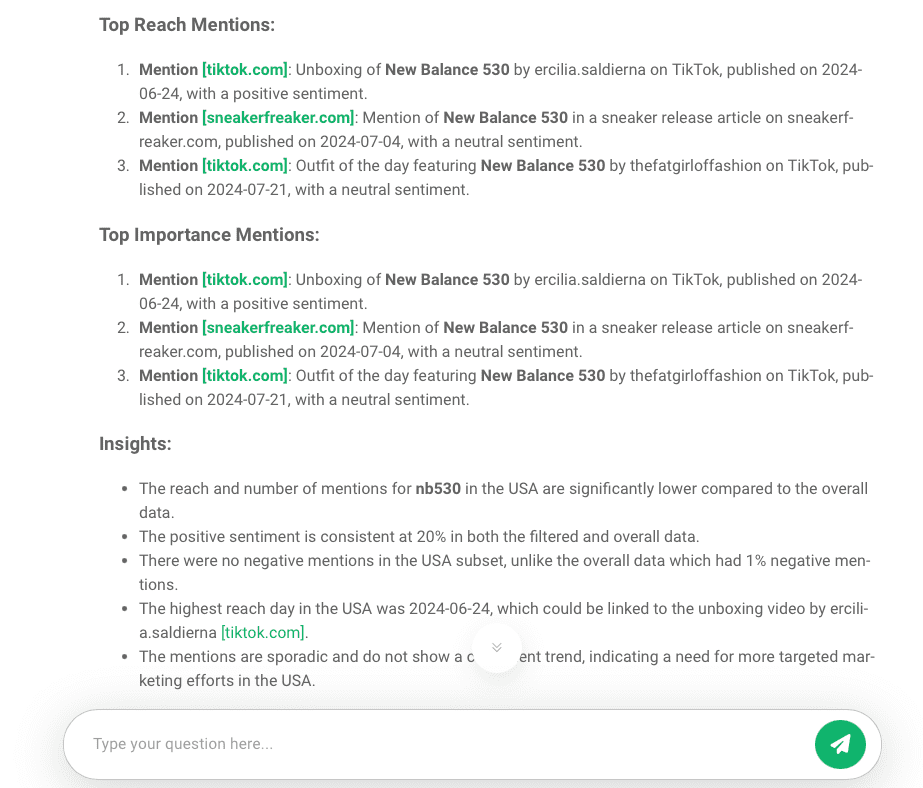

I used the prompt: What are the results for the USA?

You can also specify the time range. This way, you can measure the effectiveness of your product campaigns.

Interpretation and application of results

- Actionable insights: Translating research findings into actionable strategies can be challenging. There’s often a gap between data analysis and practical application.

- Long-term vs. short-term focus: Balancing the need for immediate actionable insights with long-term strategic planning is often difficult.

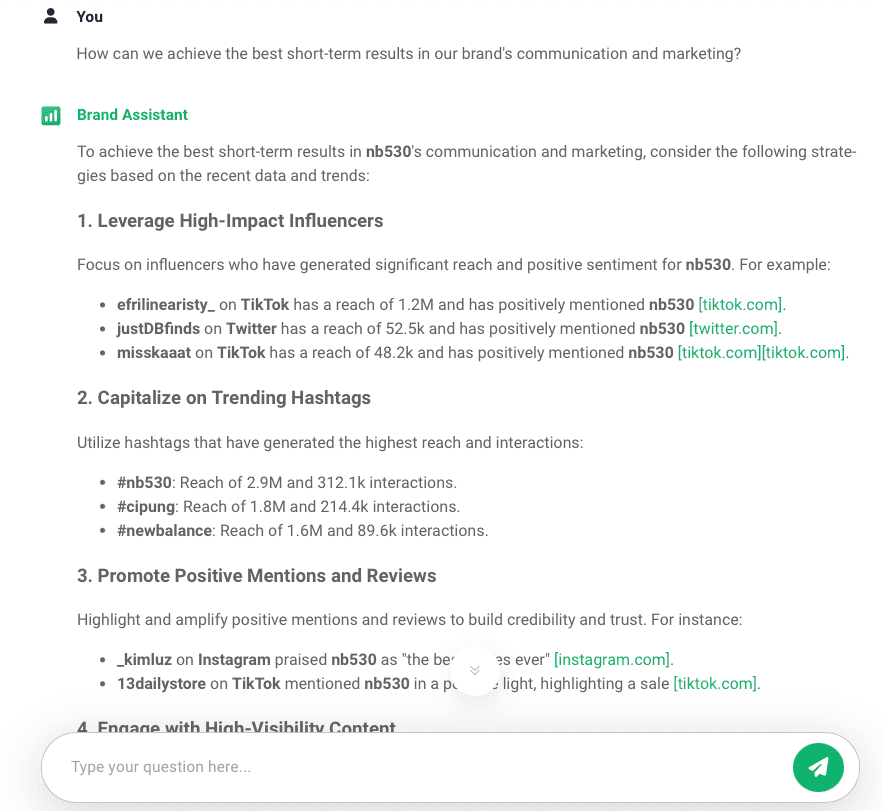

Solution

You can use the Brand24 AI Brand Assistant to help you turn the collected insights into an actionable strategy.

Our chatbot’s advantage over other tools (like Chat GPT, for example) is that it always informs its answers with the media monitoring results.

This way, its answers are data-driven and customized for your specific situation.

By recognizing and proactively addressing these challenges, organizations can enhance the effectiveness of their product research processes, leading to more successful product development and marketing strategies.

Conclusion

Long story short, a craftsman is only as good as his tools.

To conduct proper product research, you will need the right AI software to support your efforts.

You need a tool that both collects a lot of data and delivers it in an accessible and actionable form.

This way, you will be able to set your business goals based on your product research results.

Brand24 meets all those criteria with its unique AI-powered features. They analyze the collected data for you and provide informative insights about your product and potential customers.

Additionally, remember customer research through interviews and surveys. These methods provide first-hand insights into your customers’ needs and wants, which can inform your product development.

These effective product research methods guarantee truthful results and actionable insights.

Why wait any longer?

Final thoughts:

- To create a profitable product, you should conduct product research first. This process will help you understand your customers’ needs and the product demand and evaluate your product idea.

- Try the soft launch method, collect customer feedback examples, and let your product teams refine the product before the official release.

- Leverage social listening to conduct product research and user research. Other useful research methods are live interviews and surveys.

- Implement regular research to your online business to stay ahead of competitors. Monitor opinions throughout the product lifecycle to ensure user satisfaction and solve issues as they emerge.